Citizens Bank’s earns a 1.6-star rating from 1 reviews and 401 complaints, showing that the majority of clients are dissatisfied with banking services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

unfair fee

Recently, I used my debit card attached to my Citizen's checking account to pay part of my UAlbany orientation fee.

The school made a mistake and initiated an $80 charge instead of the $10 partial payment I'd authorised. They reversed the charge the same day, and charged the appropriate $10.

However the $80 was still on hold in my account, creating a negative 'available funds' balance. I had $31 in the account, to cover the $10. When the $10 charge posted, it posted against the negative available funds.

Consequently, I was charged a $39 overdraft fee. I called the bank, figuring that since no actual overdraft occurred (the $80 was never actually claimed by UAlbany), they'd reverse the fee.

Instead, I'm told since it's not a bank error, they can't reverse the funds. I was told to contact the merchant (UAlbany) to request a refund of the fee. Even the student financial center representative I met with, in an attempt to get the fee (as suggested by the bank in the first call), spoke to the bank. He argued with their supervisor at their customer service phone center on my behalf for close to 20 minutes and got no further than I did.

So Citizen's Bank is making a profit off me. I am a disabled college student, living on SSD and stdent loans. And they are making an unfair profit off me. I willingly pay overdraft fees that are my fault. But this is not my fault, and I'm still out $39.

The complaint has been investigated and resolved to the customer’s satisfaction.

overdraft charges

Citizens Bank charged $74 in overdraft fees for a $35 recurring item that was presented against a balance of $27.98, a $7.02 overdraft. That is a 1054% fee!

The $35 item should not have even been honored in the first place, because it was for a debit transaction on a card that had been canceled. Citizens Bank decided to drop MasterCard and forced me to switch to Visa, and I had started to use the Visa debit card weeks before.

When I explained that I wanted to have the charges taken off my account by two different members of Citizen Bank's call center group in Ashville, North Carolina, they said there is no way they would reverse the charges.

Both customer service people, Shauna Payne and Ryan Walkenshaw, identified themselves as "Supervisors" and refused to let me talk to anyone else to escalate the situation. The conversations were being recorded. They both said they would be happy to leave a message with someone to call me back, but there is no way that the overdraft fees would be waived by anyone at Citizens Bank.

I told them if they cannot get me a manager to speak with today, they need to put the funds back in the account today and we can resolve the issue when they call me back. I told them that I had made a deposit in the account to pay an important bill, and the $74 that they took out brought the balance down to a point where there is not enough to cover the payment. They both said that was not their problem.

Shauna Payne kept talking over everything I said. At the end of the call, she claimed she would transfer me to a manager's voice mail, and transferred me to a disconnected Verizon mobile phone.

I can't imagine how they can get away with this. Think twice before opening up ANY account with Citizens Bank at this point!

The complaint has been investigated and resolved to the customer’s satisfaction.

Did you know you can't pay your excise tax from your Bill Pay online? I found out the expensive way when I got a Demand Notice with $80 worth of fees for not paying on time... I thought it was all taken care of, since I had paid my 1st quarter excise tax with no problems. When I called, not only was I on hold for 25 minutes, but they told me it was "A Glitch" the excise tax was paid the first time - So, I was SOL. I went in to the Branch, still pissed, and 6 days later, have not heard from the Branch Manager who started out updating me the first day, but I have not heard from since. They make it riduculous and expensive to close your account. Not a happy camper.

On January 9th at 8:50am, I was awakened to a call stating I had not paid my car payment. Not only had I made the payment, but it was taken out of my account on January 4th. After stating this, the rep asked if I wanted to reverse my payments since I had doubled my payments for a year and been sending extra money. The rep stated if I did this, I would not have another payment until some time in 2017, but Citizens would go back and reapply the interest to my account. I stated I did not want to do this because my intent was to reduce the principal amount. On January 22nd, I received my statement which listed over $440.00 had been applied to interest, while a little over $100 had been applied to the principal. I immediately called to find out why this had happened. After awhile, I was told there was a "gliche in the system" which caused no interest to be taken out of my payments for the entire year of 2017. I checked my statements and found that I did pay some interest in 2017. I then realized the call on January 9th was to try to get me to reverse my payments so they could go back and apply the interest and I would not notice a difference, but since I did not do that, they took the money out of the next payment, without any explanation. Thank God I only have an automobile loan with Citizens Bank. I will be having my account reviewed.

I opened a checking account last December to take advantage of their $100 promotion. I completed all required actions.

Firstly, the customer service told me the bonus would be credited by Feb 28. I was charged $100 for overdrafting by account in early March. The bank only refunded $25. But if had the bonus in my account as promised, I would not have to pay for any overfees.

Secondly I received a message from the bank, saying that the corrected the system and the bonus *will* be credited by 4/15. I specially confirmed with them I satify all conditions of receiving the bonus. Now it's already 4/20 I still have not heard anything from them.

Citizens Bank is a bank that never keeps their promises. I'd close the account after I earned enough from their Green$ense.

Just adding my recent experience to all the others. Apparently Citizens Bank sent a letter out in March about changing checking account types. Like all the other junk mail, I tossed it. My mistake! Since I didn't contact them they automatically changed my checking account to one that requires a $5000.00 balance to avoid a $17+ dollar service charge.

Hmmm...unemployed for two years and never had more than a $650 balance after direct deposit. I was informed that they do have a regular checking account with a $4.95 service charge. I wonder why they don't default people to that checking account?

Ahhhh...money! I had $5.00 in my account, but doing it this way; they hit me for $17 and $6.95 every two days in penalties. So when I checked my account, in just over one weeks time; I now owe over $70.

Here's the real gotchya part, since I don't have $70 they won't close the account and are gonna continue charging $17 a month + $6.95 every few days. Now if this wasn't about ripping people off, wouldn't it be more reasonable to default unanswered customers to the cheaper of the two accounts; especially, since we all know that most unsolicted mail never gets read? And maybe charge 18% interest instead of $6.95 every 2 days.

On 8/11/11 I had $22620.01 in my business checking account a check came throught for 26.18. they bounced it and charged me a 39.00 bounce fee because A charge was on hold for 2246.84 but had not yet posted to the account. I ran that morning before the charge was posted and deposited cash to cover the 22620.01 before it posted to my account. I don't understand how they bounced the check when that charge was not posted to my account. The charge was also dated to post to the account 8/15/11 but came out of my account 8/12/11. The Check posted on 8/11/11. Citizens also lost 2 deposits I had made on 2 seperate occasions and told me it was my problem to find out where they went. So I had to get my customers to there bank info and track down the checks they paid us with. It was kind of embarassing. I found out where the money went ! They deposited the money in someone elses account. I am truly sick of this bank. When you call the bank you never get the right information. I have been banking with citizens since 2017 and I notice they change practices and DO NOT inform the customer, But when you call them they say it has always been that way. Belive me I do not want to bounce things and give citizens my money. It seems things are one way for a while then they change to the advantage of the bank.

My 17 year old daughter opened up her first account with Citizens Bank this past year when she just started working. Due to the fact that she was charged fees that she was not expecting when she did a wd from a non Citizens ATM - (Citizens AND the ATM charged her a couple of $$$) - her account was overdrawn a whopping 27 CENTS.

They immediately hit her with a $22 Overdraft charge - and sent out a letter a couple days later stating that they were also charging her $35 because the account was overdrawn for 5 days ... and by the time we got to the Bank the next weekend ... they tacked on another $35 because it was overdrawn on the 11th day. This is an OUTRAGE .. I spoke to the manager at Citizens Bank and he basically said that there was nothing they could do except waive the initial $22 fee .. but they still charged us - and I paid - $72 for a 27 CENTS mistake. Thank you Citizens for your compassion and understanding - I encourage EVERYONE to stay away from these theives ... they have absolutely no scruples whatsoever - and this is the second issue I have had with them in two months .. the first time - they charged my account in error $200 - (Long story) ... and it took me over two months to get it back - they finally corrected it just recently. I intend oin contacting the BBB - but I think these banks can charge what they want - all we can do is stay away .. and encorage others to do the same. DO NOT BANK WITH CITIZENS BANK

I have an ongoing problem with Citizens Bank gift cards. The bottom line is this: they cancelled my two active gift card before their expiration date, but they continued to charge me a monthly 'service charge' for these cards, cards which were no longer in service. Think about that: a service fee when they had cancelled the service! When I complained, they refused to reimburse me for service charges on the out of service cards. Doesn't a service charge mean that you are paying for a service? If Citizens cancelled the service (i.e. use of the gift cards), how can the service fee continue to be charged?

I am just as angry about the very poor way I have been treated. Citizens could have made it easy to find out that the cards had been deactived, but they did not. I used the card and it didn't go thru at one business. Odd I thought, so I tried a second time, different place, a few weeks later. Still no luck. I went to the citizensbankgiftcard.com website, typed in my card info, and all looked fine (i.e. there was money on the cards). Figuring my website verification might have activated something on my cards, a few weeks later I tried a purchase again, and still no luck. I tried the 800#. There was no option to talk to an operator, and pressing 0 did nothing, but I keyed in my card info, and the system said there was money on the cards. I shopped again. No luck again. Back to the 800# to do the optional card registration, figuring this might solve my problem. I was surprised that this option lead to a human operator, who told me that citizens had cancelled the cards.

I was sent checks for the card balance LESS card service charges. The 800# person gave me a Massachusetts Citizens bank address to write to for service charge reimbursement. I wrote. Citizens ignored my letter. They didn't even respond! Am I not worthy of a response? I emailed Citizens customer service. They said they couldn't help me, but gave me an address, this time in Atlanta, to send yet another letter to. I did so. Once again, I never got a response! I am pretty shocked at this. Is this the practice now, to just ignore letters from customers? I wrote to the places Citizens told me to write to, and they just ignored me.

I didn't give up though. I wrote to the head of Citizens at their Providence HQ and I actually, finally, got a response. It was a short letter saying that Citizens was just following service charge policy as outlined in the gift card rules they had attached to the letter. They presented no justification for charging a service charge for cards that they had taken out of service, nor did their gift card rules address this situation. What I felt even more disappointed about was that Citizens HQ did not offer one word of apology for ignoring both of my previous letters, when I had sent those letters to the very people Citizens told me to contact in order to resolve this issue. Ignoring a customer letter once is bad enough, but twice is pretty rotten, and then failing to apologize when I told them about this says to me that the people at Citizens HQ care very little about their customers.

I know I share blame, as service charges don't start until the "13th month after issuance". I got the two $300 giftcards from my siblings. It was their way of thanking me for taking care of our 92 year-old mother as she needed 24/7 care, and my job had been outsourced to India, so I had time to do so. To be honest I felt guilty taking money from my siblings to take care of our mother so I just had a hard time using the gift cards. Weird, I know, but it didn't sit right with me. I did use one of the cards once, but after that I just put them aside.

I lost $45 in service charges ($2.50/mo for 9 months, on two cards). The 800# person told me that Citizens cancelled the cards on 6/3/2017, and I got my check, less service fees, in December 2017. Of the nine months of service fees, 3 months were while the card was active, and 6 months (June thru December) are service charges on cards that had been put out of service. Those service fees bought me nothing but bad service! They made it so difficult even to find out why my cards were suddenly not working, and they expect me to pay them service fees for all this aggravation. It is beyond belief to me that Citizens would, when I have repeatedly presented them with these facts, all the way up to the very top of the corporation, would not make things right. I am really very surprised how little they care about doing the right thing for their customers, and it is obvious that this poor attitude is prevalent at the very top of the corporate ladder.

I am left to again ponder the question in Citizens online ads: “Is this how you define a good bank?”

I am so tired of Citizens. I have been with them since about 2017 myself and they are the most deceptive sleezy bank I have ever had. Over the long weekend I used my debit card for several purchases including one small one for $6.00. I accidentally on Tuesday morning made a withdrawl not realizing that an error had been made. It was my mistake I will take the blame and the $39 charge but they instead withdrew my large withdrawl which was my last transac tion first and then all the other small ones from the 5 day weekend and now want to charge me $350 in charges. I tried to explain to them that the large withdrawl was my last transaction and should not effect the transactions prior. They would not even try to listen or help. There reasoning is that they put the larger transactions through first in case it is a mortgage payment. But you tell me would you rather have one check bounce or a bunch of small ones in the $20 range and spend $39 on each transaction. Yeah they do it for the customers I don't think so its there way of raping the customer. Well they just lost another customer and I hope they go under.

Please, please lodge your complaint with the OCC. Visit occ.treas.gov/customer.htm There you'll find an online form, complete it and leave the rest to the Government. We can flood the OCC with our complaints and keep Citizens Bank very, very busy

Citizens bank i sone of the most UNETHICAL banks in the country. Their overdraft policy is Very Aggressive for the sole purpose of maximizing their revenues. They makes MILLIONS a year from overdrafts. And they tarin their employees to defend the bank with the most shameful, pathetic rationale for their Overdraft Scam. There are a number of class action suits against Citizens Bank for the deceptive way they Manipulate Transactoin to Multiple their overdraft charges against their customers. In my 30 years of banking no bank has come close to the sleezy operation at Citizens.

policy

I just opened an account exactly 27 days ago today and almost from the very start I have had nothing but issues with them! They held my first deposited check for what was only supposed to be 3 days, according to my online info. When I went back into my online banking account my hold date was changed from 3 day to 7! I called and they told me that was strange it should not have been held that long it is probably a mistake it should be released in a few days if not call back. It was not released so I called back and I was told it was held longer because it is a payroll check and it will be held that long for the first time and after that they would release the check in 3 days tops the next time.

I deposited another check and the same thing happened it original showed a realaese date of 3 days so when I went in again the date was changed again to not only the original 3 days but an additional 7 days at total of 10 days! I immediately called and this time I was told oh your account is new we hold all check a minimum of seven days for new accounts until the 25th day. I was furious because they never said this to me in the previous other calls! So now my check is due to be released on the 27 day. Why on the 27th day I said? They said oh because of the weekend. I said you considered the weekend int the 25 day time period they said YES! So I go to the bank and deposit another check on my 27th day since opening my account and I once again check my hold status only to see my check being held for ANOTHER 7 DAYS! I had enough in the account to cover this check completley but yet they held it again so I called again and I was told oh the teller has the discretion to hold for as long as they feel they need to. Can you believe this crap! I called the bank branch to check this status of the teller having the discretion to place holds on the account, I spoke to assistant Manager Todd Bloom in the Warrington PA office and he basically told me that NO the tellers do not have this discretion and that is the policy a 25 day hold BUT there were 2 holidays in there. There is only one holdiay and I have passed my 25 days and he laughed and said there is nothing he can do for me that is policy after telling him I do not appreciate him laughing at my situation because I have bills that need to be paid and DO NOT HAVE ACCESS TO MY MONEY and this is completely unacceptable I hung up with him!

I then called the customer priority line [protected] to talk with Pauline and she was the one told me when I spoke to her that new accounts have the 25 day hold status. She gave me the same song and dance! I told her every time I called there I received a different answer or different policy that accommodated them being able to hold MY MONEY! This is the worst bank I have ever dealt with! I am getting out now before the fees start coming. Horrible policies, horrible customer service, horrible bank managers horrible contact info they change their minds like the wind, just to hold onto your money. This is no different then robbing me for a week and then saying oh here you go I will give your money back no recourse! If I took something that wasn't mine and held it and tried to give it back it is still a crime isn't it!

Run while you can got to a credit union or a small local bank for the service you should be getting! I will stop with this write up I will get to Ellen Alemany Citizens Bank CEO if it is the last thing I do!

The complaint has been investigated and resolved to the customer’s satisfaction.

I took out a 5 year car loan with Citizens Bank. I paid off the loan early, making my last payment on December 1, 2015. To date, April 19, 2016, Citizens Bank has not sent me the car title. Therefore, I have been unable to register the car in the state I live/drive the car and/or sell the car. The car has been sitting for almost five months since I cannot legally drive it since I cannot register it without the title and internal damage may have also been done to the car.

Lets all get together and write the attorney general then.

If your from Boston..actually from where lets do it.

I have written the attorney general, division of banks, and am currently looking fior a lawyer.

I think I found an article where citizens was sued in Sept.

It may sound impossible to sue big banks.

But with the current climate and spotlight on bank fraud...there is no better time.

citizensbankfraud@gmail.com

R

do it..

https://www.eform.ago.state.ma.us/ago_eforms/forms/piac_ecomplaint

cheating

A $15 transaction was there after I closed my account and cancelled card I cut my card in pieces, they show that I purchased after they cancelled my card, not able to tell the source of transaction yet trying to extort my hard earned money .

Banks cheat you cannot do any thing, they cheat for their lords make them rich when loose money public money save them to let them cheat public for ever.When profit only for few, otherwise curse for all. CITIZENS BANK cheated me we need a credit score for banks so that they cannot blackmail customers

The complaint has been investigated and resolved to the customer’s satisfaction.

Several times in the last two months my account with citizens bank has been attacked and drained by this bank. It all started with a tax levy for 200. The story goes like this: my check goes in auto so thursday morn I check my account. Money's not right, so I call card serv to get info I'm told of levy by a live person. Then I ask for available balance and am told by a live person that I had 203 dollers in account. So under fear of further levy I take 200 out so I wont be broke. Two days later I get notice that account over drawn by 280. I call the bank and they say they dont always see everything. It doesn't stop there; they inform me of other charges coming in and that my over draft fees are still going to rise. This all after I checked my available balance. These charges were going to be larger than my weeks pay so I tried to stop auto deposit at work- they couldnt stop it, but could void it so it would bounce back. It went in and bounced back but my employer, being with citizens bank, was called by the bank demanding that money back or they would charge the account. I was called on the carpet and told the story and now have to pay back entire weeks pay. My next step was to fight with the bank. After much dialogue they refunded me 100. I then asked how I could prevent this. They said take the feature off the account that lets you over-draw. Did that. Next time, the same thing happens. Check available bal and use account accordingly. Now am told I'm overdrawn 130, I ask why and am told "Didn't anybody tell you that items put thru as credit don't show on available balance?" Like Mcdonalds, Dunkin Donuts etc.

Customer Service-Overdraft Fees

I have also had problems with Citizens Bank. On October 2, 2009 I received my Social Security Direct Deposit. Also on that date there was a check from 7 months ago that was cashed by the bank. This check was to an old landlord that I used to have, and way back he told me that he never received this check, so I stopped payment on the check and got a bank check for the money and sent that on to him. Now after 7 months he managed to cash the check. The bank never called me to tell me that a “stale Check” was being cashed, and I didn’t know that “stop payments” were only good for 6 months, so the bank paid out this “old check”. Now because this happened and I didn’t know about it, it overdrew my account and I bounced a bunch of other checks. It was only after calling customer service that I found out that “stop payments” were only good for six months and that the bank shouldn’t have cashed this “stale check”, but I was told that it was up to the bans descretion.

Now the fees that came in due to this amounted to more than $900. I was frantic. I got hit with fees on top of fees. My wife’s direct deposit ended up going into our account before we could stop it, and it paid all of their fees off and left us very little money for food to feed our family of 5.

Also during this time I was running out of Insulin (I am a type 1 diabetic) and I also have Secondary Progressive Multiple Sclerosis. Well I needed Insulin for my pump and the bank refused to free up any of the charges that they had on our account. I ended up have an MS flair twice and ended up in the ER. I also received 2 perscriptions that needed to be filled in order to get over this flair.

I called the bank and a very nice customer service representative named Madona helped me out and freed up $78. so that I could get the prescriptions filled, and then when I went to the bank I was told that I could not take the money out because citizens had put a hold on my account and the one person who could take the hold off was not in that day. I was then escourted out of the bank and was told that Corporate Security was going to be I would not get back any of the fees that I have paid if she had anything to do with it.

I then contacted customer service and lodged a complaint with them. Nest thing I know the claims department is sending me another affidavit in the mail, and this time they want me to try to locate my old landlord so that he can sign it saying that he did infact take money from our account. Can you believe that? I’m sure he’ll sign that? right?

I was told by Citizens Bank that I can not close my account at this point because it is now back to being negative again, and when I tried to open another account with a different bank I was notified that because of citizens bank I would have to wait for that account to be settled before I can open another account anywhere else. So now my wife is stopping her direct deposit and I have to call Social Security in order for them to stop their direct deposit.

I’m thinking about not having a bank account at all, I’m thinking about getting a safe, and then just getting money orders for all of my bills.

Thank you CITIZEN’S BANK for encourgaing me to not trust banks!

The complaint has been investigated and resolved to the customer’s satisfaction.

patments

pay payments by western union so the company can get payments faster always seem to be posted on account 3 to 5 days later, at that time we get a late fee and extra charges for not paying on time.. but westernunion states that payment was received.within 15 min. want to know if there is a way to stop comp from ripping off people this way?

The complaint has been investigated and resolved to the customer’s satisfaction.

ripped off

My husband and I have several accts. with citizens bank as well as mortgage accts. We have been with them since they took over commenwealth bank. When we were with commonwealth they used to call sometimes to say heh we know your husband is traveling a lot out of the country you need to switch money into your acct. a check is going to post today. That was without a doubt unusual but that's the kind of service we received from commonwealth.

Then citizens took over. We stayed with them hoping to build the same kind of relationship. We realized there service cannot compare. Over the years we opened and closed many accts. with them and never really wanted overdraft, so yes we paid many overdraft fees which now are through the roof. Last year my husband opened a savings overdraft and sometimes puts money in that acct.

I recently learned that if you do not have enough to cover the full amount of your mistake of overdraft they do not take any money at all from that acct. and you get charged for everything even if you could of covered most of your mistakes. To me they are stealing our money because they will not use any overdraft that does not cover the full amount. That's bull crap! Why should I pay $234 in overdraft fees when I should only pay for what I could not cover.

My husband also transfered the same day $2800 dollars from our ING acct. which to me is cash, but they said no. Before when my husband fought with them over this the manager said why do you have your money in ING instead of here at citizens and was very rude to my husband because he told them he gets higher interest on his money in the bank and only transfer when he needs to. Please help us resolve or expose this bank I am sure other people are also getting ripped off.

The complaint has been investigated and resolved to the customer’s satisfaction.

My account had identity theft, which I notified to Citizens first charge, they reimbursed, another charge went through by the same company, then another! They did nothing to stop it after already knowing it was fraudulent, not even notify me. I found the error. They told me legally they had 10 business days to reimburse they took almost 90. Charging me fees the entire time this money wasn't in my account and are now saying they aren't responsible for the $1, 000's of dollars of fees that would have never happened if the money was in the account. That is not even humane, this ruins people's lives and credit scores. So they do not have to resolve the issue they will not let you speak to a manager, will "accidentally hang up" or leave you on hold for over 2 hours. Only one person that is miraculously never available can resolve this issue. I have 3 bank accounts and never as much as had an issue, Citizens is a nightmare and they are not a place by any means to trust with your money.

I messed up this week. I deposited a check on Saturday thinking it was going to clear on Monday but forgeting that Monday was a holiday and a non-banking day. Well, after paying eleven bills online I found myself with eleven overdraft charges on Wednesday. That's $429 that I gave to Citizens bank all because I forgot my check wouldn't clear until after the holiday. Had my check cleared I would have had more than enough to clear my bills but this did not matter to anyone I spoke with. It seems to me their should be a cap on how many overdraft charges a bank can give for this type of mistake. Eleven!

unfair charges

After a long string of very frustrating experiences with Citizens Bank, I didn't think it could get any worse until they charged me a fee for a debit when I had the money in the bank. The sequence of events was:

-Two debit purchases on Friday (had plenty of money to cover these)

-Check I had written was cashed on Saturday (overwithdraft charge ensued; I didn't transfer money in time)

-Debit purchase on Sunday

-Deposit on Monday (labor day) to cover the check in case

Result: They processed my Friday debits the following Tuesday, even though I had the money in the account to cover them at the point of purchase. I recieved an overwithdraft on Tuesday, following the labor day weekend, for FOUR PURCHASES... when I had plenty of money to cover my 2 purchases on Friday. I used a DEBIT for my transactions, mind you, but they allowed each charge to go through anyway. Their explaination was that it was because it was after 3:00pm on Friday and it went in the system as next day business. I searched their policies online and it states:

"When you withdraw funds from an ATM or make a purchase with your debit card, the funds will immediately be removed from your available balance."

Not to mention, they processed my check first, the charges in decreasing order of amount, THEN my deposit.

I was charged $39 for every single one, at a total of $156.

This is WRONG and UNFAIR. If you read their rules and regulations, each one is intentionally written to be ambiguous to work in their favor. Additionally, most people who overwithdraw can't afford the ridiculous fees that they are charged. Something needs to be done about this.

The complaint has been investigated and resolved to the customer’s satisfaction.

Just happened to us at Citizens bank near New Haven, Ct. Still trying to sort it out over a week now. The manager does not return our calls. $259.oo over draft fees. This is disgusting. We work so hard to have someone rob us like this.

incredilbe overdraft fees

Over $400 and climbing for Overdraft/Insufficient Funds that they made happen- Incredibly on a mortgage payment that I ended up paying myself via Western Union. Tried to pay the awful fees and end the horrible stress but was told no- fees are still coming and account must be open to levy them. The "Juice" is climbing rapidly and I need more phone numbers- Already have the Citizens Bank one in Rhode Island and have already talked to State Banking Commission(not much help but to say this is all legal!)

The complaint has been investigated and resolved to the customer’s satisfaction.

identity theft

Someone stole my information and charged 2 cameras to my debit card. after numerous calls to citizens bank finally had to go to the main branch and file an affidavit for unauthorized card use. Their employee filled out the form and my wife signed it. After weeks of being bounced around they only credit my account for one camera (148.93). When contacted again and more trips to the bank they state that because the form was not filled in correctly they cannot re-open or refund the rest of the unauthorized use. They Filled out the paperwork! We are out 148.93 and there is nothing they can do about it. On top of that it caused my account to be overdrawn and they charged me another $150 in overdraft fees.

The complaint has been investigated and resolved to the customer’s satisfaction.

citizens bank fees

Citizens bank is the worst when it comes to fees over draft 11cents and i get a charge of 109.11 for 10 days over, hope this bank goes under !

The complaint has been investigated and resolved to the customer’s satisfaction.

We’re all in the same boat, citizen bank doesn’t care for its customers their just trying to squeeze as much pennies as they can out of us . Ridiculous...

I have both checking and savings account with Citizens Bank. One day I was browsing and noticed that my checking account was in negative od $9 and I immediately made a transfer of $20 dollars just to cover the negative. The next day I checked, they had charged an overdraft fee of $35 which overdrawn my account again and on top of that they added another overdraft fee! that makes it $70 dollars within 3 days! I called and explained the situation, the rude lady said that there is nothing she can do about it! Guess what? I just open an account with PNC Bank and I am leaving their behind! they are the really crooks!

Citizens Bank is aweful! Today I was charged an overdraft fee on an overdraft fee which should never have happened in the first place. This bank is out of control alright. They are stealing money from innocent people and getting away with it.

I had an outstanding authorization in my account. The amount of that was $16.00 which is sent to the WWF on a monthly basis. The authorization showed up in my account on the 10th and even though I had a positive balance of $8.80 they charged me $39.00 because they said you can not have money on hold that is more then your balance. Ok, I didn't agree. This had never happened before. But I let it go. I would be more careful from now on. Then on Thursday the 10th I got my direct deposit from my job. The WWF had not come out at that point. So today I get home from work and I had another notice from the bank. I had been charged another $39.00 fee. So I opened my account online. They had put the $16.00 in my account on the 9th, charged me another overdraft fee and then put my direct deposit through. NOW just in case I confused everyone. They never put the WWF money through when they charged me an overdraft fee because the pending amount would have made my account overdrawn. Then after I had my direct deposit. They now entered the WWF the day before my deposit so now you add the $16.00 to an already overdrawn $30.00 because of the $39.00 overdraft charge. And they add another overdraft fee. SO this $16.00 pending funds cost me an extra $80.00. This is very apparent when you look at my account as I know the customer service rep understood. But I was told she could not fix it and a supervisor couldn't fix it either. When I asked her for contact information of somebody who could help. I was told they are not allowed to give an information out to the public. There was nothing anoyone could do to make this wrong right!

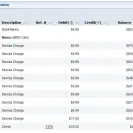

12/10/2009 Insufficient Funds Fee eNotice $39.00 $1, 137.07

12/10/2009 Direct Deposit $1, 222.27 $1, 176.07

Memo: PAYROLL

12/09/2009 DBT Purchase $16.00 ($46.20)

Memo: WORLD WILDLIFE FUNWASHINGTON DC 7734

12/08/2009 Insufficient Funds Fee eNotice $39.00 ($30.20)

12/07/2009 DBT Purchase $7.23 $8.80

I can beat that...I was charged electronically for $108.00 EBAY fee's on the wrong account...While the funds were on hold, I tried to call Citizen's to stop the charge going through the evening.

EBAY complied. The bank did not. I was given false information. I was given a direct line which was an answering service. I called 2 times and received no return call. In the meantime

a $39.00 fee charge was applied. I was told that EBAY is responsible for reimbursing me. I filed a dispute. The dispute with citizen's was placed and I was led to believe that I could use my card without

penalties . I was told that I would be given a temporary credit. It's been over a month and that never happened.

As soon as I received the paperwork for this problem, I immediately went to the bank to ask for help and nip this in the bud. I waited 2 hours and purchased food which would later incur more fee's.

Ironically after waiting 2 hours while the plot to rob the bank was happening before my eyes, I approached the manager only to be told that the bank was closing. The lights went out.

The bank had been robbed in front of my eyes. I did not get the paperwork in. I stayed put to help the police while other witnesses ran away. I figured I could call when I got home. I called 3 times

to no avail. All this time my fee's are adding up. I was out of budget and needed to eat. I was forced to use another card for take out incurring more fee's due to an unplanned extra 15% charge for a tip.

After suffering and waiting so long, I was told that the forms were never received. I faxed additional forms and a letter...In the meantime I was being charged additional $25.00 on each $39.00 fee for

coffee and other small charges incurred by my debit card on hold a day prior to the $108.00 taken out accidentally. After all this time and 3 debit cards involved related to buying food for a disabled son, my fee's had risen to almost $700.00. Yesterday I was told in a matter of fact way that because I actually owed the fee's to EBAY that it was a federal law and the $108.00 charge could not be removed. I was to pay twice for this

fee. I never disputed owing the fee's. I tried to be honest and sincere. I did my citizen's duty to citizen's bank and helped police catch the robber only to be robbed myself today of close to $1000.00

I regret staying and thinking that my family bank would be grateful to me for standing forward in helping the FBI, local police and the bank catch these robbers.

As far as I'm concerned the bank itself is a robber and what goes around comes around. I paid all these fee's. Yesterday my car insurance came out as scheduled for $120.00 causing another overdraft that I had intended to avoid with my fee adjustment. Today I'm working feverishly to sell my own jewelry to get by until my retirement social security check arrives on November 3rd. I'm stressed out. Last week I received a

$200.00 fine for not stopping for a pedestrian crosswalk when there was no pedestrian in sight. 2 cars were stopped. I stopped only to let the police car go around me thinking it was a citizen's duty to help police again. Now I'm faced with going to court to fight this when a policeman gets a nice overtime check and a break to go to court.

How is this connected to the citizen's bank issue? That's easy to explain. Both instance are related to robbery of innocent hard working citizen's who try to obide the law and get a slap in the face.

The culprit here is GREED...When will this stop. To pay all these fee's is horrendous when in reality I owe nothing. I paid $600.00 already. To fight EBAY would be to lose my account with them. I cannot risk that.

I have to eat this up and remember that no one who takes my hard earned money is my friend in need.

I speak out and have written my congressman. I was denied my right to speak with management at citizen's. My money has already disappeared and I will never get it back. I would say it was at least 3 or 4 months of gasoline and groceries. I need oil but I can't afford it so we are both cold for awhile. I'm a single parent with a single income. My son wants to move to another country.

I try to explain that it's not the country but a fee greedy rich people in America who want to be richer.

I am a citizen. I was robbed of my hard earned money by citizen's bank. Citizen's bank is suppose to be my bank. I helped catch a robber that robbed citizen's and was only robbed myself. My face is forever in the video which will be used at some point in prosecution. I ask who is the real robber in this case.

Same problem-outrageous fees and if you are 5 days late paying these fees they charge another $35.

Rob the citizens is a better name!

overdraft fees

I have had my Citizens account for over a decade. I have been unemployed for 6 months in this economy and barely getting by. It is a struggle. In the past week, due to my unemployment check getting posted a day late, Citizens allowed 7 charges to go thru for gasoline ($27), groceries ($55), Walgreens ($8), and 4 other charges all of less than $25. I was charged a $39 overdraft fee for each and every one of them totalling $234 and a total of over $300 in the past week. That is nearly one-half of my unemployment check! I asked why they allowed the charges to go thru and they said "With the small amount of each charge, we see it as a customer service to allow them to pass" - even though they charge ME more than any of the charges actually were! Now I don't have enough in my account for my child support check. What a rip-off! And they refused to credit any of those charges back! THEN they offer me an application for overdraft protection, that they turn down because I have "insufficient income".

The complaint has been investigated and resolved to the customer’s satisfaction.

I work at meijers.and I used this bank.ok.just last week.I was overdrawn 31 cents. 31 CENTS! THEY CHARGED ME 35$.THEN this week.they took what money we had wich was 13$.took all of it and charged me 65$.then the next day.it was double.my wife was like wtf.when she heard.I about [censor] a brick. This is extortion. These ppl tipped mecoff.then we had an issue with dte.dte.redfunded my money.but the bank didn't.kept telling me it was in there.[censor].THEY STIFFED ME 75$.I MAKE 10.45 AN HOUR.I'M NOT DONALD TRUMP.

Same here. I can't close this account

If any legal action is taken please contact me at - thechildlikeempress@yahoo.com. They have done very shady and illegal business practices and charged multiple fees for their initial fee - I did not overdraft this is them taking fees for their own fee...I have never dealt with such a horrible business in my life.

This is terrible and their check cashing policy is terrible as well.

I have a mortgage with Citizens Bank.

When I first got the mortgage I was required to maintain flood insurance on the amount of the loan.

Shortly after the big floods in 2010 I was contacted by Citizens and told that now I had to maintain flood insurance for the 'replacement cost of my home' which is much higher then what I owe them on the mortgage amount.

The increase in Flood insurance premiums is now costing me over $1000 dollar more per year and rising.

I don't think it's right for Citizens to change their mortgage contract policies mid stream.

In 2010 my house got flooded real bad. I got over 9.5 ft of water damage meaning I had to completely re do my entire house.

Everything had to be ripped out from the foundation up. Everything except for the bare walls and roof. All outside siding had to be removed, all electrical, heating, a/c, furnace, domestic hot water system, all hard wood oak floors ripped up and replaced.. everything in the entire house.

At that time I had a $150, 000 dollar policy for flood damage and EVERYTHING in the entire house was replaced without a problem for just $133, 000 so I do not understand why Citizens changed their policy on flood coverage requiring me to maintain a new policy for $250, 000 dollar coverage.

No One from Citizens bank underwriter department will talk to me in person about this situation. It just seems that they do not care what my concerns are and only their own.

Patrick Bonanno

Warwick, RI

I use online banking, I receive direct deposit and I am constantly checking up on my online banking. I stop at the ATM today and notice I am suddenly negative 240.00. WOW. yesterday I checked my account and I had POSITIVE 59.00? Not only was the customer service representative extremely rude she didn't even actually listen, simply told me to get overdraft protection and shes sorry. Sorry for... what...? I am a struggling college student and you say sorry for screwing me over? because you HELD all fees until it was up to 240.00. Horrible company.

I messed up this week. I deposited a check on Saturday thinking it was going to clear on Monday but forgeting that Monday was a holiday and a non-banking day. Well, after paying eleven bills online I found myself with eleven overdraft charges on Wednesday. That's $429 that I gave to Citizens bank all because I forgot my check wouldn't clear until after the holiday. Had my check cleared I would have had more than enough to clear my bills but this did not matter to anyone I spoke with. It seems to me their should be a cap on how many overdraft charges a bank can give for this type of mistake. Eleven!

The bank has switched transactions in order to charge additional overdaft fees on numerous occasions

Citizen Bank is charging $40.00 for overdraft fee an a service charge of $38.00 . Which is a total of $78.00 dollars if you go over. Last month I got charged $78.00 for being .04 cents over drawn. This month I was charged again $78.00 for overdraft and service charges. I'm a 65 yr. old widow with diabetus and asthma. Now I can't afford to get my insulin. Please can anyone help me

I made a payment to time warner cable on the fourth of this month using my debit card, and it was charged to my account. Now the bank has put the exact same amount on hold to pay again on the 8th, this puts my account in over draft, and I will have that fee along with another one for another payment that has not come out yet. I called time warner and they have no record of any payment due or pending. By the time this is all said and done the bank will expect me to pay $74 dollars in overdraft fees, and that is only for 1 week. I am on SSI/SSD and do not have the money for this. I am very upset and wish I could afford a lawyer to go after this bank as this is the fourth time in 3 months they put something on hold and overdraft my account. I thought they could not do this any more, but they say they can and any money I put in they will automatically take out what is owed to them. Any suggestions?

I bounced 1 check which should have omly cost me $38.00. Citizens bank said all ny smaller debit puechases would have ro be cleared after the bounced check even though they were made after the chech was presented. I then recieved a $38.00 overdraft fee for all 10 debit purhases costing me almost $400.00 in fees. A sinilar occurence happend a few months late costing me $200.00. All in all Citizens has taken close to a $1000.00 in overdraft fees. They have also cleared payment on debit purchases when ther were no funds available and rhen charged me an overdraft fee the next day. I would like to join the class action suit against them.

illegal account opening practices

I worked for Citizens in PA for almost 2 years. Fran, the Bucks County Regional Manager, pushes OD fees EXACTLY as described by many posts.

We were forced to open checking accounts that had excessive overdraft fees and monthly charges in order to ripoff the customers. Here's how:

We had to open accounts, lying to the customers that the account has "no fees" and put specifically designed waivers on the accounts so that the customer doesn't realize the scam (the maximum waiver you could use was for 1 year...)

Then, when the waiver expires months later, the customers have their guard down and they don't obsess with every line on their statements, they get hit by monthly fees that will overdraw the account (as most people keep in their checking account only enough money to cover their checks - that's why it's called a CHECKING account). The overdraft fees will overdraw the account again and again and so will the checks you write believing that your account is still good...

I routinely had customers with hundreds of dollars in fees by the time they received their statement - we were specifically instructed to hit high school kids, college students and senior citizens.

Another trick we had to use is open a "Gold" checking account to senior citizens who would come in and ask for a savings account by using a high interest rate as a carot and not disclosing the fees (using the waivers as noted above). Problem is, that "Gold" checking account had a high-balance requirement and the poor people would be hit by unneccesary monthly fees a few months later...

And to add inslult to injury we even had telemarketing days and evenings when we were forced to make telemarketing calls (disguised as "service calls" so that the bank circumvents the do-not-call registry laws). Not only these were clearly marketing calls (as suggested by the program feeding us the leads!) but also we had to open a number of checking accounts over the phone (the daily and weekly targets were set by Fran again, the Regional Manager).

If only homeland security new how many checking accounts Citizens Bank routinely opens over the phone without proper identification or signatures... all the auditors have to do is go to any Bucks County branch towards the end of the day and ask for the signature cards of the checking accounts opened the SAME day to uncover the illegal practice (this way there is no time to mail the signature card and obtain backdated signatures...)

Stay away from Citizens Bank in PA! I quit several years ago and I am still haunted about the things we had to do...

The complaint has been investigated and resolved to the customer’s satisfaction.

awful experience

Citizens Bank Master Card. Brand new account. No feels, low interest, sounds good. Wrong! Never recieved a bill. They called me asking where payment was. I was shocked. Told them I never recieved a bill. They said ok, another one went out yesterday, no problem.

Two days later, got another phone call. told them still waitilng on the bill. They said if you don't get it in a few days, call this number 1-8... Waited all week for bill. Never came. Called the 800 number today. They said the bill only went out on Monday, so they weren't suprised that I didn't have it yet. I said The bill went out over a week ago! No no, bill went out Mon. They wanted me to give them my checking account routing number and my husband said Don't you dare! They now had a late charge fee of $39.00 AND, interest for late payment.

The supervisor told me that if I would take care of this on the phone, she could negotiate the $39.00 fee for late payment. Sounds phony to me!

Sent them a check for the full amount and told them to cancel the account. We ALWAYS get our mail.

The complaint has been investigated and resolved to the customer’s satisfaction.

Lst month(N0vember) my balance was41.48. I looked at my December's statement and there are 23 transaction on there, one for 19.99 aqnd the other for 12.00. So as I received a nasty letter from them saying that I was late in payment, thre would be a 39.00 late fee added to my account. I NEVER RECEIVED A BILL and I ALWAYS pay my bill online., and to top things off, my payment was 11.19 Then they told me that I owed them $2, 285.00. FOR WHAT? I downloaded my account on line and there is NO SUCH TRANSACTIONS! SO, I will go ionto the branch on Thursday morning and ask them whre they came up with such a figure, get my real balance, and SHUT DOWN THE ACCOUNT, and I will also turn them in to the Better Business Bureau and have them investigated. I am very upset, and I am seriously thinking of turning them into the IRS, and have them investigated, because you are NOT SUPPOSED TO DO THESE THINGS TO THE CUSTOMERS. I learned my lesson the hard way, but I guarantee you one thing, they will remove the supposed charges for $2, 280. Thanks a lot citizens bank, I really need this kind of kiaus and stress in my life. RIGHT?

I had a similar experience. Signed up for 12 month interest free card. transferred a balance. then no bill. when I realized a week after the first payment was due that I had not received bill I called the company. they said they mailed it. hmmm I get all my other bills how come not theirs. well now I know, .. because I was "delinquent" in my payment, the no interest deal went out the window. It's now my word against theirs regarding the mail. evil but brilliant on their part.

They ripped me off to

Citizens Changes Monthly Loan Amount

INFORMATION AMOUNT MY COMPLAINT:

- Feb. 2007: Financed a 2007 Dodge Caliber through Citizens Automobile Finance in my name only.

- Signed loan paperwork for financing; monthly payments of $262.04 per month for term of loan.

- Sep. 2007: Deployed to Afghanistan for 9 months; made monthly payments (on time) in excess of monthly loan amount.

- In order to stop mailing checks from Afghanistan to Citizens, sent Citizens a memorandum requesting "Automatic Payments" be set-up in the amount of $500.00 per month. After receiving paperwork from Citizens, filling it out, and returning request, "Automatic Payments" started; $500.00.

- "Automatic Payments" continued until I called to cancel. Automatic payments stopped.

- Due to the amount I was sending Citizens, either via mail or automatically (when it started), loan was in good standing until May 2009. Did not send Citizens any payments after cancelling "Automatic Payment" option.

- Dec. 2008: My divorce was finalized and ex-spouse was awarded automobile (2007 Dodge Caliber). However, she was now responsible for monthly payments, insurance, maintence of the automobile. Judge DID NOT order her to refinance car in her name.

- Dec. 2008; Day after finalized divorce, called Citizens to have all payment vouchers for loan sent to ex-spouse. Explained to Citizens she would now be making the monthly payments; starting in May 2009 when next payment was due. Also stated to have any and all banking information (my "Automatic Payment" information, billing statemnets, etc... removed and stopped), the onlyreference I wanted with my name is the individual responsible for the loan; the one who signed the loan contract. She (my ex-spouse) will now be making the loan payments.

- Apr./May 2009: Ex-spouse sent check to Citizens in the amount of $262.04 to satisfy loan payment for May 2009. However, my checking was also debited +$400.00 by Citizens in the beginning of May 2009.

- May 30th, 2009: Phoned Citizens to find-out what happened and why my checking account was debited and why +$400.00. Explained to Citizens that my ex-spouse will be the one making payments from now on (as I explained to Citizens in Dec. 2008); which she did the end of April. Also asked why the amount debited was +$400.00.

- Citizens stated, based on my request via the memorandum I sent months ago (to have the "Automatic Payments" set-up to be $500.00 month) my NEW monthly loan payments were now $500.00, not the original, signed, legal loan contract amount of $262.04 per month.

- Citizens stated I needed to send a signed memorandum stating I wanted to change amount back to $262.04. After going around in circles trying to get an answer on how Citizens can change the original loan amount frrom $262.04 to $500.00, they said I asked to do so based on my memorandum I sent months ago.

- Again, I tried to explained to the Citizens representative that the memorandum I sent months ago was for the "Automatic Payment" amount I wanted to send ($500.00) and NOT to "rewrite" the loan agreement and original loan amount (262.04). Got no where with the 2 representatives I spoke with.

- Jun. 1st, 2009: I typed memorandum requesting I wanted my monthly payments to be $262.04, NOT $500.00 and faxed to Citizens.

- June. 19th, 2009: Phoned Citizens to see if the monthly amount was corrected from $500.00 to $262.04, it WAS NOT. I faxed the memorandum again.

- July 16th, 2009: Received late notice in mail from Citizens stating I still owe $237.96. I phoned Citizens to find-out what was going on.

- "Matt, " stated he didn't know what I was talking about. He than proceeded to say Citizens would waive the $20 late fee if I would pay what I owed now. I requested to be transfered to a Customer Service manager. "Matt" stated that since I was late, the called would be "re-routed" back to collections section. I hung-up and called customer service myself; I got through.

- "Tom, " customer service manager, stated the amount was changed, however it would not take affect until Aug. 2009. Again, I tried to get an answer on how Citizens could change the monthly loan amount from $262.04 to $500.00. He too explained that it was done based on the memorandum requesting "Automatic Payments" to be set-up in the amount of $500.00 a month.

- "Tom" is attempting to get Citizens to make the original loan amount of $262.04 effective 1 July 2009, not Aug. 2009. This will put my account in "good standing" and not -$237.96. Therefore, the next payment would be due in Aug. 2009.

In conclusion, I still do NOT understand how Citizens Automobile Finance can change a customers loan amount (which was listed in the signed loan contract). If a customer requests to send more towards their loan, via "Automatic Payments, " he or she should be able to do so; which I did. However, once the automatic payments are stopped (which I did), the amount due should be the original amount depicted on the loan contract... NOT WHAT WAS REQUESTED ON AN "AUTOMATIC PAYMENT" BY A CUSTOMER.

The complaint has been investigated and resolved to the customer’s satisfaction.

I have loan with Citizens for over a year. No problems. Auto payment all set up. Great customer service. Easy as pie!

When you have a loan with monthly payments, you need to make the payments if it is in your name. No "vacations", no blaming someone else, it is your responsibility.

So suck it up and send the money.

Terrible! only thing I can say! our car was surrendered in a chapter 13 it is worth 4k and we had to pay 16k. I call and ask when they will come and get it they say never, they say they don't "recognize" bankruptcy matters and refuse to come get this car. we worked very hard to pay all of our debts early and got a discharge and we are still getting the run around from Citizen's and we are trying to give them their vehicle back! I offered to have it brought to the bank the woman told me "there is no where to leave it" and to make matters worse the lawyer is as bad. I wish someone had a clear answer of how to return this vehicle.The nightmare of bankruptcy is over except for this car and nobody will help me.

My problem with CAF is they are ignorant. Never did I have a late payment, paid every 2 weeks more than amount due. My probelem is when I tried to pay off the car. Called verified wire transfer would be OK, and they would refund difference. Wire transfer made and accepted, Citizens lost the wire transfer ! yea right, found the wire transfer, told it would be applied. Problem too much money was sent and had to send money back! Won't send check for more than a certain amount. Sent back money, took 5 days for bank to recieve money. I paid off car July 1st, online bill payment, didn't credit account til July 7th, waiting for small overpayment, wait 10 days for check to be mailed. This organization holds on to money that isn't theirs to get the interest. Why wait for refunds, why does the right hand not even know about the left existing!. They will not return daily interest from June 13th to July 7th even though the payoff had been in their bank on the 13th, which they acknowledge. I talked to "Matt, Amanda, Megan, Kelly Robinson, Rosemary, Ben, and Vicki", Same run around terrible company. I will be contacting the Attorney Gerneral Of RI, How long can these people get away with this, I'm not the only one.

I am trying to pay off my debts, so I decided I was going to start making extra payments on my vehicle. I noticed on an old CAF statement that I had, that if I made extra payments, it might interfere with my auto-debit taken out each month. So I called customer service at CAF and asked them if I made extra payments, would it change the amount that was deducted automatically from my checking account each month, or if it would change the dates of the auto-debit. The agent assured me that if I made an extra payment by check, and mailed it so they received it a couple of days after the debit went through, that it wouldn't mess up my auto-debit. So the first month, I paid $300 extra towards the principle. Lo and behold, this month I check my bank statement, and CAF took out $300 LESS than I normally have deducted from my account. What happened to "THIS WON'T INTERFERE WITH YOUR AUTO-DEBIT?!" I swear, I hate CAF for being such idiots. Needless to say, I called my bank and they paid off CAF and I transferred my loan to them. My interest rate also went WAY down. I would highly recommend that you also transfer your loan to somewhere else!

"

The vehicle was in our business name, the loan was in my name. Since our separation, my ex stopped making the payment, I've been paying the loan on time with my PERSONAL check. The loan was over paid by one payment at the time I paid it off. Citizens sent me a refund check in our business name but I was not able to cash it due to the closures of our business and it's bank account. I contacted Citizens, after sending them the supporting documents they sent me a replacement check in my name. I deposited the second check into my account. The payment on this check was stopped and I got charged for the returned check. I contacted Citizens again, they told me to repeat the step I already did, to write another letter and submit proof of the business closures, which I already did before they sent me the second check. It's been a year now I haven't heard or received my refund. This company is HORRIBLE, people that work for them are a whole bunch of ANIMALS.

These are horrible, nasty, rude, people. They are not even human! DRIVE YOUR CAR INTO A TREE AND GET THE INSURANCE TO PAY THEM OFF AND MAKE SURE YOU HAVE GAP INSURANCE. IT WOULD BE EASIER THEN DEALING WITH THESE NEANDERTHALS! SATAN OWNS THIS BANK! RIDE A BIKE OR WALK INSTEAD OF DEALING WITH THIS BANK!

I mailed myFINAL payment Feb 16th. I was very excited. The payment is not due until Feb 28th. Guess what? Today is Feb 28th and they have no payment. I called On Feb. 22 and was told by a female they are behind because of Presidents Day. I called again on Feb. 24th and was told they are behind and it could be the following week Wed (this is past my due date) and 16 days past the time I mailed it. I called today Feb. 28th and spoke to a man. I explained I have sent my payments for 5 and half years and no problems now they can't not find it. I made copies of everything and I read the final statement and where to mail. He is now telling me I sent it to the wrong address. I called later this afternoon and the system is down I was told to call back in 15 mins. That was 3 hours ago and the system is still down. I have NEVER been late on one payment or have missed a payment and no one will help me.

I have a loan for my car and this is my nightmare. They are charging $4.65 per day and It seems that it does not matter how much you will pay you still will own them 20 years later

Brent, I am in the same boat as you. It has been five months since I received my statement. I just send my check with no paperwork, except a note stating how many months its has been since I received a statement, and that I am making every effort to continue to pay off my car loan. I do suggest that you look into refinancing your automobile loan; that is what I am doing. Best of luck to you all.

Having big issue to get them to send paper billing statement to my address which we was far ahead then we did not received any more billing statement till last three months ago. Then we recieved a thresting call that we owe money that I asked them ot send paper statement so I can keep paying the statement which keeps falling on deaf ears. Nothing has been done for next three months and still foghting with them to get the billing statement out to my address which I kept repeating it for over ten times on three calls I received. This month I had to called them and wonder why I not recieving any billing and I had to start all over. Is there any way to get them to listen and get the billing statement send to the house so I can pay it on time. Or is this how they get more money from the customer for the interest increase for late payment which did not get the billing statement? How I get them to listen and get them send the billing statement to the house?

they are doing fraudulent activities to rescue their bank

Probably you have asked the question “Why a financial institution which is supposed to be safe is doing fraudulent activities to surpass the economical reception?”

Citizens Bank, one of the most vulnerable banks to the reception finally is alive, while other stronger banks fell. Suspicious, don’t believe me?

Try to open an account in Citizens Bank, and then wait for about six months without using it. After six months, then you will find yourself in an office discussing why there are irregular charges in your account, and they suppose that you made those activities, but even worst, the increment of the charges can be faster and higher that you can imagine and without notification. After 2 weeks you are obliged to pay about $350 because these are extra-fees for late payment.

The same issue is occurring to my friends, they are having the same complaints but nobody can do anything, and there is not defense in your favor.

They never send a notification to prevent those issues, but you will never have explanation about why.

But why?

A manager from Citizens Bank told me that he cannot do anything they have made a lot of changes in their terms and financial rules, and even managers lost privileges to help people in those cases, because of the economical reception.

Economical Reception? Economical Reception?

Customers are NOT guilty about economical reception? Why citizens bank don’t do as other banks did? Why the don’t declare in deficit? They are using their last resources to survive the reception, but using irresponsibly the money from the customers without their consent, and without return.

Don’t believe me? Open a Citizens Bank account now, and wait for about 3 to 6 months. Be prepared to pay a big error.

I forgot to tell you something... after you open a bank account in citizens bank, you cannot close it. They refuse to close it. So you will probably continue having those issues because they need you to take YOUR money!

The complaint has been investigated and resolved to the customer’s satisfaction.

This is a bad bank! I had an account with them about five years ago and got rid of them quickly. I never had any overdraft problems and just hated that their terrible website did not show pending payments for days. They still have this problem. A friend of mine still uses them and his account got overdrawn for $600 when the money was in there to be taken out with some left over. They just took the money and gave no reason for it. Now it is overdrawn and they keep adding on the daily charges. They also just recently added some new thing that if you don't keep $1, 500 in your account they will charge a monthly fee. Who has that kind of money to spare. I told him to go with PNC or another bank because they don't charge all these ridiculous fees. Citizens Bank is obviously going under which is why they are charging all these new fees. Stay away from them! They're crooks!

One word of advice: You can elect to have Citizens Bank not cover checks if you don't have the money in there. You can do this on their website then they will send you a paper to sign to authenticate it. This way they will not cover the checks that come in if you don't have the money. They will likely still charge you the fees per check, but it won't keep the charges piling up for all the checks they do put through. Getting rid of this bank is the better solution.

How do I be a part of this law siut- they chagred me overdraft fees when I had money to cover my transactions all but 10cents- I put money in to cover - they took the overdraft fee out before my transactiosn went totaly through and charged me over draft fees for all those transactiosn that were covered but 10 cents- thoese items we posted to my acct but on hold- taken from my balance- and they still charged me and they will not reutnr my calls

Exact same thing is happening to me again for the 2nd month in a row. The first time the bank paid a check that was written 3 mos prior. WHY WOULD THEY HONOR A CHECK OVER 90 DAYS?!?!?!? I'll tell ya why: so they could earn over $175 worth of fees. When I called the bank, the girls said if it were her, she'd call the payee of the check. Nvr mind that bills were being paid at the same time as they covered this check and it was clearly not going to clear my account. Did they contact me? Of course not. Went to local branch, guy understands totally, but has kept me waiting for over a month to reverse fees. That hasn't been resolved and guess what? they did it again! I check my account, theirs enough to cover a few small charges, but as before, I'm being charged for more overdraft fees I opted out! And i requested an email alert for if my account is too low to cover a charge. The guy in "Relationship Servicing" says they cannot honor that because they can't see the balance when the charges are being paid. (?!?) They offer a nonworking service? Why offer in the first place? That's right: so they can lie and steal from customers hard earned money. So I am filing a class action suit against them.

I would not have believed it until it happened to me.. I have been hit with some overdraft fees.. Of course I blame myself at first, I shouldn't be so careless with this money hungry bank but, I was recently hit with almost $700 IN OVERDRAFT FEES... again. It seems like they process payments when they want to so you overdraft, enough to the point I was in such a hole, my paycheck wouldn't cover the fee's. I have a son and a kid on the way and this has me in a bit of a pickle. I am still negative $279 and cant do s*** about it. Not to mention Citizens Visa card.. I had $9000 credit line dropped to $2000 for a late payment after I complained on why I was not receiving emailed bank statements. I always payed on time and payed over the minimum balance. For this one incident I was treated this way and no one could help me? And did I ever get a response to my question about my email statement? Person on the phone wanted none of it and after 2 emails in the past 2 months, all I received was an automated thank you reply. Yea, Thanks Citizens!

They take every chance to charge you all sorts of fees and do not give any sort of consideration. I could not make a cash back in the grocery even if there was money on my account.

They have a big fee just to check your account from another atm even if you do not withdraw money.

They hold your deposited check for a long time before releasing it.

Unlike other banks they charge you for first time overdrafts with absolutely no consideration.

Closed my account immediately.

DO NOT open an account if you do not want to lose money and get horrible customer service.

JMR09, if its illegal then how do we take legal action?

Citizens Bank just RAPED me out of $400.00 ! I balance my check book to a "T", and they still managed to screw me over. They do sneaky things. They don't care about you as a customer. They are bank vampires just out to suck money money from you. You are just another sucker to them. not a customer or human just a number.

I've even been charged for debit purchases... when I had the money in the bank! They found a way to justify an overwithdraft fee because "friday is part of the weekend" and they processed a bounced check from SATURDAY first, after the weekend was over. Yet I can't get my deposited checks for 24-48 hours? And credit charges are withdrawn immediately? This is not legal.

this bank SUCKS! they manipulate charges to put the larger ones through first, then assess huge overdraft penalties on a DEBIT card account. Quickly adding up to hundreds of dollars in fees. They prey on college kids with these tactics. Should have let them fail instead of bailing these phuckers out.

How? Can we form a group? Begin a Class action suit? This bank and stolen from me time or time; and continue to try to make ME as the person at fault!

Help...how can we put a stop to this?

awful bank

Someone did thousands of dollars worth of fraudulent activity on my checking account over at least a nine month period and I the bank would only reimburse for 60 days of that fraudulent activity and I can't get anyone to help me get my money from the bank not even the fdic or the ms dept of banking and consumer finance. I'm talking over 10k. Can anyone tell me how I can get my money back. All of it.

The complaint has been investigated and resolved to the customer’s satisfaction.

They SUCK LIE LIE LIE

overcharged

Last November Citizens Bank hit me with over 500$ in over draft fees on three purchases all equaling less than 10$. They took my direct deposit Social Security Disability Check and canceled out the fees, regardless of the fact that I did not want that. I nearly became homeless because of that.

I left the account to mold while I opened a checking account with a much better (and more popular) bank. Recently a charge of $3.99 was made via paypal for some arbitrary purpose to the Citizens account by mistake. I made a call to their customer service to ask that the fee be removed as a courtesy, which they agreed to. They then stated my account balance was 'fine' and 'in the clear'.

Well, I though they meant the account was POSITIVE in balance, so I did nothing.

I went in today to deposit 50$ to keep it from happening again, and my account was 100$ NEGATIVE.

They will not waive the fees, or even work with me on the fees. Instead until i make the account positive, I will incur another 39.00 charge every 7 days. No one told me this before. The seven day limit to deposit after the fee was refunded was YESTERDAY, and they will not make an exception!

I am on Social Security, I make 637.00$ a month! I cant afford to lose another 100$ of my income!

I called the bank where I opened the account (Willow Grove) since i live 150 miles away from it now, and the manager (Debbie) was EXTREMELY rude and treated me like I am an idiot who cant manage my money. She told me to practice my money management skills and then hung up.

I have NEVER had an account overdraw at ANY other bank. Citizens Bank should be ashamed of its self. Bad customer service and insane fees will make this bank one of the next to sink!

The complaint has been investigated and resolved to the customer’s satisfaction.

I feel very sorry for you. Citizens Bank is a TERRIBLE bank and they do NOT care about their customers. This is clearly a case of predaotry lending. The bank wants to make you think they did you a favor by allowing the charges to go through, while at the same time charging you outrageous fees for the "convenience" (their word, not mine).

Gone are the days when banks looked out for their customers. Banks like citizens are looking out for their bottom line. They are simply looking out for ways to increase their profits and revenues for their share holders. They also don' want the "average" customer. They want people with lots of money

I am a former of the bank and am all too familiar with their poor business practices. Sorry to hear about all your trouble. I left them and went to Bank of Ameirca. At least I was given the option of opting out of this practice. I hope Citizens bank goes belly up, and that their CEO, Larry Fish, knows what it's like to have someone abscond with his money - like what his bank has done to so many unfortunate people.

unfair practice