Worst service

They just send the card and never the statement and increase the money every month... no one in Barclay to listen... I have written so many mails... but no response till date... when I called the gurgaon no [protected] no one care to pick the calls...

Anybody here listen the problem... guys beware of Barclay cards...

Reduced credit limit

I was given an initial credit limit of $1750.00, when I received my card. I got a letter saying that after a review of my transactions, I posed to be credit risk. I was told that I would have to prove myself to get any more credit than $500.00. Why was this not checked from the beginning? I plan to pay this bill and cancel this account. This is a ridiculous way to encourage new business. I agree this is a rip-off from a company who misleads its clients. This needs to be addressed to Better Business Bureau and FTC.

The complaint has been investigated and resolved to the customer’s satisfaction.

I made a purchase to a skin cream company in December for a "free" sample for 5.95 for a shipping and handling fee. Details were if I liked it I would be sent the product and charged a 69.95 monthly fee. I thought about it and didn't really like it after I impulsively ordered it and then I saw posts where a lot of others did the same but were charged the 69.95 fee many months and multiple times AFTER they had cancelled the orders. Well I immediately called Juniper and of course they told me the only way to cancel was with the vendor or cancel my card and wait to get another issued. I then did some serious searching and found the vendor's contact number and cancelled. The cancellation showed up on my Jan statement so I thought great -thanks to the internet and other consumers I stopped a possible night mare. WELL today I saw the 69.95 charge on my account and almost went ballistic. I calmly called juniper and explained the situation and was basically told by the foreign rep..."bottom line is I made the charge not Juniper" -so much for having them help to clear this up. I told them I will attempt to contact the company for a SECOND time to stop this and then cancel this *** card. I have never been late and pay the balance off almost every month and so last month they even cut my limit in half.

Anyways I have in 20 years only one other time with another card company called to dispute a charge and they took care of it immediately!

I will find another (hopefully better credit card company) and cancel this company-as if they care! BUT I care so there!...my 2 cents!

This is the worst bank/credit card company EVER! I transferred a balance to this card with 4.99% interest. I have paid every month on time for over 2 years. Last month I accidentally sent in a less than minimum due payment ON TIME! They charged me for a late fee and raised my interest to 12.99%. I called and spoke with them and they were rude, demeaning and offered no resolution. I am trying to transfer this balance to another card and warn everyone to never do business with these people EVER!

If you like a credit card company that provides terrible customer service, where the only people that will talk to you are in the Philippines, go to Juniper and the US Airways Mastercard. They read from a script and do not have answers to any questions. I particularly liked sitting around for hours waiting for a promised call from a supervisor. The so-called supervisor in the Philippines called two days later and told me that if I wanted the issue escalated, I needed to send in a letter by mail to Juniper Bank. Thanks for all you do in exchange for $100 in annual fees and the money you made off $30k of charges this year. Appreciate it.

Was told by a rep that there would be no late fees or returned payment fees applied to my account after a mix up with payment info. The lady specifically said to me, "ma'am, I'm not lying to you, there will be no fees applied to your account"...low and behold there are late fees and returned payment fees on my account. When I called to get these removed the manager said they cannot be removed even though their rep said they could be. Refused to listen to the recorded conversation where the rep told me these would not be applied to my account simply stating that there is nothing she can do. Her name is heather johnson - she was very rude.

I made two transaction online and was left a message on my cell phone shortly after directing me to contact a toll free number but not identifying the company leaving the message. I called the number and was prompted by a auto attendant to enter my complete social security number and zip code which, of course, I would not do. After pressing many prompts, i located a customer relationship manager who only identified herself by her first name and would not tell me the company until I asked her to do so. She informed me that she was employed with juniper bank who handles the credit card which i used on my online purchases. after we confirmed transactions, I told her I wished to speak with a supervisor or officer of the company because this verification process was absolutely litigious. she put me on hold for several minutes and returned to tell me that "everything has a purpose" to which I ended up hanging up because I knew I would never get anywhere. I canceled my card with this company immediately.

Wow, what a joke of a bank. Barclays Bank's customer service department is by far THE worst I have encountered. I am surprised Frontier Airlines has not moved on to a different bank to administer the frequent flier credit card offer. The customer service at the bank is the worst I have ever experienced.

If I did not love Frontier Airlines and want the mileage credit I would have dumped Barclays Bank long ago.

Seriously, I do not understand how a company (Barcays) can stay in business with the poor customer service, lack of follow through, incompetent employees, not well-trained employees on their own products (e. g. stating they don't offer a "Pay Pass" credit card through Frontier Airlines, when they do!), weak supervisors, not calling back within 24 hours as they state a manager will do and managers not even aware of what the problem is.

This goes back to mid-May when I was sent a new credit card because I was "upgraded" to a better card. Two months later and nearly 30 phone calls and I don't have resolution and continue to get incompetent customer service employees who give me incorrect information and do not seem to care to fix the situation. Stay clear of getting one of these cards if you can help it. (I read the negative post by a person who "was roped" into one there at the Denver Airport.)

I am so disappointed in this product, Barclays Bank, any Barclays cards, especially the Frontier Airlines Barclays MasterCard, the incompetent call center they use in Manila, the uniformed bank customer service personnel in the U.S. who do not follow through and seem uninterested in helping, Frontier Airlines.

There are other better choices out there. Be aware - Mike

Wow, what a joke of a bank. Barclays Bank's customer service department is by far THE worst I have encountered. I am surprised Frontier Airlines has not moved on to a different bank to administer the frequent flier credit card offer. The customer service at the bank is the worst I have ever experienced.

If I did not love Frontier Airlines and want the mileage credit I would have dumped Barclays Bank long ago.

Seriously, I do not understand how a company (Barcays) can stay in business with the poor customer service, lack of follow through, incompetent employees, not well-trained employees on their own products (e. g. stating they don't offer a "Pay Pass" credit card through Frontier Airlines, when they do!), weak supervisors, not calling back within 24 hours as they state a manager will do and managers not even aware of what the problem is.

This goes back to mid-May when I was sent a new credit card because I was "upgraded" to a better card. Two months later and nearly 30 phone calls and I don't have resolution and continue to get incompetent customer service employees who give me incorrect information and do not seem to care to fix the situation. Stay clear of getting one of these cards if you can help it. (I read the negative post by a person who "was roped" into one there at the Denver Airport.)

I am so disappointed in this product, Barclays Bank, any Barclays cards, especially the Frontier Airlines Barclays MasterCard, the incompetent call center they use in Manila, the uniformed bank customer service personnel in the U.S. who do not follow through and seem uninterested in helping, Frontier Airlines.

There are other better choices out there. Be aware - Mike

I am stuck with a $600 dollar bill.. the product was charged over and over again and I never got thte product

Not these ### said it is too late to get the money back from the company that neer sent the product.

I did EVERY thing for me and now htey said.. nope sorry too much time has gone by we cannot help..

Any one help me in suing?

You can Google Barclay's Bank Corporate Headquarters and get their address in Delaware.

Juniper reduced my credit line from $11, 000 to $7650 after my credit card was stolen and they had to eat $200.00. Then, they raised my rate from 8.99% top 14.51% and put back the $200.00 on my card. I just got a letter informing me that as of November, my interest rate will be 19.99%. I have never had a late payment, over limit charge or any other trouble. I am canceling my card and transferring the balance. Write to the president or CEO and copy the FDIC. Many people are doing this, and the FDIC doesn't tolerate this crap. The more people who do this, the better chance we all have of screwing Juniper.

Issue regarding barclay creditcard amount

I am holding this card for last 11 months and started using it few months back only. This is to inform you that I am not getting any statement regarding my Credit Card but daily getting 20 calls from your collection department and each time i am confirming my email id on demand but till now I have not received a single statement. Now a days, these daily calls are affecting my professional as well as my personal life. So I don't want to use this Barclaycard anymore.

I want to pay the entire amount which I have spend through my credit card (Except the interest amount and late payment fee), as I am not getting any statement from Bank. Regarding this issue I have spoken to customer care several times and updated the same address (as registered in your Dtatabase).I have asked many times to customer care executive to provide me the request number, but they refused each time by saying that they will execute the request as soon as possible.

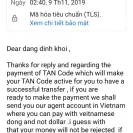

I just love the Internet!

Got the same scam in my email a few days ago. Same Check details, only the Name, Amount and Date were changed...

(Minor Photoshop note: The Date line had a break in it. LMAOOOOOOOOOO)

Hope the image attachment goes through...

-SAB

100000000000000000000000000% scam!

please sir

i requasted to you . My draft no. is [protected] [protected] [protected] : 011 my name is mr Jagdishchandra Patel. so pls give me a information this draft is original or not. from india

This is a scam, but surely you know that already right?

If not, then you are an idiot.

Best regards,

Ronnie

TO,

The Manager

Braclays Bank,

United Kingdom.

Dear Sir,

Sub: Regarding Confirmation of your Drfat.

My name is Ajay Kumar lived in India at Amritsar, I had recevied a mail from Yahoo/msn lottery that is "you had won the prize money of 1000000/- pound And Sterling". They informed me to pay Rs.300/- pounds for receving the documents from them. I told them without seeing my document I can't pay the money. Then they send me scanned copy of Barclays Banks Draft through mail. The scanned copy details Draft.No.: "[protected]" ':[protected]: [protected]: 011' at the top [protected] with, Certified Bank Draft, Date 11/04/2009, Pay Ajay Kumar. The sum of one million pounds/- with for seal FOR BARCLAYS BANK with Director's Sign. and Currency operations dully signed, with 08020, Bank Draft as like your formate.

I request you please clarify me that scanned copy of your bank Draft is valid or not. Please inform to me your mail ID, I will sent copy of your Draft for your verification.

Sorry for the inconvenience Cost. Please reply immediately.

Thanking you

Warm Regards

Ajay Kumar

Mobile No.: [protected]

Email ID: aayush8128@yahoo.com

TO,

The Manager

Braclays Bank,

United Kingdom.

Dear Sir,

Sub: Regarding Confirmation of your Drfat.

My name is S.Sivasubramanian lived in India at Chennai, I had recevied a mail from Euro Million Award Team that is "you had won the prize money of 750000/- pound And Sterling". They informed me to pay Rs.50000/- for receving the documents from them. I told them without seeing my document I can't pay the money. Then they send me scanned copy of Barclays Banks Draft through mail. The scanned copy details Draft.No.: "[protected]" ':[protected]: [protected]: 011' at the top [protected] with, Certified Bank Draft, Date 26/10/2008, Pay S.Sivasubramanian. The Sum of Seven hundred and fifty thousand pounds sterling only/- with for seal FOR BARCLAYS BANK with Director's Sign. and Currency operations dully signed, with 08020, Bank Draft as like your formate.

I request you please clarify me that scanned copy of your bank Draft is valid or not. Please inform to me your mail ID, I will sent copy of your Draft for your verification.

Sorry for the inconvenience Cost. Please reply immediately.

Thanking you

Warm Regards

S Sivasubramanian

Mobile No.: [protected]

Loading email preview, please wait...

From: barclays bank online plc

4 Sep 07 03:03 PM

To: moin_4u@rediffmail.com

Subject: ACKNOWLEDGEMENT FOR FUNDS TRANSFER REQUEST

Open in a new window

Show Headers

Barclays Bank PLC.

Registered in England.

Registered No: 1026167.

Registered Office:

1 Churchill Place,

London, E14 5HP.

Proud sponsors of the Barclays Premier League

ACKNOWLEDGEMENT FOR FUNDS TRANSFER REQUEST

Dear Valued Customer,

Welcome to Barclays BANK Plc (B.B. Plc). One of the most efficient commercial bank in the UK. Our international transfer Unit, to which links you to us, is strictly under the international law governing international transfer.

I am Mr. Oliver Leeds, The international transfer manager of the Barclays BANK Plc and the transfer officer designated for your funds transfer.

The account of which its details and ownership has been reinstated in your name shall be released to you in the earliest.

To further the transactions, you are to produce the below requested information as soon as possible.

LOTTERY INFORMATION.

Names: __________

Mobile Phone Number: __________

Fax Number If Available: ______________

Lottery Ref Number: _________________

Amount Won: _________________

Name Of Your Claims Agent: _______________

Scanned Copy Of Your International Passport/Driver's License__________________

Country At Present_________________________________

This is to confirm the authenticity of your claim!

On receipt of the information, you shall be educated on the process

mastered to facilitate this transaction in the earliest.

Proud sponsors of the Barclays Premier League

Yours faithfully

Mr. Oliver Leeds, Co- Head Inward

Tel:+[protected]

Chief Accountant/Account Director.

CC: GENERAL MANAGER (B.B. Plc).

Proud sponsors of the Barclays Premier League

OFFERS FROM Barclays BANK PLC UK.

===============================================================

Home internet online transfer

===============================================================

Alternative methods of payment

===============================================================

Standard Account Service

===============================================================

Foreign Currency Drafts

===============================================================

Company or Personal Cheques

===============================================================

Copyright © 2007 Barclays BANK Plc.

_____________________________________________________________________________________

CONFIDENTIAL FROM Barclays BANK PLC.

This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to which they are addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than the intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited.Yours faithfully

Mr. Oliver Leeds, Co- Head Inward

Chief Accountant/Account Director.

CC: GENERAL MANAGER (B.B Plc).

Barclays Bank PLC . Registered in England. Registered No : 1026167.

Registered Office: 1 Churchill Place, London, E14 5HP.

Barclays Bank PLC is authorised and regulated by the Financial Services Authority

Proud sponsors of the Barclays Premier League

________________________________________

For ideas on reducing your carbon footprint visit Yahoo! For Good this month.

From: "m o i n"

4 Sep 07 03:28 PM

To:

Subject: Re :ACKNOWLEDGEMENT FOR FUNDS TRANSFER REQUEST

Open in a new window

Attachment(s): 1 Close

Name: LOTTERY_INFORMATION.doc

Size: 24064

Download Attachment

Scan For Virus with F-Secure

________________________________________

Show Attachment(s)

Show Headers

Note: To help protect your privacy, images from this message have been blocked.View images | What is this?

On Tue, 4 Sep 2007 10:35:00 +0100 (BST) BARCLAYS BANK ONLINE PLC wrote

Barclays Bank PLC. Registered in England. Registered No: 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. Proud sponsors of the Barclays Premier League ACKNOWLEDGEMENT FOR FUNDS TRANSFER REQUEST Dear Valued Customer, Welcome to Barclays BANK

Plc (B.B. Plc). One of the most efficient commercial bank in the UK. Our international transfer Unit, to which links you to us, is strictly under the international law governing international transfer. I am Mr. Oliver Leeds, The international transfer manager of the Barclays BANK

Plc and the transfer officer designated for your funds transfer. The account of which its details and ownership has been reinstated in your name shall be released to you in the earliest. To further the transactions, you are to produce the below requested information as soon as possible.

LOTTERY INFORMATION.

Names: __________ Mobile Phone Number: __________ Fax Number If Available: ______________ Lottery Ref Number: _________________ Amount Won: _________________ Name Of Your Claims Agent:

_______________ Scanned Copy Of Your International Passport/Driver's License__________________ Country At Present_________________________________ This is to confirm the authenticity of your claim! On receipt of the information, you shall be educated on the process mastered to facilitate this transaction in the earliest.

Proud sponsors of the Barclays Premier League Yours faithfullyMr. Oliver Leeds, Co- Head Inward Tel:+[protected]-2456Chief Accountant/Account Director.CC: GENERAL MANAGER (B.B. Plc). Proud sponsors of the Barclays Premier League OFFERS FROM Barclays BANK PLC UK.===============================================================Home internet ==============================================================Alternative methods of payment===============================================================Standard Account

Service===============================================================Foreign Currency Drafts===============================================================Company or Personal Cheques=============================================================== Copyright © 2007 Barclays BANK Plc._____________________________________________________________________________________CONFIDENTIAL FROM Barclays BANK PLC.This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to which they are addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than the intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited.Yours faithfullyMr. Oliver Leeds, Co- Head InwardChief Accountant/Account Director.CC: GENERAL MANAGER (B.B Plc). Barclays Bank

PLC . Registered in England. Registered No : 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority Proud sponsors of the Barclays Premier League

For ideas on reducing your carbon footprint visit Yahoo! For Good this month.

Barclays Bank PLC.

Registered in England.

Registered No: 1026167.

Registered Office:

1 Churchill Place,

London, E14 5HP.

Proud sponsors of the Barclays Premier League

IN BB TO THE TRANSFER OF FUNDS (WINNING FUNDS) FROM THE BRITISH LOTTERY COMPANY.

DEAR VALUED CUSTOMER MD. MOINUL HAQ,

You are welcome to Barclays Bank PLC. The payment Bank for BRITISH LOTTERY COMPANY. We are pleased to be at your service. We are Regulated and Stipulated by the Financial Service Authority (FSA), the financial institutions that govern all financial activities in the United Kingdom. Futher more nothing will be dedouting from your winnings because its fully covered by the british lottery board before depositing the winning fund under the Barclays Bank PLC below is the cost of Re-activation fees which you must pay in other to make the transfer to any of your account in your country.

In receipt to the transferring of your funds worth the sum of £1, 500.00.00(One million Five Hundred Thousand Pounds Sterling) (This funds was said to be a winning funds drawn by the BRITISH LOTTERY COMPANY.) so congratulations. As per your question, The funds is expected to be transferred to your country, you cannot keep the funds in our Bank as a current account because you contacted us for the transferring of your funds, so the funds is said to be a transferring funds. In every successful transfer of funds especially in this regards, it is an essentiality that you activate a premium account with the bank that can accommodate and transfer such an amount of money. Transferring the Sum of £1, 500.00.00 GBP here in the United Kingdom. need utmost care and confidentiality at course of transferring the funds. So you need to be guarded with policy and rules regarding the transfer. By so doing, you are expected to act in accordance to the policy here.

So, to commence with the transferring of your funds, you are expected to re-activate a Premium account for the transfer. The cost of activating a Premium account is (400.00 GBP = 32, 700 INR ) (Four Hundred Great Britain Pounds Sterling) which will be added to your account balance. After the activation of an account and the confirmation of your payment with our account manager, You will ask to send your account details for the transfering your winning fund.

Your Fund (£ 1, 500.000.00 )Will Made As Below Information Within 24 Hours After Your Re-activation Payment

BANK ACCOUNT:

ACCOUNT NAME:

BANK NAME:

SWIFT CODE:

TYPE OF ACCOUNT:

BANK CONTACT ADDRESS:

VALIED CONTACT PHONE NUMBER:

So if you are ready to make the payment of (400.00 GBP = 32, 700 INR ) for the cost of transferring your winning funds to any of your desire/nominated bank account in your country, you are expected to notify this office for the payment details so that it will be sent to you as soon as possible in other to make the transfer of your winning (1, 500.000.00 GBP ) to your bank account in your country.

Barclays Bank PLC London, is committed to rendering qualitative services to you, Also you are advice to send us a scanned copy of your driver's license or your international passport for final verification.Your urgent reply will be most welcome.Treat with dispatch and reply to our official email address above. We look forward to serving you better.

Yours faithfully

Mr. Oliver Leeds, Co- Head Inward

Phone:+[protected]

Chief Accountant/Account Director.

CC: GENERAL MANAGER (B.B. Plc).

Proud sponsors of the Barclays Premier League

----------------------------------------------------------------------------------------------------------------------------------------------------------------

CONFIDENTIAL Barclays Bank PLC This email and any files transmitted with it are confidential And intended solely for the use of the individual or entity to Whom they are addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than The intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited.

(400.00 GBP = 32, 700 INR ) (Four Hundred Great Britain Pounds Sterling)

IN WHICH ACCOUNT SHALL I TRNSFR THIS AMOUNT CLEAR MY DOUBT

On Wed, 5 Sep 2007 09:13:05 +0100 (BST) BARCLAYS BANK ONLINE PLC wrote

Barclays Bank PLC. Registered in England. Registered No: 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. Proud sponsors of the Barclays Premier League

IN BB TO THE TRANSFER OF FUNDS (WINNING FUNDS) FROM THE BRITISH LOTTERY COMPANY. DEAR VALUED CUSTOMER MD.

MOINUL HAQ, You are welcome to Barclays Bank PLC. The payment Bank for BRITISH LOTTERY COMPANY. We are pleased to be at your service. We are Regulated and Stipulated by the Financial Service Authority (FSA), the financial institutions that govern all financial activities in the United Kingdom. Futher more nothing will be dedouting from your winnings because its fully covered by the british lottery board before depositing the winning fund under the Barclays Bank PLC below is the cost of Re-activation fees which you must pay in other to make the

transfer to any of your account in your country. In receipt to the transferring of your funds worth the sum of £1, 500.00.00(One million Five Hundred Thousand Pounds Sterling) (This funds was said to be a winning funds drawn by the BRITISH LOTTERY COMPANY.) so congratulations. As per your question, The funds is expected to be transferred to your country, you cannot keep the funds in our Bank as a current

account because you contacted us for the transferring of your funds, so the funds is said to be a transferring funds. In every successful transfer of funds especially in this regards, it is an essentiality that you activate a premium account with the bank that can accommodate and transfer such an amount of money. Transferring the Sum of £1, 500.00.00 GBP here in the United Kingdom. need utmost care and confidentiality at course of transferring the funds. So you need to be guarded with policy and rules regarding the transfer. By so doing, you are expected to act in accordance to the policy here. So, to commence with the transferring of your funds, you are expected to re-activate a Premium account for the transfer. The cost of activating a Premium account is (400.00 GBP = 32, 700 INR ) (Four Hundred Great Britain Pounds Sterling) which will be added to your account balance.

After the activation of an account and the confirmation of your payment with our account manager, You will ask to send your account details for the transfering your winning fund. Your Fund (£ 1, 500.000.00 )Will Made As Below

Information Within 24 Hours After Your Re-activation Payment BANK ACCOUNT:ACCOUNT NAME:BANK NAME: SWIFT CODE:TYPE OF ACCOUNT:BANK CONTACT ADDRESS: VALIED CONTACT PHONE NUMBER: So if you

are ready to make the payment of (400.00 GBP = 32, 700 INR ) for the cost of transferring your winning funds to any of your desire/nominated bank account in your country, you are expected to notify this office for the payment details so that it will be sent to you as soon as possible in other to make the transfer of your winning (1, 500.000.00 GBP ) to your bank account in your country. Barclays Bank PLC London, is committed to rendering qualitative services to you, Also you are advice to send us a scanned copy of your driver's license or your international passport for final verification.Your urgent reply will be most welcome.Treat with dispatch and reply to our official email address above. We look forward to serving you better. Yours faithfullyMr. Oliver Leeds, Co- Head Inward Phone:+[protected]-2456Chief

Accountant/Account Director.CC: GENERAL MANAGER (B.B. Plc). Proud sponsors of the Barclays Premier League ---------------------------------------------------------------------------------------------------------------------------------------------------------------- CONFIDENTIAL Barclays Bank PLC This email and any files transmitted with it are confidential And intended solely for the use of the individual or entity to Whom they are addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than The intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited. Barclays Bank PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority. Barclays Bank PLC adheres to the principles of the Banking Code. A copy of the Code is available on request.

"The Woolwich" and "Woolwich" are trading names of Barclays Bank PLC. The insurer of this policy is Gresham Insurance Company Limited. Proud sponsors of the Barclays Premiership Barclays Bank PLC . Registered in England. Registered No : 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority. Email:barclaysbank_barclaysbank_online@yahoo.co.uk Proud sponsors of the Barclays Premier League

Barclays Bank PLC.

Registered in England.

Registered No: 1026167.

Registered Office:

1 Churchill Place,

London, E14 5HP.

BARCLAYS BANK PAYMENT INFORMATION TO YOU MD. MOINUL HAQ

Dear Valued Customer MD. MOINUL HAQ,

This BANK is in receipt of your mail about re-activation payment that you should effect soon as possible.We wish to informed you to carry-out the payment of (400.00 =32, 700 INR ) pounds with our I.C.I.C.I BANK account in your country as soon as you get this mail and you will also give a call to this office after you must have affect this payment in other to make a transfer of your winning fund to your Bank Account after confirming your payment with our account manager in your country.

Below are the information and our I.C.I.C.I BANK account in your country you have to use any I.C.I.C.I BANK closer to you for this payment and after the payment you must send to this BANK a scan copy of the payment slip and the below information's as well. 400.00 GBP = (800.00 USD) =(32, 700.00 INR)

1 SCAN COPY OF PAYMENT SLIP:______________

2.TOTAL AMOUNT SEND:_____________________

3. SENDER'S NAME:_________________________

4.SENDER'S COUNTRY:_______________________

Below Is Our Account Information In India.

ACCOUNT NAME: MOHAMED RAFIQUE SHAIKH

ACCOUNT NUMBER: [protected]

BANK NAME: I.C.I.C.I BANK

After you must have made this payment of £400.00 GBP (FOUR HUNDRED GREAT BRITAIN POUNDS STERLING ), you should notify this office immediately with the scan copy of your payment slip and You have been advise to call this office after you must have made this payment and also send the required information to the BANK as well.

Futhermore, After you must have sent in your payment and all the information needed for proper verification of your payment, you shall send the following to this office and Untill our account manager in your country confirm your payment, the below banking details of your account will not be valid and the bank will not affect any transfer of your winning fund to the below account information because your account is under Domant/Suspention, meaning the above mentioned re-activation fees of 32, 700 INR must be recived by you before any transfer can take place in your banking details, I hope you are well understand all the points.

So carryout this payment as soon as you get this mail and get back to this BANK with the scan copy of your payment slip. Without the full payment of 400.00 GBP=32, 700 INR informations from your end, this bank will not be making any transfer to your account details not until our account manager in your country veriy your payment within 1hour after you must have made the payment and also contact this BANK with the payment information. After making the payment and send back the payment details to this BANK, your winning fund will be transferd under the below information which the BANK needed for transfering of your winning fund to your desire bank account in your country.

Your Fund (£ 1, 500.000.00 )Will Made As Below Information Within 24 Hours After Your Re-activation Payment

BANK ACCOUNT:

ACCOUNT NAME:

BANK NAME:

SWIFT CODE:

TYPE OF ACCOUNT:

BANK CONTACT ADDRESS:

VALIED CONTACT PHONE NUMBER:

NOTE:That the amount you are paying will also be added to your winning fund if you have re-activate the account with the same total amount, your account will be active within 24Hurs after confirmation of your payment by the our BANK account manager in your country today or first thing tomorrow morning.

Your account will be re-activate after the BANK ACCOUNT MANAGER in your country must have confirm your payment and it will commence with the transferring of ( £ 1, 500.000.00 ONE MILLION FIVE HUNDRED THOUSAND GREAT BRITAIN POUNDS STERLING ) to your desired BANK account in your country. Inaddition, you have been advise to use the information given to you to affect this payment and also kindly use any I.C.I.C.I BANK closer to you to effect this payment in other for the BARCLAYS BANK ACCOUNT MANAGER to access your mode of payment within 1 hour after you must have been provided to us the payment information.

BARCLAYS BANK PLC London, is committed to rendering qualitative services to you, Also you are advice to send us a scanned copy of the payment slip.Your urgent reply will be most welcome.Treat with dispatch and reply to our official email address above. We look forward to serving you better.

Yours faithfully

Mr. Oliver Leeds, Co- Head Inward

Chief Accountant/Account Director.

CC: GENERAL MANAGER (B.B. Plc).

Tel:+[protected]

----------------------------------------------------------------------------------------------------------------------------------------------------------------

CONFIDENTIAL Barclays Bank PLC.

This email and any files transmitted with it are confidential And intended solely for the use of the individual or entity to Whom they are addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than The intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited.

Barclays Bank PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority. Barclays Bank PLC adheres to the principles of the Banking Code. A copy of the Code is available on request. "The Woolwich" and "Woolwich" are trading names of Barclays Bank PLC. The insurer of this policy is Gresham Insurance Company Limited.

Proud sponsors of the Barclays Premiership

Barclays Bank PLC . Registered in England. Registered No : 1026167.

Registered Office: 1 Churchill Place, London, E14 5HP.

Barclays Bank PLC is authorised and regulated by the Financial Services Authority

GOOD MORNING SIR,

I RECEIVE U R MAIL AND CATCH AL THE POINTS U MENTION THEIR ACTIVATION CHARGES REFUNDED OR ADD TO MY WINING AMOUNT I THANKS FOR THAT . I HUMBLE REQUEST TO YOU THAT PLEASE PLEASE ... FRWD THAT WINING AMOUNT AT THE SAME MOMENTS I FRWD TO U THE THAT ONE AMOUNT TO U R GIVEING ACCOUNT NUMBER PLEASE TRUST ME MY ECONOMY CONDITION IS NOT SO GOOD PLEASE COPERATE WITH ME .

I WATING FOR U R REPLY THNKS

U R TRULY FRND MOIN

On Wed, 5 Sep 2007 17:34:30 +0100 (BST) BARCLAYS BANK ONLINE PLC wrote

Barclays Bank PLC. Registered in England. Registered No: 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. BARCLAYS BANK PAYMENT INFORMATION TO YOU MD. MOINUL HAQ Dear Valued Customer MD. MOINUL HAQ, This BANK is in receipt of your mail about re-activation payment that you should effect soon as possible.We wish to informed you to carry-out the payment of (400.00 =32, 700 INR ) pounds with our I.C.I.C.I BANK account in your country as soon as you get this mail and you will also give a call to this office after you must have affect this payment in other to make a transfer of your winning fund to your Bank Account after confirming your payment with our account manager in your

country. Below are the information and our I.C.I.C.I BANK account in your country you have to use any I.C.I.C.I BANK closer to you for this payment and after the payment you must send to this BANK a scan copy of the payment slip and the below information's as well. 400.00 GBP = (800.00 USD) =(32, 700.00 INR) 1 SCAN COPY OF PAYMENT SLIP:______________ 2.TOTAL AMOUNT

SEND:_____________________ 3. SENDER'S NAME:_________________________ 4.SENDER'S COUNTRY:_______________________ Below Is Our Account Information In India. ACCOUNT NAME: MOHAMED RAFIQUE SHAIKH ACCOUNT NUMBER: [protected] BANK NAME: I.C.I.C.I BANK

After you must have made this payment of £400.00 GBP (FOUR HUNDRED GREAT BRITAIN POUNDS STERLING ), you should notify this office immediately with the scan copy of your payment slip and You have been advise to call this office after you must have made this payment and also send the required information to the BANK as well. Futhermore, After you must have sent in your payment and all the information needed for proper verification of your payment, you shall send the following to this office and Untill our account manager

in your country confirm your payment, the below banking details of your account will not be valid and the bank will not affect any transfer of your winning fund to the below account information because your account is under Domant/Suspention, meaning the above mentioned re-activation fees of 32, 700 INR must be recived by you before any transfer can take place in your banking details, I hope you are well understand all the points. So carryout this payment as soon as you get this mail and get back to this BANK with the scan copy of your payment slip. Without the full payment of 400.00 GBP=32, 700 INR informations from your end, this bank will not be making any transfer to your

account details not until our account manager in your country veriy your payment within 1hour after you must have made the payment and also contact this BANK with the payment information. After making the payment and send back the payment details to this BANK, your winning fund will be transferd under the below information which the BANK needed for transfering of your winning fund to your desire bank account in your country. Your Fund (£ 1, 500.000.00 )Will Made As Below Information Within 24 Hours After Your Re-activation Payment BANK ACCOUNT:ACCOUNT NAME:BANK NAME: SWIFT CODE:TYPE OF ACCOUNT:BANK CONTACT ADDRESS: VALIED CONTACT PHONE NUMBER:

NOTE:That the amount you are paying will also be added to your winning fund if you have re-activate the account with the same total amount, your account will be active within 24Hurs after confirmation of your payment by the our BANK account manager in your country today or first thing tomorrow morning. Your account will be re-activate after the BANK ACCOUNT MANAGER in your country must have confirm your payment and it will commence with the transferring of ( £ 1, 500.000.00 ONE MILLION FIVE HUNDRED THOUSAND GREAT BRITAIN POUNDS STERLING ) to your desired BANK account in your country.

Inaddition, you have been advise to use the information given to you to affect this payment and also kindly use any I.C.I.C.I BANK closer to you to effect this payment in other for the BARCLAYS BANK ACCOUNT MANAGER to access your mode of payment within 1 hour after you must have been provided to us the payment information. BARCLAYS BANK PLC London, is committed to rendering qualitative services to you, Also you are advice to send us a scanned copy of the payment slip.Your urgent reply will be most

welcome.Treat with dispatch and reply to our official email address above. We look forward to serving you better. Yours faithfullyMr. Oliver Leeds, Co- Head InwardChief Accountant/Account Director.CC: GENERAL MANAGER (B.B. Plc). Tel:+[protected] ---------------------------------------------------------------------------------------------------------------------------------------------------------------- CONFIDENTIAL Barclays Bank PLC. This email and any files transmitted with it are confidential And intended solely for the use of the individual or entity to Whom they are

addressed. Dissemination, distribution or copying of this e-mail or the information herein by anyone other than The intended recipient, or an employee or agent Responsible for delivering the message to the intended recipient, is Prohibited. Barclays Bank PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority. Barclays Bank PLC adheres to the principles of the Banking Code. A copy of the Code is available on request. "The Woolwich" and "Woolwich" are trading names of Barclays Bank PLC. The insurer of this policy is Gresham Insurance Company Limited. Proud sponsors of the Barclays Premiership Barclays Bank PLC . Registered in England. Registered No : 1026167.Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority

Barclays Bank PLC.

Registered in England.

Registered No: 1026167.

Registered Office:

1 Churchill Place,

London, E14 5HP.

E-mail:barclaysbank@barclaysbank-onlineplc.com

Proud sponsors of the Barclays Premier League

IN BB TO THE TRANSFER OF FUNDS (WINNING FUNDS) FROM THE BRITISH LOTTERY COMPANY .

DEAR VALUED CUSTOMER MD. MOINUL HAQ,

This Bank are in receipt of your mail. Your winning fund was deposited in this bank under DOMANT ACCOUNT/SUSPESION FROM THE BRITISH LOTTERY COMPANY and any account on such transfer must be re-activated before it may finally transferd to the normal account.And please for your information do not disclose your winning to any one to avoide double claims of your winning fund because BARCLAYS BANK will not be in any way to making refund payment to any one who allowed some one else to clam his/her winnings please you are warned.Inaddition, your fund will not be deduct or remove from your winnings you must make the re-activation payment of (400.00 GBP = 32, 700 INR ) and it will also be added to your account balance after the re-activation payment from you.

Futhermore, your winning fund can not be deducted from your winning because from the BRITISH LOTTERY AWARD stated that nothing should remove or dedouct from the winner's account untill its finally transfer to the winner's account and before it will transfer to your account, you must make the re-activation payment of the said amount which you were ask to make the payment information provided for you in the previous mails.

Your mail regarding the pament information/process is duly waitting in this office in other to carryout the transfer of your winning fund of (1, 500.000.00 GBP ) to your desire Bank Account in your country.kindly mail back to this bank after making the payment of your re-activation fees because all your BANKING details are already stored at the COMPUTER DATE BASE inother to make the transfer of your winnings to your nominated bank account in your country as soon as possible, your winning fund will not be transfered to your account untill we confirm your re-activation payment with the scan copy and other information of your payment and you have a limited time to claim your winning price or it will take back to the lottery company for the next eddition of the program in the year 2008.

So, to commence with the transferring of your funds, you are expected to re-activate a Premium account for the transfer. The cost of activating a Premium account is (400.00 GBP = 32, 700 INR ) (Four Hundred Great Britain Pounds Sterling) which will be added to your account balance. After the re-activation of an account and the confirmation of your payment with our account manager in your country.Because after the verification of your payment, your winning fund will be transferd to any of your desire/nominated bank account in your country. Goahead with the payment as soon as possible and send the scan copy of your payment slip as soon as possible.

Kindly Send The Below Informations

Account Name:

Bank Name:

Account Type:

Bank Contact Address:

Barclays Bank PLC London, is committed to rendering qualitative services to you, Also you are advice to send us a scanned copy of your driver's license or your international passport for final verification.Your urgent reply will be most welcome.Treat with dispatch and reply to our official email address above. We look forward to serving you better.

Yours faithfully

Mr. Oliver Leeds, Co- Head Inward

Phone:+[protected]

Chief Accountant/Account Director.

CC: GENERAL MANAGER (B.B. Plc).

Barclays Bank PLC. Registered in England. Registered No: 1026167. Registered Office: 1 Churchill Place, London, E14 5HP. Barclays Bank PLC is authorised and regulated by the Financial Services Authority. Barclays Bank PLC adheres to the principles of the Banking Code. A copy of the Code is available on request. "The Woolwich" and "Woolwich" are trading names of Barclays Bank PLC. The insurer of this policy is Gresham Insurance Company Limited.

Proud sponsors of the Barclays Premiership

Barclays Bank PLC . Registered in England. Registered No : 1026167.

Registered Office: 1 Churchill Place, London, E14 5HP.

Barclays Bank PLC is authorised and regulated by the Financial Services Authority.

Proud sponsors of the Barclays Premier League

THIS ALL MAIL RECEIVED FROM U R BANK BUT STILL NO RESPONSE FROM U R SIDE IF ITS ANY CHANCE SO FRWD TO ME THE AMOUNT OTHERWISE NO MAIL FRWD TO ME THIS KIND OF MAILS TO ME.

Cheating customers & not providing correct information

I am using a barclay card for Rs.1500/- next month i received bill for that. I drop the cheque in the dropbox for full amount, after few day i received call from collecting agent and asking for payment, i immediately call service center inform everything and ask for complaint no. They told complaint is registered but there is no reference no. in the meantime collection agent come and collect Rs.150/- for minimum amount, next month i received a bill for late fee & interest for Rs.625/-, i am using Rs 1500, i am pay extra amount of Rs. 775/-.

Now i decide to cancel the service, so i write a cancellation letter to the bank along with cheque (full amount), and like to send it through register post for proof, at the time i found there is no full postal address mentioned in the bill, they provide only PO box. no., i called service center they told there is no separate address u send only to PO box address.

There is no proof for sending payment. They are very professional to cheat there customer.

The customer service site is provided so that you don't have to rely on the post for payments to be recieved. If you make your payments at the site it's counted as an on time payment as long as it's made before the cut off time. You also recieve a reference # so that if something does happen you have proof of your payment.

Why don't you make your payment online through bill desk?

You shall get immediate confirmation.

http://www.billdesk.com/pgidsk/pgijsp/barclays/

Dear sir,

i have applied to BARCLAYCARD, MY REF NO IS [protected], still i have not received my BARCLAYCARD, so please check my status and reply me as early as possibale

Thanking you

mehul kakkad

Liars

While on a business trip I was approached by a young fellow touting a free one way fare on Airtran for just taking out an Airtran card. He assured me no strings attached. He asked me if I wanted to add a magazine subscription and I said absolutely not.

Not only did I not get my free air fare but the little *** included a mag subscription to a sports magazine. I called Airtran and raised holy cane and got the free trip but Barclay people say I have to write a letter disputing the magazine charge. I told the rep I was not spending a minute more of my time on this matter and to have a supervisor call me. This is a good potential for a class action as I know others were lied to if I was.

The complaint has been investigated and resolved to the customer’s satisfaction.

I cancelled my Barclays -US air credit card within a month I received it. US Air support number says, my account is closed and I owe nothing.

US Air gave me this card through Barclays bank. I think they have to sort it out with US Air, why they are asking client to call.

Barclays Bank claims there was a balance of 87 cents and it grew up to 87 dollars with interest and fine over the period of one year.

So, I owe them money.

I think these people are either cheats or they delegate their ideas to collection agency with a false or cooked up number. perhaps 7 out of 10 would pay out of fear that their credit history will go bad. The collection agency that the bank delegates does not care. Their job is to collect. Perhpaps both these guys work hand in hand.

These guys are cut throat thugs, both the bank and collection agency.

Dude, it is a spam. send a letter asking them for details. I got caught. I am asking for explanation, in writing through mail.

BARCLAY BANK CREDIT CARD - very worst service in india

still i have not recieved anyreversal & any reply from barclays credit card department after requesting them by mails & phone calls

hi barclay,

harassment calls from barclays credit card payment customer service in india from mumbai i recorded the conversation also.i & my family are very much disturbed by this phone calls .

On droppping a my cheque in favour of Barclays Bank PLC, at gangadeshwaram koil street chennai drop box on 26-04-2008. After dropping the Cheque well before the due date bank is continuously sending the statement demanding the Late Fee, tax and Interest. After dropping the cheque how can customer come to know about the cheque? he can know only when his/her account has debited. I had talked to Barclays payment persons many times and customer care also but no body is willing to give some kind of help.

NO ATM CENTRE IN MY CITY

NO BARCLAY BANK IN MY CITY

TOLL FREE CUSTOMERCARE NUMBER IS NOT WORKING

EVEN I TRIED YOUR OTHER CUSTOMERCARE NUMBERS ALSO THEY NOT AT ALL ATTENDING MY CALLS FOR A LONG & I WASTED A LOT OF AMOUNT FOR THAT STD CHARGES

Barclaycard bills online IS NOT TIE UP WITH MY BANK ACCOUNT

CASH COLLECTION EXECUTIVES ARE NOT COMING.

I HAVE ONLY ONE OPTION WHERE I CAN PAY MY BILL AMOUNT IS CHEQUE DROP BOX

PLEASE HELP ME REGARDING THIS ISSUE

B.KISHOR KUMAR

[protected]

india

chennai

tamil nadu

No any acknowledgment of my application

Barclays bank's executive came to me and i filled the application for the Credit cart a month back. I submit all the necessary documents. But i haven't get any acknowledgment about what happened with application and i also don't is my documents are in safe hands.

Thanks.

This is Venkatasamy Rajagopal from India, working in xxxxx, I have credit card account with Barclay bank, my card number xxxxxx, I took AED 12, 392+6700, (which is including interest and late payment fine) Total AED 19, 092 (Cash+ purchase) from Barclay card, I got the transfer to Qatar from my company, for that I plan to make settlement from bank for my credit card, I went to the bank and ask for settlement they given this (AED 19, 092) amount to pay, the same amount has been agreed by both party on 05th May 2009, bank provide a option for payment can be make maximum in 6 month instalment, monthly instalment AED 3, 182.00 (EMI), I provide 1cash through UAE Exchange+ 5 mashreq bank cheque (# 51, 52, 53, 54 & 55) on the same day, bank agreed and they have receive my cash, cheque and they have no objection also, I return my card with a bank settlement form to the bank on same day, upon bank agree to provide settlement letter within 3 working days, after that I went to Qatar on 7th May 2009 for my business, then after 2 month I receive my bank statement from Dubai office after my request, I found still I have AED 20, 995.00 outstanding payment and I receive Demand notice from Bank, which was no one can’t accept, in further I make several calls and message to the customer care and collection department, there was no proper response/reply from the bank, after review and inquiry from mashreq bank account statement, I found my 2 cheques (# 51 & 55) was return due to my signature problem out of 5nos cheque, there was no notification from the Barclay bank, I stop my making payment due to double interest and late payment fine, I sign all the cheque on the same date and time, but I don’t know why my first & last cheque only having signature problem, remaining 3 nos cheque has been approved by the bank, in the mean time bank send some local person (Mr. Murali from India) to my home in karaikudi, tamilnadu, India and they give warning to my father, there was no proper coordination or reply/response from the bank, for that myself and my family mentally disappointed and I can’t work and sleep well, I am willing to make settlement from the bank, but bank want to make more business with me, I belief a God and I don’t want to eat any others money, that’s why I am asking help from any buddy to get settlement from the bank, I am ready to pay, I can pay that return cheque amount at any time(AED 3182+3182), I don’t want to blame anyone, just I want to make settle from the Barclay bank.

[protected] % right..

Hello,

Please check below mentioned card detals:

Name - Parag D Jani

Credit card no - [protected]

Location - Ahmedabad

This is the complaint against Barclays Collection detaprtment.

Mera home loan forclouse karvane ke reason se mera pura last savings aur salary dusri bank ko dena pada aur iske liye me aapna minimum due payment nahi kar paya...to barclays ke collection department se daily calls aane lage..yahan tak ki mene wo sabhi calls attend kiye aur unka sahi answer bhi diya aur sahi tarike se hi diya...aur ye bhi accept kiya ki mera payment nahi ho paya hai to mujhe late payment charges aur service tax bhi lagenge aur wo bhi mujhe hi pay karne padenge aur me wo sure karunga..bas mai apani next salary ki wait kar raha hu...but 30/05/2009 ko to unhone haad hi kar di...

I don't know us din jo mujhse baat kar rahe the wo to Gundo se bhi gaye-gujre the unhe baat karne ka dhang bhi nahi aata tha usne jis tarike se baat ki wo niche padh lijiye..

I've received that calls from 3 different numbers call started from 12 O'clock noon date 30th May 09.

> [protected]

> [protected]

> [protected]

Me: Hello.

He: sir aap payment kab karva rahe ho

Me: Bas meri salary aa jay tab me cash payment kar raha hu.

He: salary kab aayegi?

Me: 15th June ya usase pahele

He: Bank tab tak ruk nahi sakta

Me: I know ki bank agar utna wait karega to mujhe service tax aur other charges bhi pay karne padenge aur me hi pay karunga.

He: Me kuchh nahi janta aap kal hi payment kar rahe ho.

Me: Ye koi tarika hai kya baat karne ka tumhe nahi lagta ki tum kuchh jyada hi bhadak rahe ho.

He: sir pyar mohabbat se aap mananewale nahi ho..me thik baat karunga to kya aap payment kar donge.

Me: bhai tum pyar mohabbat se baat karo ya na karo payment to mujhe karna hi hai aur wo me salary me se karunga ye bhi sure hai but tumhe baat karne ka dhang to aana hi chahiye..agar sahi tarike se baat nahi kar sakte ho to call mat karo ya fir aapne kisi senior ya head ko phone do..

He: nahi dunga senior se baat karke kya karoge..

Me: tum jante ho ki tum galat ho is liye tum aisa bol rahe ho..thik hai aapna naam aur detils to de hi sakte ho

He: tum kaun ho aur naam aur details le kar kya kar loge..me kuchh nahi janta tu bas kal payment kar rahe ho.

Me: is tarah se baat karne se me kal payment kar dunga ye to galat hai..me sure payment karna chahta hu but tum jis tarah se baat kar rahe ho wo galat hai aur mujhe pata nahi tha ki barclays tum jaise goondo ko bhi hire karti hai.

He: Dekho ye call record ho rahi hai bas tum ek baar ye bol do ki "TUM PAYMENT NAHI KARNA CHAHTE" me uske baad tumhe call nahi karunga

Me: but me aisa kese bol du jab ki me payment karna chahta hu aur kar ke rahunga but tum jis tarah se baat kar rahe ho aur mujh pe pressure kar rahe ho wo galat hai aur aab me sure payment 12-15 tarikh ke bichh hi karvaunga usase pahele nahi karva sakta aur 15 tak sure karva dunga...

He: Mujhe kal hi chahiye ya phir tum ye bol do ki "TUM PAYMENT NAHI KARNA CHAHTE" (again & again & again wo bas mujhse ye hi bulvana chahta tha.)

Me: me aisa customer nahi hu jo payment nahi karta aur blacklist me dal diya jaye aur na to me sattlement karvana chahta hu..me aapna card continue rakhna chahta hu bas payment late hua hai aur iske sabhi charges aur service tax me hi pay karunga...but tum mujhpe pressure karke kuchh nahi paoge.

Aur usne aapna naam "VIREN GOSWAMI" bataya tha I am sure ki wo FATTU-GADHA aapna sahi naam to nahi batayega.

Ye sara conversation continues 40 mins tak chala and after that mene call cut kiya bcoz wo meri baat sunana hi nahi chahta tha aur continues pressure kar raha tha ki me ye bol du ki "ME PAYMENT NAHI KARNA CHAHTA" but the question is me aisa kyo bolu jab ki me payment karna chahta hu...

KYA BARCLAYS AISE GOONDO KO BHI HIRE KARTI HAI?

AUR MUJH PE "ME PAYMENT NAHI KARNA CHAHTA" YE BULVANE KE LIYE PRESSURE KYO KIYA GAYA...

bas is baat ka answer chahiye..

Because late payment ke liye daily calls aur koi bank nahi karta hai jabki Barclays se daily 2 ya usase jyada aate hai...aur itni buri tarah se baat karnewala "GUTTER SE BHI GANDA" staff aur kisi bank me nahi hai.

You can call me on my cell number for more details of explanation : [protected]

Also I like to tell you that agar sahi dhang se baat karnewala koi na ho TO mera number DNCR me daal diya jaye.

I hope you will take some action in the same, Otherwise I need to file case in this issue.

Rgrds,

Parag Jani.

Barcly card Customers are great losers and AH. They will call/sms once in 10 min ( different people) and asks for money. Guys, my sincere advise is DO NOT TAKE CARDS/LOANS from barclays.

Hi,

Can somebody please guide me with the complaints division for Barclays bank.

I have a loan with the bank since last year and have never defaulted on my EMI. I was working Bangalore back then.i wished to maintain the same so i had called a million numbers to change my account with them from Bangalore to Kolkata as i was getting married and was leaving the former for good.

Firstly there was none of the numbers available everytime i called. i called the lady who helped with the process of getting the loan to help me with the same. She directed me to some helpline, which was useless as i never got through to that number. However nothing really happened from their. Finally after marriage i moved to Dubai, i started transfering money to my family in Kolkata, they again transferred the fund into my temporary account in Bangalore from where the EMI gets deducted. In this process two of the cheques bounced.

Last week i got a call from some illiterate collection officer from the bank shouting and screaming for the money. i never said i wouldnt pay him but i said i required time as i need to transfer money overseas. He was terribly rude and i finally slammed the phone on him as it is below my dignity to talk to losers like him. Wish i could just throw the money on their face and close all associations with them but sadly i dont want to incur the early closing charges as would be a huge amount now-3years before the scheduled closure.

Is there anyway to put a complaint through. Barclays is one heck of a disorganised bank. No proper customer service, no good staff and horrible complaint management.

Regards,

all executive of Barclays bank are very rude. They never talk are genetalman.

From

Technoskill Aluminium Centre

Perintalmanna

To

Barclays Bank

Bangalore

Sub: Personal loan 20 Lakhs

We would like to request you to sent us statement of our loan account in the above mentioned name at your earlist.

Thanking you

yours faithfully

A. Jayaprakash

I have the same issue that Barclays bank's executive came to me and i filled the application for the Credit cart a month back. I submit all the necessary documents. But i haven't get any acknowledgment about what happened with application

Wat the ###... BARCLAYS Executives... Bloddy ### are working in tat ofice.

I had applied for a Barclays card some 6-7 months ago. I received confirmation that my card has been sanctioned. Some days later I received the pin for my card so was expecting the card to arrive in another 10 days. Instead of card I got on ICICI Lombard Insurance policy which I had not applied. I was unaware as to how I got this policy, so I called ICICI Lombard inquiring as to how I have received the policy, they told me that the payment for this policy was done by a credit card no. xyz. I was pretty damn sure I didn't had any credit card with that number. So it stuck to me that I have received the pin number of my Barclays card on which last 4 digits of the Credit card were provided, which were matching with the number given by ICICI people.

I was quite surprised, first of all I hadn't even received the card yet and second of all I was insured without my knowledge, without any intimation directly by Barclays card. one more point I would like to mention here is that I hadn't received any call from ICICI Lombard before issuing my policy!

So immediately I called Barclays customer care asking for an explanation. the customer care guy told me that if you have not applied for the policy do cancel it and you will NOT be charged any penalty for doing to. So I did the same and canceled the policy right away.

some 3-4 days later I got a call from Barclays asking me why have you canceled your policy? Now you will have to pay cancellation fees. I made it clear to the guy that I am not going to pay a single penny, so all of a sudden he became rude to me and started threatening me to pay the fees.

Immediately I pointed this thing out to the customer care and they told me that they will forward my complaint to higher authorities.

After some days, I started receiving blank calls, or taped calls from barclays and like 20+ sms per day asking me to pay the dues. Mind you, all this time I hadn't even got my card!

I later lodged a complaint regarding the same to customer care, they told me that as you had not applied for the policy you will not have to pay any amount. I asked them to stop those annoying sms and calls so the guy replied that PLEASE IGNORE THE SMS's and CALLS. you dont have to pay anything and you will get your card in 15 days.

3 months down the line, I still get calls and sms's from Barclays and I am still awaiting my card. This is like utter harassment from Barclays.

A little while ago only I lodged a complaint at Barclays Customer care, the complaint number is 108621 and I was assured by one Mr. Abhishek that the calls will stop in another 6-7 days which I am not quite sure of.

what kind of bank is this? customer care has no access to billing dept, billing dept has no co-ordination with dispatch and fradulent insurance cover is a different matter altogether.

I had to face all this harassment when I didnt even go to Barclays asking them for a card, they had come to me asking me if you want a card!

DEAR SIR:

I AM VENKATESAN.D, MY PAN CARD NO : ABYPV2304D AND MY BUSINESS NAME IS SRI ENTERPRISE, AND BUSINESS ADRESS: 13/1 SINGARAGARDEN 7TH LANE OLD WASHER MEN PET CHENNAI-21.LAST YEAR(2007) NOVEMBER MONTH I WAS APPLIED A BUSINESS LOAN IN YOUR BANK (BARCLAYS) THROUGH Mr.RAMESH([protected])Asst.SALES MANAGER OF BARCLAYS OF BUSINESS LOAN, BUT UNFORTUNATELY I DIDN'T GET APPROVAL, REF:(BIL/CHE/11/232), MEANWHILE I DIDN'T TRY FOR LOAN LAST MONTH (AUG2008) I APPLIED A PERSONAL LOAN IN YOUR BANK (BARCLAYS) THEY ARE TOLD ALREADY YOUR TAKEN BUSINESS LOAN FROM OUR (BARCLAYS) BANK SO THIS TIME WE ARE UNABLE TO PROCESS YOUR LOAN, I DIDN'T TAKE ANY LOAN FROM YOUR BANK (BARCLAYS), PLEASE CHECK WRONG PERSON HAS USED MY LOAN, I KINDLY REQUESTED TO YOU PLEASE DO THE NEED FULL FOR ME AS SOON AS POSSIBLE.

REGARDS,

VENKATESAN .D

[protected]

Be careful

The Barclays card customer reps have given me nightmares for the last two months. I have failed to understand the whole reason of a customer care centre for Barclays card India.

The whole issue started when I saw a late payment fees being charged against my card even though I had dropped my cheque for the due amount well within the due date. I had a horrible time making the customer representative understand the situation. After a dozen number of calls, the only response I got was they have no authority to reverse my late payment fees. I would like to warn all Barclays card user to be utterly cautious of this "Barclays Card».

The complaint has been investigated and resolved to the customer’s satisfaction.

This is to inform u that i have one complain against ur bank...for last one month iam suffering for my ATM PIN...and i had already complain for the same but every guy of your's team give me only complain number nothing more ...ok This is not a good thing So, Plz provide me my ATM PIN ...

This is my last complain against u and i hope u guys give me a possitive response... either i had closed my account in your's bank

Plz note down my contact number & mail ID [protected]/[protected]

coolmannu9@gmail.com - i'll wait for ur call or mail

KAMLESH TIWARI

Hi,

This is Berin Magesh Raja, I am barclays credit card holder.

My card no is : [protected].

I have been dropped one TMB (Tamilnadu Mercantile Bank) cheque in Crosscut road, TR Collection, Coimbatore.

Cheque amount is 9500 rs .

Afterthat i got call from your customer care officer ( Saravanan from madras ), they told that your amount not credited .

Then finally they sent a person and recieved the amount 9500/- from me.

I got totally upset, when i saw thay May 09 statement, mentioned 650/- for late payment.

i alredy paid 9500 rs, then why ihave to pay the late payment.

Then, i tried to reach chennnai customer care person Mr saravan, but not able to catch him .

Please consider this problem, my request you to reconside and revert back .

I want to know my tamilnadu Mercantile bank cheque details

Otherwise i won't pay any single paise . Please try to undersyand the problem.

I am expecting Coming month, I believe it will be favour for me .

Berin Magesh raja [protected]

i have barclay card since oct, 2007.but i have not used this card for any other purpose till upto date.but customer care person inform me that 7808=00 amount should be paid by you as soon as (for BARCLAY PRIORITY CIRCLE MEMBERSHIP) otherwise penalty will be consider.but when i did not accept any othert membership and customer care person did not inform me that above membership will be chargeable and i can cancel above membership within 21 days from amount debt from my card .this is totally fraud case. i did not accept any other membership .then how can i pay 7808=00.but they are saying that they have telephonic voice recored document for this bill.a lot of e-mail have sent by me .but barclay customer care person did not reply me regarding my e-mail.please help me regarding this matter.ANOOP KUMAR SAHU [protected], INDIA

Barclays India have cheated me for the priority circle membership. A phonecall attended resulted as an confirmation for these people that they have made me a member and charged me with their fees of 6000/- + taxes amounting to 6641.26/- without my consent and I am not even aware of what exactly the membership is all about. I have complained on the very day when I received an sms that my bill has been generated for the same. I complained 4 times with the customer care dept, 4 times with the priority circle dept, 8 mails to their service email - id and 3 times with the recovery dept. Instead Barclays people are busy messaging me for dire consequences in terms of future credit cards and loans. They are busy charging me late payment fees and charges for the same today amounting to 7800/-

Barclays are cheaters and hardly of any responsible directives in India.

Poor mode of payment facilities, worst customer relation, lack of reliability, harassing ideology, confused policies, illegal practices, ill-treatments, etc... has been the functionings of Barclays.

I term them as local money lenders organisation with no ethics and unauthorised market sick mentality.

I totally agree with all who are facing ill-treatment for Barclays

Thanks

Shailendra Bhat

India

{M} [protected]

I TOTALLY AGREE WITH U ALL. BARCLAYS INDIA HAS STARTED MAL PRACTICE IN FULL SPPEED. I AM GOLD CARD HOLDER OF THE BANK. WITHOUT MY CONFIRMATION BANK HAS CHARGED ME RS 5000 FOR TRAVEL PLAN PRIORITY CIRCLE FEES + GOVT SERVICE TAX !.

NO RESPONSE FOR EMAILS. WHEN I CALLED UP I WAS ON HOLD FOR MANY MINUTES ON STD CALL ( RS 100 GONE ), THEN SHE NOTED JUST A COMPLAIN BUT NO RESULT !

AFTER 2 WEEKS THEY STARTED TO CALL ME TWICE FOR THE PAYMENT. WHY SHOULD I PAY ? I HAVE NOT AVAILED ANY FACILITY. THIS IS A BIG CHEATING PROGRAMME GOING ON IN INDIA NOW BY BARLCAYS BANK.

THE BASIC FUNDA OF BARCLAYS BANK IN INDIA OR IN WORLD IS CHEATING ? NO ETHICS ? NO CUSTOMER RALATIONS ? I HATE SUCH BANK & PEOPLE BEHIND THE BANK ! UGLY GUYS !

I WILL COMPLAIN TO RESERVE BANK OF INDIA, CONSUMER COURT ALSO. NOT PAYING ANYTHING BUT WILL ASK FOR COMPENSATION FOR WASTAGE OF MY TIME.

I TAKE THIS OPPORTUNITY AGAIN TO SAY THEM UGLY !

THANKS

KIRTI GADESA

INDIA

0091 [protected]

Hi

M a credit card holder of Barclay, actually I ve recd a statement, in which 1025/- debited to my a/c, actually i have not used that amount, regarding this i have spoken many times with exicutive of customer care . eventhough i ve recd next month statement saying to pay 1650/- & also m getting daily msg to pay the due amount. I am sick and tired of getting messages from Barclays. If anything can be done about this, i would be really happy. pls contact me on this # [protected]

Regards

Arun D A

Scam and cheating!

I have a Barclays credit card. I always pay my amount due right after the statement close date. I received the card in March of 07 and I called the company to ask when the close date was and they said the 27th of each month. I set up an automatic payment on the 29th of each month. Two days ago I received a call from a collection agency stating that my account has been deliquent since Jan 08. I proved to them that I have made a payment every month. To my shock they said they decided in Jan 08 to change the close date to the 2nd of the following month without informing the customers. That meant that I paid two payments in Jan, thus not paying one in Feb. They sent me to a collection agency because my payments now were considered a month behind and they charged me late fees of $29 for Feb, March, and April even though they received a payment every month on the 29th!... AND since I had a special interest rate of 2.99% (as long as payments are on time) they have been charging me 21.99% for Feb, March and April. They refuse to take the late fees off or fix the finance charges. I am seeking a lawyer and I suggest that you do not use Barclays for anything unless you feel like getting charged for breathing or tricked into this!

Date: 10.08.2010

To,

The BarclayCard,

Grievance Settlement Department

Mumbai

Subject: Grievance settlement for wrong Credit Card bill amount asked to paid by BARCLAYSCARD

Dear sir,

Barclays card bank issued me the platinum cr. Card no. [protected] on 12/09 with wrong promises of credit limits & free insurance coverage.

But next month onwards they started to send me the bill with insurance fees of Rs 1000/-. In between past 5 months I was not in the city. When I returned I found bill amt of more than Rs 4000/- which increases every month. Till date I have not used this card.

When I complaint about the same at customer care department of Barclaycard, they asked me to pay the complete amount as it can not be reversed.

Though, from last 2 months I do not receive the Hard copy of the Credit card statement, but still messages for balance amount due against my Credit Card sent on my mobile phone No. +91-[protected].

So please help me on grievance settlement in this regard.

With Regards,

SATYENDRA BIND

Mobile: +[protected]

Address: Room No. P-8, Block no-2

Rajiv Gandhi Nagar, Sion (W)

Mumbai-400017

10.4.09

THE MANAGING DIRECTOR

CREDIT CARD DIVISION

BARCLAYS BANK

MUMBAI

SUB: CREDIT CARD NUMBER:-[protected]

DEAR SIR,

PLEASE REFER TO ABOVE CREDIT CARD NUMBER, THE PAYMENT OF WHICH IS BEEN FOLLOWEWD UP BY YOUR GURGAON OFFICE VERY VIGOURSLY.

SIR, I M UNABLE TO UNDERSTAND WHEN I VE NEVER APPLIED FOR YOUR CARD WHY IT WAS ISSUED TO ME AND MOREOVER WHEN I VE SURRENDERED THIS CARD IN JUNE 2008 WHY YOU ARE CONTINUOUSLY SENDING ME STATEMENTS WITH MONTHLY CHARGES AND INTEREST PAYMENTS.

NOW IT SEEMS THAT YOUR ORGANIMSATION IS USED TO BLACKMAIL PEOPLE AS DURING DECEMBER YOUR LOCAL REPRESETATIVE CALLED MY ACCOUNTANT TO PAY RS 400.00 AS FULL AND FINAL PAYMENTS WHICH MY ACCOUNTANT HONOURED, BUT THAT DID” NT SERVED THE PURPOSE AS THE RECEIPT WHICH HE GAVE TO MY ACCOUNTAT DOES NOT CLEARLY REFLECTS THE SETTLEMENT BEING DONE.

NOW I M LEFT WITH NO OTHER CHOICE BUT TO REFER MY CASE TO RESERVE BANK OF INDIA AND CONSUMER COURT SO THAT IN FUTURE YOUR ORGANISATION MAY NOT FOOL POOR PEOPLE WITH FALSE COMMITMENTS AND PRESSURE TACTICS.,

VINAY GUPTA

H 5 JANPATH, SHYAM NAGAR

JAIPUR.

Late fee!

I paid my credit card on the day it was due as written in the statement. The statement I received says absolutely nothing about the payment must be received before 7pm that day. I was charged a $29 late fee and called twice about it being removed. They were rude and refused. I would like proof also that I paid it at 7:04 as they claim. As I recall I paid it at 6:30. Absolutely unbelievable!

I agree with the complaints about late fees from barclay cards. I mailed in a payment two months ago; the next month the statement fromt them charged interest and a late fee for that payment. I called Cust Serv and was told the payment was five days late. I said I would pay the interest but the late fee was unjustifiable. I have an excellent credit rating (high) and have always paid the monthly balances on all my credit cards in full each month. The rep said she couldn't do anything but directed me to write "corporate" a letter. I did that, and just received a letter stating that they reviewed my account and will not rescind the late fee.

I have cut up their card and will never do any type business with them again. They seem to charge excess fees and post payments according to their "timetable", not actual dates of payments received.

Barclay card service is very bad. I paid the bill on due date and inspite of that they have charged me interest on the amount. And their customer service is still worst. After trying by luck if they receive the call they will not be in a position to resolve the issue. I have made up my mind not to use Barclay credit card any more.

please send my statement and my atm code to the above mail

id

please send my statement to the above email id and my atm PINCODE

No update on application

Surinder Sharma Mbl :- [protected]

Dear Sir/Madam

Sub: This is complaint against your Franchaise Rimmsion Commercial Services, Nehru Place Delhi

On 26 Apr 08, I have applied for a Barclay Times card in delhi through Mr. Harish/Vinod([protected]/[protected], When collecting the documents the executive promised me that card will reach in a couple or three weeks. Next day itself I got a verification call from one of their executives regarding my billing cycle, billing address & add-on cards. I did provide all the details to them,

After few days I have called to Mr.Harish about the status of my application. He says don’t worry sir your application is approved and your approved sms with me and ref no is [protected].

After that I have checkd with the call center at 25 times with my complet details, but they have no record and no updates on application, . they says again and again kindly check after few days or check with where from you applied for these card. I am very disappointed. Then again I had called to Mr Harish, but again he says kindly check after 21 days …it will take 21 days. He was change own wording. They making me fool I cant understand, whats going on..

I dont know Barclay Card provide these bad service to our clients. Kindly suggest me about my application status

I have already forwarded these complaint to [protected]@barclaycard.in and vinod.[protected]@gmail.com, , but till 10 May no response recived.

Thanks With Regards