CitiFinancial Servicing’s earns a 2.9-star rating from 0 reviews and 203 complaints, showing that the majority of clients are somewhat satisfied with loan servicing.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Un returned auto

On October 15, 2009 my car was repossessed while I was ill and in the hospital. I then sent $1303.96 to the company to return my vehicle on Ocotber 21, 2009 by Western Union.

The company has refused to give me my car back and has not honored the agreement sent to me certified mail.

Can someone help!

[protected]@aol.com

The complaint has been investigated and resolved to the customer’s satisfaction.

Wrong number

I just got a new cell phone two months ago. I have never had a loan through Citi Financial Auto, yet they have my phone number connected to one of their delinquent accounts. I am sure the problem is rooted in the fact that cellphone companies recycle old phone numbers and I have become a victim of this practice. The harassment began just a day after I got my new phone. Citi Financial Auto began calling up to five times a day looking to collect a debt from someone I had never heard of. After calling Citi Financial Auto in Texas multiple times to have the number removed from their collection list, they continue to call my cell phone up to five times a day. This cost me money every time they call because I have to explain that they have the wrong number. Just one day after talking to someone named "Jenny" and the manager "Ann" at the Texas call center, who assured me the number was removed from the delinquent account, I got a call from Citi Financial Auto at 9:50 am on a Sunday morning. When we called back after this harassing call we were told that "Ann" was a generic name they used for all of their managers and there was not way to track who we actually talked to just the day before. I have listed my cell phone number on the national do not call list and they are now in violation of this national law.

The complaint has been investigated and resolved to the customer’s satisfaction.

Customer with wrong information

I am a service member who protects this country. I have been trying to pcs to another duty station. Where I have to get permission from the lienholder to take my vehicle. I have been working on this for over a month and I have still not gotten any results. I called one day to find out what I needed to do in order to ship my vehicle. The person(S) I talk to said that I only needed a fewer things and they needed to be faxed to them at the following number. I said well okay what are the items. She respo money nded with a letter stating where the car was going to be how long the car was going to be there and how it was going to be shipped and who was shipping it. Make sure that my account number was on it and there name and address. They needed a set of my orders an les (military pay stub) proof of insurance. They wanted proof that we had started a direct despoit on to the account too. When the lady told me that, I asked why and I also respond with we have never been late on a payment. On top of that when we first signed up for the loan they already had a pay stub. The voice on the other side stated I dont know this is just our policy. When she said that I asked her to repeat it again because I could barely understand her. She transfered me to another department. This went on for a couple of days of trying to get a straight answer. Still nothing has been accomplished, I faxed another wanting confirmation with a call back stating that once recieved to call me. That was never done. I called my insurance they tried helping me out also and still did not get anywhere either. I have provided them with them with the following information several times. No response. I called again today. I told them if I can not take my vehicle with me your not getting your money. They guy hung up on me. I called again and this time I got told that they were going to repo my car. All I have to say is I serve my country and I get no respect. Fine then they wont get there money and they need to hire people that knows what they are talking about.

The complaint has been investigated and resolved to the customer’s satisfaction.

Scam and rip off

I am a customer of rooms-to-go and citi financial. On 8-13-06 I purchased items from rooms-to-go totaling $1534.93 which was not due until 1-14-08. On 9-23-06 I purchased items for $2216.96 not due until 4-14-08. On 1-13-07 I purchased items for $639.97 not due until 1-14-09. Total due as of 4/2008 was $3751.89, plus two months of interest and fees of about $117.00 equal a grand total of $3868.89.

In march of 2008 I sent a cashiers check to citi financial attempting to pay the entire amount of $3868.89 off and in full. The check that I mailed was for $4392.00, which left $523.11 to be applied to the amount not owed until [protected]. This should have left an amount around $116.86 which would not be due until january of 2009 in accordance with their promotion.

Instead of applying payment to all amounts owed for the 2008 charges citi financial took it upon themselves to apply only part of all but about $1.70 of what was due for 2008 and all but about $95.81 of what was due in 2009.

Further, citi financial raised my apr to 263.16% and 277.83% for the two 2008 balances which is completely unethical.

I have attempted to correct this error that citi financial employees have admitted is an error on the behalf of citi financial. The employees state they cannot help me and constantly refer me to another person. After six attempts I am being told that I have to give citi permission to fix their mistake. I am told that I should have caught their error four months ago and called then, and "now it is too late. " I am told if I don't agree I can file a complaint, but they will not refer me to an address or telephone number to file the complaint. They told me I can send a fax letter telling my story but will not allow me to follow up on the fax.

My account is now delinquent and past due as a result of citi financials actions. I have also attempted to ask rooms-to-go for assistance, but they have refused.

My account has been blocked and citi is demanding payment.

Final point, the total amount I paid in march 2008 was much greater than the amount I owed up until january 2009. The account should not have any amount due at this time and citi financial states they cannot correct the error. Citi financial states my only option is to pay them the amount due as they have determined even in view of their admission of the error.

8-13-06 purchased 1184.95 (No interest/payment until 1/2008)

8-13-06 purchased 349.98 (No interest/payment until 1/2008)

9-23-06 purchased 2216.96 (No interest/payment until 4/2008)

1-13-07 purchased 639.97 (No interest/payment until 1/2009)

1-14-08 minimum payment came due for the first two purchased, plus interest and fees (About $117.00 in interest and fees).

March 2008 total due minus what was due starting january 2009 was around $3868.89. In march 2008 I paid citi financial $4392.00, leaving a balance of $116.86 which should still be covered under their "no interest/no payment" plan until january 2009.

Again, citi financial is refusing to correct their error. Several dollars in fees and interest have now been added to my account. And, my account is delinquent!

The complaint has been investigated and resolved to the customer’s satisfaction.

Hidden insurance now part of payment

We bought a used Buick Rendezvous from a dealer and a little over 2 later it started breaking down on us, so we took it back to the dealer. They told us the warranty was out on the part and to fix it we would have to come up with $2000. Yeah, right. We demanded a new vehicle. And they sold us a Jeep Commander, and said they were sorry for the trouble, but still wound up placing the Buick loan on top of the Jeep loan. Upset down. Fine. After repeated requests, Citi lower the monthly from insane to normal $545, considering the size of the "new" loan. We made regular payments for 2 years. Now my wife lost her job, and I called Citi to see about restructuring the loan for lower payments. The guy (they always go by "Mr. so and so OR Mrs. so and so") told me if i make 3 more regular payments it could happen. Did that. Requested the modification. The lady I spoke with now, said she didn't now any rep by that name and didn't see the agreement, but said that 3 more payments and I could get the loan restructured. I felt this was just a runaround they were giving me. Then I get a letter in the mail stating that now they are charging me $116 extra on the monthly loan because I had missed some insurance payments. I missed 2 cause of her job loss but immediately picked up my insurance company again. Now they are demanding that I pay my $545 payment (which I have now been told cannot not be change because they only do 1 modification per loan, ie they lied previously), my normal insurance which is $100 comprehensive and their $116 collision insurance. Where do they think the $$$ is coming from? I called to make arrangements to pay in August for the July payment and the lady combined the insurance and the payment but said I only needed to pay $597 (I also did this type of payment in June with them per the conversation with one of their reps). They miss-typed a digit in my bank account, and the check came back to them stated the account was closed. I talked to my bank and they said they haven't received any check from them. Citi agreed it was their foul up but is now demanding I pay the full insurance payment with my monthly payment. What? I made the payment per arrangement, it was their fault the check came back, and now the arrangement is no good? This company is a financial crook. NEVER SIGN ANYTHING WITH CITI ON THE FORM! They will scam you! And they're getting massive money from the government to boot!

The complaint has been investigated and resolved to the customer’s satisfaction.

This company is assisting Alqueada to cripple the American public right under our government's nose.

This company is wrong hoe the ydo business. I found out the hard way about hidden insurance cost. It seems tha tno matter what you do you are always behind with this company. I will never use them again. If the dealership I am going to use tries to finance me through them that dealer will lose a sale. There will be no second chance for citi auto or the dealer.

High interest

I borrowed a 10, 000 loan from CitiFinancial in 2004, the pay back is $18, 000. I purchased a car for my daughter and paid off some credit card bills. I pay $300 a month for 60 months. I got a $1, 000 loan in 2007. They refinance the loan. Let's do some simple math! I paid $300 a month for 3 Years. $300 x12=3600 x 3=10, 800 thats what I have paid so far. I got laid off on April 30th, 2009. So, I couldn't afford to pay $300 a month. So, I called to see if they could lower my payments. They reduced my payments to $145.00 and sent me a statement saying I will pay this amount for 122 months. Lets do simple math again! $145 x 12=1, 740 a year x10 years=17, 400. So, I talked to someone in customer service and she told me that my balance was $20, 155. I have paid $10, 800 already.

When I finish paying this loan off, I would have paid $30, 955 for a $10, 000 loan. This has to be illegal! I need a attorney to call me @ [protected]. My name is Brenda Brown.

The complaint has been investigated and resolved to the customer’s satisfaction.

I have a similar situation is there someone out there that can help me out of this mess. Every month mypayments are going toward the interest. I found out last week, my loan was setup to pay the interest first. I borrowed $7, 500. Repayment will be $17, 000. $148 for 120 months. I was told the interest is taken first then the payments will go towards the principal.

doubled rate & closed act. after opt-out period

My husband is a small contractor who uses a Home Depot credit card issued through CitiFinancial. We recently received a letter about an "across the board" rate hike which more than doubled the interest rate. Of course, we could have opted out, but he needed the card to do his business so we decided to stick it out. Just shortly AFTER the opt-out period ended, we now get a letter stating the company is no longer going to "carry" that card and all accounts are being closed. So now we are stuck with an outrageous interst rate and no way to use the card to continue our business, which is how we were going to pay the increased interest in the first place. If we had known the card would be closed, we would have obviously opted out. Talk about feeling raped! This may be the end us.

The complaint has been investigated and resolved to the customer’s satisfaction.

Trying to pay my auto payment

Every month on the 5th I have an auto-pay taken out of my account for my car payment.

On June 5th, no auto pay was taken out, so I waited and waited. Around June 13th I called and told them about the problem. I spoke with a representative for about 30 minutes trying to get to the bottom of it, they referred me to another representative who I had to explain the problem to over gain and then he referred me to a voice mail of a Supervisor whom I left the message regarding trying to get my car payment PAID.

I called back the next day after no response to phone message, emails and talking to several people. After talking to another person, they said I needed to make a debit over the phone for the payment, so I did gladly to get this taken care of immediately.

On July 15th, still no debit from my account. I email their customer service emails (2 of them) and proceeded to explain that I did a transaction over the phone and they gave me a confirmation #. At this point, still no reply.

On July 17th, I called back and got Ms. R, and during my conversation with her which lasted about 45 minutes, she worked her computer and proceeded to do another debit from my checking account with the routing number and checking account number. After all was said and done, a confirmation # given to me, I thought all was taken care of.

July 30, I called again asking for another Supervisor after giving the information all over gain to their call center as usual. The call center person proceeded to tell me that "I" was the problem. That I must have given them the wrong numbers to my account. At this point, needless to say, I was fuming. How hard could it possibly be to PAY MY BILL. These people working there at Citi Financial Auto must be complete ###s! Well, after I wouldn't talk to this woman any more, she said she would transfer me to another supervisor. During that time, the call was disconnected. This was just great!

July 30, One hour later, I called back and said I wanted to speak to the person who runs the show. I was referred to a woman named Lisa. After another hour of going over all of this once more, she proceeded to do ANOTHER check debit with the same account numbers that I had already given three people to get this debited from my account. After all was said and done, she assured me that the transaction would go though and no late charged would be charged and that she would make sure that nothing got posted to the Credit Reporting Agencies for their mistake.

August 3, There were no charges posted to my account. My car payment was now into TWO months with a third payment just days away from needing to be paid. I email her back with all coorespondence from the Credit Union telling her that there was not a problem with any of the account numbers, or any information that I had given them. They told me that it was their system. I forwarded all of the documentation to them.

August 4, Still no debit from the account. I then proceeded to send another email to everyone I could find on the internet that was associated with Citi Financial Auto and cut a pasted the entire email log to each one of them. Still no reply from anyone.

August 6, FINALLY a debit to my account for the car payments, however they charged me $14, 95 for a late fee. I emailed all of their Supervisors letting them know that the debit finally went through and to please send confirmation of email and to credit me the $14.95 back.

I spent 8 hours of my time over two months with 10 employees to get my car payment PAID and hoping that my auto-pay will continue with no more problems on their end with processing correctly.

I just hope that this company does not put this on my Credit Report as delinquent and I hope as a result of the Fair Credit Reporting Act they will make them take it off if they do put it on.

I don't know about you, but this is ridiculous! It took that many employees to process a payment? No wonder why the company is in a financial mess.

The complaint has been investigated and resolved to the customer’s satisfaction.

To,

The Manager

City Financial Bank Push Vihar, Delhi

Sub: Miss used of ECS Check.

Sir,

I’m Dharmendra Upadhaya My loan A/C No:-[protected] & I had purchased a byke Bajaj Discover 135 since 2007, Rajeev Bajaj Automobile Shahdara & finance from City Financial Bank. This account has closed on March 2010. & But 1459Rs. Cut from my account on July Month, 2010. So please return Amount in my account please do the needful.

Thanks You,

Dharmendra Upadhaya

Loan A/C No:-[protected]

Byke No:-DL5S 6091

Mob:-[protected], [protected]

Mail id: dupadhaya@gmail.com

Address: - 299/G-2, Shalimar Garden Extn-I Ghazibad

Sahibbad Pin: 201001.UP

The same thing happened to me. Why is it so difficult to make a payment. I haven't gottened a statement in 2 1/2 years.

I also have automatic debit from my account on the 18th of every month. On September 12th i noticed my account had alot of unauthorized activities going through it. Went to the bank and after they reviewed my acct. we decided to close the acct. I called citifinancial early monday morning to tell them to stop the auto debit that will be coming in on the friday which was the 18th because the account was closed. I also told him i was mailing my payment. I mailed the payment.

I got a letter today telling me i owe them 25dollars because i did not give them 5 business days to cancel the auto debit even though i talked to them on a monday. i thought the business days were monday to friday. Does that make 5?

25$ might not be much to other people, to me it is alot. I try to avoid unnecessary bills because i do not even have enough to afford to eat 2times a day now.

Every auto debit that was going through my old acct was ok with cancelling. Infact American Family's was supposed to be there within 2days and yet they were able to accommodate my request.

A customer service agent who thinks he is smarter than me basically told me in a patronizing way they did not care as long as i pay them the 25 $ and that i have no other choice.

Gosh. I am worried. The exact same thing happened to me...I paid over the phone 4 days ago, and still not even a pending transaction. I have Nuvelle. I think I will call tomorrow just in case.

Fraud and cheating

I am a customer of Rooms-to-Go and Citi Financial. On 8-13-06 I purchased items from Rooms-to-Go totaling $1534.93 which was not due until 1-14-08. On 9-23-06 I purchased items for $2216.96 not due until 4-14-08. On 1-13-07 I purchased items for $639.97 not due until 1-14-09. Total due as of 4/2008 was $3751.89, plus two months of interest and fees of about $117.00 equal a grand total of $3868.89.

In March of 2008 I sent a Cashiers Check to Citi Financial attempting to pay the entire amount of $3868.89 off and in full. The check that I mailed was for $4392.00, which left $523.11 to be applied to the amount not owed until [protected]. This should have left an amount around $116.86 which would not be due until January of 2009 in accordance with their promotion.

Instead of applying payment to all amounts owed for the 2008 charges Citi Financial took it upon themselves to apply only part of all but about $1.70 of what was due for 2008 and all but about $95.81 of what was due in 2009.

Further, Citi Financial raised my APR to 263.16% and 277.83% for the two 2008 balances which is completely unethical.

I have attempted to correct this error that Citi Financial employees have admitted is an error on the behalf of Citi Financial. The employees state they cannot help me and constantly refer me to another person. After six attempts I am being told that I have to give Citi permission to fix their mistake. I am told that I should have caught their error four months ago and called then, and "Now it is too late." I am told if I don't agree I can file a complaint, but they will not refer me to an address or telephone number to file the complaint. They told me I can send a fax letter telling my story but will not allow me to follow up on the fax.

March 2008 total due minus what was due starting January 2009 was around $3868.89. In March 2008 I paid Citi Financial $4392.00, leaving a balance of $116.86 which should still be covered under their "NO Interest/NO Payment" Plan until January 2009.

The complaint has been investigated and resolved to the customer’s satisfaction.

Calling work, family and friends

I purchased my car in 2005 and the lien holder being Citi Financial Auto. At first everything was good because I paid my payments on time until last year. I lost my job after being employed for 6 1/2 years and was drawing unemployment until I could find another job. Still making my payments on time until October of last year when my hours were cut. After calling the CS department (which you stay on the phone forever) I was told I had to speak to my account manager. My account manager would never return my calls and when she did call back, she was snotty and rude. I could never get anywhere with her and she would only tell me to pay up or they would repossess the car. It took me up to May of this year to get my car payments caught up. Which was fine with them and we were to have an amendment done so that I would not owe May's payment. The amendment was never done by Citi. I moved from Indiana to Montana at the end of May. In June I called them giving them all of my information and work info so that I could get the bills needed to make my payments. It was then I spoke to James who said the amendment wasn't done and I was a month behind. I hadn't started work yet, and let him know that. Since that time now two months, Citi has called my place of work 7 times, friends and family numerous times and has made threats to repossess the car. I'm not sure what else to do with the loan company or what avenue to take anymore. In the state of Montana, a creditor cannot call your work, but that has not stopped Citi. I have told them time and time again, you will get your money and I have just started my new job. When will it end?! They won't listen to me and I've had it! No one in the company is willing to look at the case because I have been late 30 times in 4 yrs of having the car.

The complaint has been investigated and resolved to the customer’s satisfaction.

WARNING - WARNING - WARNING! Never have Citi Auto finance your car. these people are out of control. If you are ONE day late on your auto loan, they start calling your home, work, friends, family. Not once a day, but every three hours from 8:30 am to 9:00 pm. If you don't answer the phone or they don't get the answer they want, they start texting you. I lost my job two years ago and have been doing the best I can to make my payments on time, sure I'm late sometimes it's been hard meeting all my bills. But they get paid within 10 to 15 days after my due date.

I was temping at a company that was considering hiring me. One day I called Citi to let them know I would be late on my payment. From that day one, Citi started calling this company every day. After my assignment ended they still kept calling this company. The person who now had the phone number I used to call Citi was now being harrassed. So this peoson went to the HR department...the HR department called the agency I was temping with. The agency was very upset with me and said they wouldn't send me out on any temp assignments again, they couldn't take the chance that Citi Auto wouldn't call another company and upset them too!

I thought there were laws stopping creaditors from harrassing people! No one deserves this kind of treatment. Does anyone know of a place or person I can go to to complain?

I'm scared everyday...this company will come and take my car. I hear horror stories all the time that they just showup and repro cars.

I am having a horrible time getting them to leave me alone at work also. I have told them I do not have a home phone and they cannot continue to call my work. They have told me that I have to have a phone, I in turn told them it was nowhere in my contract that I am to have a phone. Once they give me a phone and they pay all the phone bills, then they can call me all day if they'd like but until that day comes, they need to remove my work number from their database. They advised me they have taken it off now 6 times but yet they continue to call me at work. I also am having problems with them charging me around 2500. more than what I financed. They informed me that I was late 32 times since I have had the car which I bought in 2004, they can't inform me of why they have added this amount to my car loan. I have asked to speak to a supervisor there for 5 years now and never got to talk to anyone until today. I spoke with Lana, she couldn't explain it either. I can't find anyone who can explain this to me, they keep telling me the same thing over and over again: Your payment is split up when we apply it to your account, some goes to interest and some goes toward the principle. I advised them this is normal for any loan, that still doesn't explain why they've added all this to my loan. If there are any late fees, they are to collect them when I make a payment so I don't understand. I just wish I could get somewhere with these people. I can't wait until I pay it off which will probably never happen cause they keep adding and adding. I am thinking we should all file a massive lawsuit against this company. If anyone has any information that can help me in anyway, please reply. Thanks

Used in TN

Irregular/regular payments

My husband lost his job and I have been trying to get out of debt as quickly as possible. I was looking into getting a low interest personal loan from my pension to consolidate our car payment and credit cards. I have had a car loan with Citifinancial since 2006. When I called for the payoff information in April 09, they told me I still owed $11, 000. I thought this was too high, and I asked for a copy of my payment history. How illuminating that was! according to the document I received, the outstanding balance as of 3/29/06 was $16, 350.69. As of 5/26/06, my outstanding balance was $19, 959.69! By 7/22/06, my balance was back down to $15, 986.29. By 2/8/07, I owed $18, 239.74! In 7/22/07, I owed $14, 665.24 and the balance has been reducing normally since then.

My payment is $381.80 and with few exceptions, over $200.00 of my payment is still going to interest. I also noticed several months where the $381.80 payment, which I sent as 1 check, was broken up as a "regular payment" and an "irregular payment".

I called the number for customer service from the payment history document and the person I spoke to was very condescending. He told me I was being charged $5.37 interest on the balance daily. This means that I have been overcharged for interest and am due that money credited to the principal of my loan. I asked to speak to a supervisor and was put on hold, only to be told one was not available. I am currently waiting for a call back, but am also writing to this complaint board to warn ALL Citifinancial Auto customers: Get a copy of your payment history. Look at the balances and how much is applied to the principal. Watch for large jumps in the amount of your outstanding balance. These people are doing something illegal, and it's time they were stopped!

The complaint has been investigated and resolved to the customer’s satisfaction.

This company is assisting Alqueada to cripple the American public right under our government's nose.

citi financial auto which is citi bank which is citigroup all one company all there rip off consumer companys all have the same way off doing bussness everybody stay away from them may be if nobody deals with them they will go away very poor company beware

Paid off account

On 6-18-02 we obtained an auto loan from Auto One now known as CitiFinancial Auto. This past Feb 4th of 2009 we paid the loan off by personal check. The end of Feb. we received our title and a congratulatory letter that confirmed the loan was paid in full. May 5th, 2009 I received a letter stating that there was a remaining balance of $1059. The letter ask that I send my original contract and continue making my monthly payments. I called the rep. the very next day which was the 6th of may. The rep told me that my check was returned for imaging on May 4th. He did not know what imaging was. I continued to call daily to resolve this. The original payoff was $1047.62. I should not incurr anything above my payoff amount. No one at your company can tellme what imaging is and they cannot tell me where the check is, so I called my bank to stop payment, cost of $25.00. I was told on the 8th of May to call John Heath on May 12, 2009. I called him on the 12th, 13th and 14th. and left messages. To this date May 20.2009 I have not received a return call. I ran my annual credit report and it shows my CitiFinancial Auto account as being paid in full on Feb. 2009. I want this resolved at no extra expense to me I paid this in good faith and have had nothing but problems since doing so. I would not recommend CitiFinancial Auto to anyone that I know. I guess my question is how can you release the title and release the account on the credit report and then 3 months later send a letter stating that there is still a balance. I don't feel your process of payments makes any sense .

Thanks for your time

The complaint has been investigated and resolved to the customer’s satisfaction.

I had a loan with citi auto that was paid off early we over paid them. They sent out title and letter said refund would be with title then 2 weeks latter they took another auto payment and said they will not refund they money and it would put account in delinquent status. If they sent out title to car letter paid in full may 20, 2009 then took payment may 27 2009 how our they intitled to this money and will not re fund it

I am having the same problem with them except they did sent me the title and they were actully overpaid 500 dollars that was to be sent with the title. it was not and now they are saying that if the return my money it will put my account in collections .

I would suggest talking to the Branch Manager when you call, and then ask to talk to his boss, and keep going up the chain until you get this resolved.

You can also start a blog with the title saying something CitiFinancial Auto Sucks! and explain your story just like above. ask people to comment and voice their opinions.

Since your credit report says its paid off contact a lawyer and let them know you need the title but they are not releasing it even though your credit report says that there is no outstanding balance.

Feel free to contact me should you have any further questions.

John

http://itswhatugiv.blogspot.com

Unethical practices of citifinancial

I have an excellent credit score and an excellent record of paying bills on time. In fact, I have no other credit card debt except for the small amount that was charged to CITIIFINANCIAL account from 1800 Mattress. And the only reason I opened the CITIFINANCIAL account was because 1800 Mattress offered no interest payments, if I opened the CITIFINANCIAL account. Majority of the time, I have made significantly higher payments on this account than what was minimally due. I believe CITIFINANCIAL intentionally avoids mailing out statements in order to generate income from late charge fees. On two separate occasions I have not received these statements and therefore missed my payments. As I am a very busy professional with a young toddler, keeping track of statement due dates was not one of my priorities. Therefore, I expect the companies such as CITIFINANCIAL to uphold their duty and mail the statements on time and every time. I have never had problems receiving other mail, such as utility bills or credit card statements from other companies. Since this occurred on two occasions, I believe this is done intentionally and is an UNETHICAL practice of CITIFINANCIAL. Since I am making all the payments with no interest, this company is not gaining a profit from my account. Therefore, I believe by not mailing statements and charging late fees is an UNETHICAL practice that this company utilizes to generate profit from each customer. I have called to dispute this late charge and the customer manager suggested that I mail a letter of dispute to their lawyers with evidence. As it is impossible to provide such evidence, I have decided to payoff my account but felt the need to share this information. My goal here is to inform the public of this complaint and suggest that by all means, PLEASE DO NOT USE CITIFINANCIAL FOR YOUR SERVICES.

The complaint has been investigated and resolved to the customer’s satisfaction.

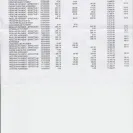

Miscellaneous 07/26/2010 $264.22 $0.00 $0.00 $0.00 $8, 103.71

Payment 07/26/2010 $264.22 $264.22 $0.00 $0.00 $7, 839.49

Funny how a payment I MADE went UP the same amount, eh?

that 264.22 is what I paid in July, and reviewing it... It went up THE EXACT same amount...

Isn't that illegal?

Yes I'm aware that it was applied to the interest, but the SAME day I paid that much, it went up JUST that amount?

huh?

They are money vultures to the core. All they care about is $$$$$.

I noticed recently the last couple of payments that were over $200 were oddly... ADDED to the total... as if I didn't pay a thing. So now I'm wondering, WHAT THE HELL did I pay over $200 for, if they're just ADDING the money I paid, to the TOTAL I had in there!

Seriously, I think this whole company is one big effing SCAM.

I have been paying this loan for nearly 5 years now, and see NO signs of improvement in it. If anything, I'm getting higher and higher in debt, because I'm paying WAY more than the damn minimum.

Looking at better business bureau... they got an F. Not surprising, but what IS surprising is... WHAT THE HELL are they still doing AROUND? Then again, all the money they've been sucking out of poor joes like us all, is what is keeping them afloat. Hell, they've threatened to garnish my wages once or twice. EVEN WHILE I'M PAYING MORE THAN SUPPOSED I'M TO!

And the harassing calls, omg. I've told them repeatedly to NOT call me at work, the owner does NOT like calls like this going on while work is VERY VERY BUSY... which is ALL the time.

They've called me while I'm in class in the middle of a lecture almost every week... Sure, if I'm behind in payments I don't mind the reminder but when I'm paying on time, why the hell BOTHER!?

Is citifinancial a part of citicorp group. I understand Citi filed bankruptcy last month

(Nov.) Citifinancial is still no good they bought my loan from no good Associates First Capital kept my same account number and when I call Citi to inquire about balance the automated voice instruction says put in account number after I put in same account number it says "Sorry that is an invalid number I call again and again until I get a live person and repeat to them my account number then I am on hold for almost 45 min. Even my account statements from Citi has that exact account number on it. After all these years sending timely payments to an invalid account number. I faxed copies of letter to Mary McDowell, Pres. & CEO Citifinancial to Baltimore, MD, also spoke to her secretary.

Is citifinancial a part of citicorp group. I understand Citi filed bankruptcy last month(Nov.) They are still no good. Citifinancial bought my loan from no good Associates Capital Bank; Citi kept my same account number from the Associates Financial debt. When I call Citi to inquire on the balance of loan using the account number I am told "that is an invalid number. Where did my payments go.

Nevever sends monthly statement, conflicting information

I recently made purchase with Ashely Furniture and had my purchase financed through Citifinancial. I have yet to receive a statement. I've called them five times now to verify my mailing address. They have assured me each time that a statement is being sent, still nothing. They say this account is not accessible over the internet so I cannot get an electronic statement and they simply refuse to fax or email one to me. I've asked where to send payments and so far have been given two different addresses, now I'm afraid to mail anything without a statement for feaer of it not being received or not getting processed properly. What can I do to make them give me a statement and continue to do so on a regular basis. I will NEVER use citifinancial again.

The complaint has been investigated and resolved to the customer’s satisfaction.

AMEN! This is the most backwards company I have ever seen. I don't get a statement either. I am in the middle of purchasing a home and the lender needed my information with Citi Financial and I found out that the it would take 10 days or more for them to get it to me. Why can't they just send one monthly like most companies. And the internet is a joke. You can't find out much there either. For whatever reason, my own account is top secret to me, they won't tell you anything.

Law suit/class action

Questionable Fees and late Fees? My individual case is similar to most of the postings listed here. My original contract was purchased 14 months ago by CitiFinancial Auto and it's been a nightmare ever since. I recently re-financed my vehicle with my lending institution just to get away from CitiFinancial Auto. At my loan closing CitiFinancial Auto did not want to release my payoff amount and really gave my Lending Officer a hard time as well as upset me greatly. I ended up paying $663.00 over and above what my balance was just to get rid of them. Now it's my turn. I have made every payment, with one late payment...and have all my records.

If you are serious about going the distance to bring this company to court, email me and tell me to count you in.

If I obtain enough names and committments, I will then ask the attorney for a class action lawsuit. Other-wise I will be taking this company on alone.

Only email me if you can back-up your records, you are committed and have the patients to deal with this suit.

My advice...find another loan institution to re-finance with and get out from under CitiFinancial. It WILL NOT get any better.

The complaint has been investigated and resolved to the customer’s satisfaction.

i am trying to pay off loan and i cannot get in touch with a person

Please add me. Too many things to say about them paid off a car loan (with a few late payments, but never over 30 days) and was told that there was 2515.38 remaining on my loan of interest and principle? SO... now i have $15.38 remaining to pay off this amount, and they STILL want an additional $191 because according to them this amount has still been accruing interest... REALLY? The past due amount on my invoice shows $0.00, so what is the interst for again? Their invoices are designed to make the consumer not see the actual amount owed and they do not put the information in plain english for anyone (including themselves) to understand. I want ALL of my money back from them and i would love to see if they send me my title anytime soon! charryse@yahoo.com

Citi-Fiancial demanded 4 payments from me in ?December, 2008, or they would take actions against me and damage my credit. As it turns out, they failed to apply as 4 monthly payments, and filed that I was late. This has damaged my credit and aided in my not being able to buy a new home.

lrcgn120@yahoo.com

Larry R. Camp

I would like to join any action. Citi-Fiannacial received over 4 monthly payments from me in December, 2008; as they were threatening my credit. As it turns out, they did not apply on a monthly basis as I required, and they reported larte payments on my credit report, and refuse to remove.

lrcgn120@yahoo.com

Larry R. Camp

For months now I have been trying to get in touch with citifinancialauto. I call and there is no answer. I call again and the operator says that that number is no longer in service. I send emails and get no answer. I write to them at their office and get no reply. I have been sending my payment every month to the address at Coppell, Texas and have not received a statement in over 2 years. I will not send my May payment and see if they are going to reposess my car. I hope they bring the cops and a lot of people with them. I already have my people ready just in case. All I need is a 10 day payoff and no one has the courtesy of replying my messages.

I AM FREEEEEEEEEEEEEEEEEEEEE, FINALLY. THANK YOU JESUS! FREE FROM CITIFINANCIAL and my credit IS IN TACT. No more worries. HOwever, again, I would like to be involved in this class suit. So please keep me posted if there is anything going around. :) I wish I had time to start it myself but I have two settlements pending at the moment. KEEP ME IN THE LOOP!

Please let me know how to get in on this lawsuit. They sold my loan to Santandar without ever letting me know, which is the ABSOLUTE WORST company to work with. They are also saying I still owe almost what I paid for the car initially 3 YEARS AGO! they will not send me payment history.

Please let me know how to get involved with this lawsuit.

Angela

[protected]

count me in, i finish to pay my truck and they turn my account to SANTANDER FOR COLLECTION, they saying i dont pay three monts.and now i still owe them $2500.00 and they repo. my truck.-------- ARTEMIO ACOSTA. ARTACOSTA20@GMAIL.COM

If there's people out there on the same situation as me please help is there some sort of class action suit against these companies this [censor] is absurd to even here it really sounds like a scem that's hurting and added dept to a trouble economy many of us out there are struggling and just CANT AFFORD DUE TO salary and cuts nation wide

I really know what the people is speaking citifinancial auto stole my account but never sent my payment to the new company this is a really back company to do business with ... I would never tell any one to use the company at all . Never again

Reneges on payoff agreement

After reading info on this website, my3cents.com, /link removed/ and the recent lawsuit settled in California I was concerned about Citi.

I am retired and unemployed. I attempted to negotiate a payoff offer with Citi a few months ago. It didn't happen because I asked to speak with a manager and he was so rude and condescending I gave up.

I tried again recently. I talked with a Ms Nolan (she was the third person I talked to; I asked to speak to someone who can make a decision.) We agreed upon a payoff amount and she gave me a due date. I asked her to fax me a confirmation (having read that Citi had received a final payoff, then demanded more money). I waited over an hour; no fax. I called back and got a person who identified herself as the "answering service". I left a msg with her for Ms Nolan that the fax is ready. Feeling uneasy, I typed my own confirmation and faxed it. I think it is strange that the fax number on my fax receipt is 2677772 and not the fax number I dialed as shown on their website.

Over an hour later I called again. Spoke to a Ms Strickland and went through the entire scenario again. She told me Ms Nolan didn't complete the "settlement macro". (This is not my problem.) She said their department doesn't send confirmations until after the payoff is made. (they need to tell Ms. Nolan) Then she asked me what do I plan to do if this is not accepted? I told her it is already accepted and I have a due date. Then she said, "oh, the manager had accepted it, he was just waiting for the "macro" to be completed." I was asked to call back in two days.

I called back in two days and Ms Strickland told me they are not accepting any more settlements and I would have to pay the full amount or do an amendment (to stretch out payments). I told her this is not right because I have an agreement and I do not intend to prolong my relationship with Citi. The call ended with me telling her this is why Citi is in so much trouble. . . you pay when you don't treat people right.

I am not protesting the mounds of interest I have paid; that was my mistake. I am protesting the way companies such as this play with people's lives and jerk them around. I don't know if it is incompetence or dishonesty, but whatever it is, it is out of control.

I filed a complaint with the FTC because Citi and its representatives cannot be trusted.

I have concluded that there is a conspiracy to ensure that middle and low income Americans never OWN ANYTHING! One of the problems is that no one cares about the fate of Americans because these companies are not run by Americans. I guess they haven't heard the trite expression, "When America gets a cold, everybody sneezes." I hope if anyone is considering Citixxxx, they will read some of this info before proceeding:

creditsuit.org

pissedconsumer.org

/link removed/

complaints board.com

my3cents.com

/link removed/

yelp.com

topix.com

business insider.com

rateitall.com

innercitypress.org/citi

californiarepossessionlaw.com [class action lawsuit April 2017]

consumer affairs.com/finance/citibank.htm

Article: MSN’s Customer Service Hall of Shame for 2017

The complaint has been investigated and resolved to the customer’s satisfaction.

I bought my car 2 years ago for 15500 i have paid on it for 2 years 9200.00 and my husband was laid off in oct 2017 and we have struggles we have been promised lower pay payments would mail paperwork never recieved we was promised deferments and they was put back on they just repo it and we call next morning and was told had to call another number that dosent answer i called 4 times held for a hour 15 min, then 45 min then 1.45 min and 2hours and 9 min each time left a message and the recording says hold may be 30 mins or longer and will call back within 24 hours it has been 48 and no call back was told my payoff is 15300.00 what the hell have i pd 9200.00 on they dont want to help anyone but they sure took government money to bail them out what can i do .

i gave my 2017 dodge mini van back in chapter 13 bankruptcy.citifinancial claimed in court that i had borrowed 24, 999 when in fact i borrowed 15, 800 .24, 999 would of been the pay off if i would of kept the van and through citifinancial at the current finance charge but they even got the van back sold the van and got that money and the monay i paid them till i gave it back in the bank ruptcy and marked it on my credit report as me owing them 24, 999 and made it look like that is how much i borrowed instead if the 15, 800

I have had nothing but problems with this company since they financed my car through the dealer in January of 2017. The biggest issue is them not processing payments when the receive them or claiming that they did not receive a payment, then "finding" it two weeks later, which of course means more fees for them. I finally gave in and set my account up on automatic payments only to have them take out the same payment twice in September 08 AND October 08 for a total of $1600 in two months! This caused a ton of fees from my bank which they say they are not responsible for. It took two months to get them to refund the extra $800 they took only to have them charge me a fee to do that! The customer service agents are the most rude people I have ever sponken to, they will barely give you their first name, never their last and even the managers are awful. I have had to close my bank account twice now because of them taking unauthorized payments and now they have done it again. I mailed a check to them Tuesday from Virginia and they presented it to my bank Tuesday. I of course did not have enough money in there (my check is DD Wednesday) but my bank paid it anyway for a "small" fee. When I called them today to inquire how they could possibly have the check I put out in the mail the same day I mailed it even though they are five states away I was told they could process payments when and how they see fit. It was presented to my account as an auto draft and they bank says that I will have to come in and close my account and open a new one (gain! ) to keep them out of it. The manager at my bank sugessted I take to paying them by certified check or money order so they do not have any banking information on me. I still can't believe that they think it is okay to take you information off your check, keep it on file, and use it to take their money when they see fit. Every single time I call them I am placed on hold, interuppted, and spoken to in an extremely rude manner. It is to the point that I would rather they take the car so I do not have to deal with them. And I have never been late with a payment! I can't imagine how they treat those that are. GRRRRR.

I purchased a truck and received financing through citifinancial auto. I mailed in a check for my monthly payment and they posted it for 200 dollars more than what was written on the check. I have contacted them several times and I was always told someone will call me back. unfortunately no one ever called back. I also had one supervisor hang up in my face and one yell at me on the phone. When I wanted to speak to their superior they hung up the phone. I think there should be an number to report horrible customer service so these people won't think they can treat paying customers any kind of way. Also i have yet to receive my money back and no one is try to admitt they made a mistake or fix it.

This company has a reputation of constant harassment even if you make an arrangement to make a late payment on auto loans with late fee charges. They usually blame their electronic communication devices which people have to talk to without feed back or asking the right question in order to get the right answers for some issues that a machine can't answer. some of those annoying and harassing calls comes in late at nights and between 7 and 8 mornings. I work nights and sleep in the day time due to job schedule change. I explained the situation and firmly emphercised that no one should call my house at that time of the day when I am just about to sleep. If I don't sleep as required by nature my job will be on line since employers do not tolerate employees to sleep on the job..especially when you work as part of law enforcement.

September 6, 2017. I made my payment through phone with my ATM card. I attempted to talk to some one in order to up date my account to no avail. All their communication telephone lines are electronically programmed and limited to what they recorded for you to hear and don't ask questions. How can some one resolve issues or problems when you are barred from talking to real people? What kind of business is this who can't serve their customers right? May be, BBB will be the best answer including the FCC. I need some answers why, Why, Why all this mistreatment?

I was paying my auto payment and sometimes late. I requested a payoff and was surprised as to the amount. I pulled an account history and found out they were adding insurance premiums to my balance which increased my payoff. There were times I did not have insurance and I was paying to the insurance company a separate amount for it and also paying my loan. Is it legal for them in Maryland to add to my loan amount thousands of dollars for insurance?

I am so glad I looked at this website today. I have had a loan with Citi for two years and every time I have to deal with them, I think, "What idiots!". It doesn't make me feel too great knowing that idiots are controlling my car loan and have my personal and financial information. I receive 10-15 automated calls a day even when I have already set up a payment. This costs me money! Also, I have been told many different things regarding the phone fee, including that the fee applies to the principal balance, applies to interest, is only a fee that they pocket and that it is not charged if you are on an automatic pay plan. The customer service people are rude, not helpful and often do not have answers to questions. Is anyone actually running this company? I am trying to get a new lender but in the current economic situation, it's not so easy. Looking for a lawyer. I think we have a good shot at a lawsuit.

Citifinancial keeps taking out my car payment after I traded in the car and the dealer has sent in payoff, I have contacted citifinancial and they claim they have not gotten the payoff I signed papers over 33 days ago and have a new car but they keep taking the car note out of my checking account and I can't get it stopped today, according to my lawyer I have to close out my checking account of 16 years to stop them from taking out the payments and file legal actions against them to get the money back the dealer Rick Hendricks Chevrolet where I bought both cars and GM has been no help or support to me in this matter and calling citifinancial is a joke I can't get anyone on the phone that speaks English that you can understand.

I am feed up with Citifinancial Auto and sick of calling INDIA! it's like talking to a bunch of idiots who have scripts to read you! I paid my truck off, they received the payment on 1/7/10. These idiots told me i am not getting my refund mailed out until 1/29/10. they need 15 business days to confirm if there company received the funds properly? I had the dealership fax them over the cancelled check that they cash and now they are telling me i have to wait at 48 hrs for them to review this. I JUST LOVE OUTSOURCING! their customer service has everything to be desired. When I asked to speak with someone in the United States, they informed me they don't have a customer service in the United States. I wonder, did we bail these ###s out on Wall Street, too? I also have a HD Card with them, that's being paid off and called. F Citifinancial/Citibank.

I took out a loan for a used huyndia at Bill Dube Huyndia in 2017 for the amount of $12, 303.40 with Citi financial auto. I have had many expenses with this car example (a new motor) amougst many other things but I have also had to continue paying for this NEVER Ending bank loan. I requested paper work from Citi financial on how much I have actually paid for this car to date- The paper they sent me I needed to get a magnifiying glass to read- but upon requesing another more ledgible copy they finaly complied. At any rate bottom line is I purchaced a used Huyndia for12, 303.40- with 1, 000.00 down.My interest was at 19% (so I thought) but appently was actually 23%. My payments are 295.19 per mnth- I have been paying this since 06/30/2017- So to date I have paid citi financial $13, 590.00 ( which is more than the origonal amount and my pay off today is $8, 463.29. If I continue paying at this rate mypayment is$295.10-$139.91 goes to interest- for some reason I think this is better than what they were doing. As I review regular past payments I am seeing many different amounts in all colums- example-(regular payment on 1/17/2017)-$295.19--principle $54.53- interest$235.76. There is absolutely no consistancy or explanations with any of the amounts paid- or interest /late charges. I could not figure this out even if I tried. I also am friends with a postal worker - I did an experiment with her ( my due date is the 13th of every mnth.- So I mailed my payment at the post office 15 days prior and was still accessed a late fee.Citi financial told me I should pay by phone for an extra $15.00 to insure my payments were recieved on time. This is a scam- I belive if I pay them as supposed I will have give them in the area of 27, 000- for a $10.000 Huyndia- this is what I was suppose to be borrowing.- But after putting 1, 000.00 down my loan still ended up to be for 12, 303.40 ( I have no clue how that happened either.I have contacted them many times due to this problem and have many documents- I will send the first round of what they sent and the second. Can somebody please help with this- I feel as if I am being held hostage with this car- I don't know what is worse the car (and it's many expenses to keep it in working condition) or (the loan which I don't think I will ever be able to pay off) Please help!

Harassing calls

We have our payment arranged for automatic debit from our account. It was set up through them and is set for the 24th of every month. It has been automatically withdrawn every month for 6 months but, in the last 2 months I am receiving calls saying my payment is past due! The original loan date was the 22nd, but, when we made the auto pay arrangements that was a weekend date, so the person that set it up made it for the 24th. I have gotten no late payment fees, so that part is fine. These phone calls on the 24th start at 8 am and when you call them back to explain, this department appears not to know what is set up! No wonder they needed bailout money, they don't even know what one department does, from the other, within the same division! Heaven help us all, these "banks" are not in control of anything, except ineptness.

The complaint has been investigated and resolved to the customer’s satisfaction.

My car payment is only behind $145.41 for July and I get phone calls from Citifinancial starting at 8:30 am and continuing throughout the day. I got 5 phone calls in one day one day this week. I get calls from numbers that when I return the call it says it's a non working number. I get calls on a Sunday and yet the hours displayed on their site for the public does not include Sunday. I talked to a representative a day ago and explained I'll pay the July balance next week and work is slow at my job so we're in a partial layoff so I didn't know what I'd be getting in the future and the very next day I started getting calls at 8:30 am and throughout the day. I answered a call earlier in the week and when the caller asked if it was me I said yes and he hung up on me. I returned a call today and told the representative I'd talked to someone a day ago and explained my situation and yet I get calls all day long which is not necessary and is harassing. She said "I will take care of that. If we don't hear from you after one day then we call." I said that was the day after I'd talked to someone. She said "your account is in collections..." I was pissed off anyway because of getting so many calls so I hung up. How do they expect us to be home for all these calls if we work? We can't work and be home at the same time and one call a day if that is sufficient. Also, we only get paid ONCE a week so if someone says I'll pay you next week why keep calling all day from that moment on even before next week gets here? That's not going to get the paycheck to come any faster! I've even went on their website and applied for a payment solution and each time, I'm told "you do not qualify..." I'm trying but times are hard all over and things happen plus there are other bills to take care of. I was approved for a lower payment in 2008 but my citifinancial representative at that time turned around and screwed it up so it was denied and I've tried unsuccessfully several times since to apply for a lower payment but was constantly denied approval.

This company is assisting Alqueada to cripple the American public.

Having issues with them myself, and reading everyone elses issues, I believe this company is dirty and they are doing their customers this way to be able to tack on more charges and interest. Thats whats happening in my case. Somehow the payoff on my account went up 600.00 in 10 days and no one at that company can tell me why, although they also refuse to send me a printout of my account. I have also been given 4 different payoff amounts in the same day by i notice in the mail and 3 reps that answered the phone each time i called back to try to get some help. Nightmare!

Paying off loan/customer sevice

These are some of the most incompetent people I have ever dealt with. I have had my car loan with them for several years. I had it set up where my payment was automatically subtracted from my account every monthy. Before that I paid online or on the phone. I recently purchased a new car so I wanted to pay off my old car and get the title so I could sell it. Why would a company allow you to make payments online and on the phone but not pay it off that way?That makes no sense. In order to make the process easier I called them 3 times to get the EXACT payoff amount. I went and got a cashiers check and sent it in. I checked the account a week later and it said I still owed money. When I called them they quoted me an earlier payoff that was $80 more...though online it said $40.92 more. They apologized for the bad info. AGAIN, they couldn't take this amount over the phone or online. So I had to take time out of my work day and I sent the $40.92 through Western Union. So now it is paid off but I have to wait 5 days so they can send the title. The people barely speak English, they have been rude and uncooperative and a simple task like paying off a loan has been a nightmare. Just stay away from this company. They will make things alot harder than they are.

The complaint has been investigated and resolved to the customer’s satisfaction.

This company is assisting Alqueada to cripple the American public right under our government's nose.

I have just gone through a similar scenario paying off my loan. They recevied payment on 9/25 and I requested an expedited delivery of the title without any success. Their answering service is in India and they have no power to get things done. I requested to talk to someone in the US and they would not give you their telephone number.

One of the employees acted as if he was typing the mailing information to send a copy of the lien release note and as asked him later to repeat this information and he had typed nothing, incredible and anoying situation.

Worst customer service ever!

I would never recommend CitiFinancial auto again

Jose Blesa

Houston, Texas

Bad customer service

Citi Financial is THE WORST company to ever do business with. the customer service is awful they are rude very disrespectful and have no type of business ethics. I had been having trouble paying my car payment on time and the customer service rep asked me could my father help me and I said my father had just passed away and he had the nerve to say well didnt he leave you with some money no im sorry to hear that and I didnt know he just came out with did he leave you with some money? I dont know who they got running that compabut when I am done paying mu car off im NEVER EVER dealing with that company again. I dont recommend that financial institution to anyone.

The complaint has been investigated and resolved to the customer’s satisfaction.

My husband and I are also just like you My husband has been off of work for over a year. Citi financial was eager to work with us the first couple of months. our branch manager told us to just send him partial payments. so we did then we get a call from the head office and they said that we had not made a payment at all. I told them what our branch manager had told us to do and they said that was not acceptable .so know I get a wage deduction notice in the mail. and find out that they started the wage deduction 1 month prior to notifing me. . they also emptied out our bank account. Without us being notifyed that they were garnishing that also, I have been checking with some attorneys and it is illlegal for them to do this with out proper notification that they are doing doing this we go to report this to our circut court clerk on Monday morning wish us luck in beating these worthless speck of humanity.

I agree with this complaint. I am a recent "victim" of CitiFinancial customer service issues but from the branch. I am dealing with the Elmwood Park branch in New Jersey and there are threatening to garnish my wages. This is with full knowledge that I have been unemployed off and on for 8 months. They didn't even tell me that I qualified for a deferment. They, in fact, told me that I didn't qualify for any payment options and also asked if I could borrow the money from a family member. That is the most asinine question I've ever heard. If I am having trouble paying, why would I borrow money that I am unable to pay in the first place.

I took this loan out to pay off my first semester of graduate school. I will NEVER do busy with CitiFinancial again. I just hope some money falls out the sky so that I can pay them and but done with this.

They closed my account!!!

I have had my Citifnancial retail account for nearly a year and a half now. Honestly, my payments are ALWAYS on time and much more than the minimum due. My FICO score was 612 until TODAY. Today I decided to apply for a lousy $179 extension for credit with Citifinancial, because I wanted to purchase a normally priced $1399.00 dinette set or te awesome total of $679.46. My current available credit with Citifinancial is $509, so I only needed my credit extended in the amount of $179.00 total. Of course I was DENIED! When I returned home, I called the toll-free customer service number & they made me aware that they closed my account as of TODAY because my FICO credit score. The economy is so low right now, Citifinancial goes & does this to me WITHOUT warning, they couldn't even give me a chance by extending my credit. So, it leads me to say this: THERE IS NO WONDER WHY CRIME GOES ON!

The complaint has been investigated and resolved to the customer’s satisfaction.

I purchased furnature 2 week ago - cleared for approval. I found out today that this was not the case - the amount was not reflected on my balance due and that my account had been closed 6 weeks ago without notification. Why? I was told the criteria had been changed for credit worthiness. Ok - except I was only 35% balance to limit AND I had made all payments in a timely manner. So (I ask you) HOW do I face the merchant? WHAT do I do with the furniture that has been sitting in my living room for 2 weeks? The shame is that my mortgage is with Citifinancial and I have an installment loan with Citifinancial. What an embarassment...What agency can I turn to for support?

Overview of CitiFinancial Servicing complaint handling

-

CitiFinancial Servicing Contacts

-

CitiFinancial Servicing phone numbers+1 (800) 922-6235+1 (800) 922-6235Click up if you have successfully reached CitiFinancial Servicing by calling +1 (800) 922-6235 phone number 0 0 users reported that they have successfully reached CitiFinancial Servicing by calling +1 (800) 922-6235 phone number Click down if you have unsuccessfully reached CitiFinancial Servicing by calling +1 (800) 922-6235 phone number 0 0 users reported that they have UNsuccessfully reached CitiFinancial Servicing by calling +1 (800) 922-6235 phone number+1 (877) 276-5550+1 (877) 276-5550Click up if you have successfully reached CitiFinancial Servicing by calling +1 (877) 276-5550 phone number 0 0 users reported that they have successfully reached CitiFinancial Servicing by calling +1 (877) 276-5550 phone number Click down if you have unsuccessfully reached CitiFinancial Servicing by calling +1 (877) 276-5550 phone number 0 0 users reported that they have UNsuccessfully reached CitiFinancial Servicing by calling +1 (877) 276-5550 phone number

-

CitiFinancial Servicing emailshelp@citibank.com100%Confidence score: 100%Support

-

CitiFinancial Servicing address6400 Las Colinas Blvd., Mail Stop CC2-109, Irving, Texas, 75039, United States

-

CitiFinancial Servicing social media

-

Checked and verified by Laura This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 30, 2025

Checked and verified by Laura This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreJun 30, 2025 - View all CitiFinancial Servicing contacts

Recent comments about CitiFinancial Servicing company

trying to locate the correct branch of citifinancialOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.