- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- UnReplied

- With attachments

wanted 24 hour pass and ended up with month's subscription and protection fees

I signed up for a 24 pass with INTELIUS for access to people search for a high school reunion.

I ended up with the fee for the 24 hours, 14.95; a month's fee, 19.95, and 24 protectionplus123 for 19.95.

None of these extra fees were clear on the original sign up.

When I received an email regarding my monthly membership, I called the number on the email immediately and cancelled the membership. They claim they never received that call.

This is a scam and I would like my complaint published to warn others about this scam.

The complaint has been investigated and resolved to the customer's satisfaction.

unauthorized cc withdrawls

I recently used a website company called Intelius to do some reverse look up checking. The cost from Intelius was $4.95. I used my credit card to pay for this. The next month when I recieved my back statement. There was an unauthorized charge from ValueMax for $19.95. I have since contacted the bank, and they are reversing the charges. And I have also reported this to the Texas State Attorney Generals office. So consumers out there should be aware that Intelius and ValuMax are working together. Or they are one and the same, scamming people for their money.

Rosa Medellin Hernandez

The complaint has been investigated and resolved to the customer's satisfaction.

charged w/out my consent

they charged my credit card $19.95 w/out my consent. i never subscribed to them. i want my money back or they need to pay my credit card ASAP!

The complaint has been investigated and resolved to the customer's satisfaction.

fraudulent charges to cc

A company named Value Max, FRAUD. My April'09 CC statement reflected 3 fraudulent charges in the amount of $19.95 - two charges from Intelius and one from ValueMax. Must be a joint scam! When I called ValueMax he would not give me any information about the company unless I gave him my CC number and email address. Cancelled CC and referred my complaint to their SIU department.

The complaint has been investigated and resolved to the customer's satisfaction.

unsubscribe

I want to unsubscribe from your company! I have been overcharged and Im overdrawn. This is an unethical thing to do to somebody. I want my name off of your site! Jennifer clenney

The complaint has been investigated and resolved to the customer's satisfaction.

the rip off just keeps going

I have previously written a complaint about Intelius and Value Max but the whole story just keeps getting worse.

After I had found that after using Intelius to try to help find an old friend (which was also a bust since the report had old and unusable address for them) I now have been charged my second unauthorized charge fro a service I not only didn’t sign up. What is worse is I answered NO when the popup give the option on the web site.

Without my permission I had been signed up for the Intelius Identity Protection Plan at 19.95 a month. What is really bad is they should be reporting on themselves and their sister company Value Max as companies that are ripping off your bank accounts.

Buyer Beware when it comes to using Intelius because you will have unwanted services add to the service you thought you were getting.

The complaint has been investigated and resolved to the customer's satisfaction.

history of scam artist

Please, if you haven't yet had funds stolen by these crooks, check this website on the chief-fraudster before using the "services" of Intelius:

http://www.techcrunch.com/2008/05/29/naveen-jains-intelius-prepares-to-go-public-how-much-of-their-revenue-is-a-scam/

The complaint has been investigated and resolved to the customer's satisfaction.

chargin for a subscription that I never ordered.

They are debiting my Check's account in the Amount of $-19.95 US Dollars in 2/2/09 for a Subscription that I never ordered.

I already ask for the reinbursement of the first month's charge and they offered to credit my account and instead of doing that they charge again another $19.95 Dollars on 3/4/09 for the subscription monthly payment.

In view of such behavior I assume that they will continue charching my account each month. I will ask my Bank no to charge my account and if it's possible to sent back the other two that they already have colected.

Somebody has to do something with this type of abuse and scam.

Ruben Martin-Campos

The complaint has been investigated and resolved to the customer's satisfaction.

cancelled before and still charging account/cannot contact via phone

I have cancelled the services with Intelius several times before in 2008 and they started charging my credit card again in 2009 for services I haven't used or resigned up for. I've been charged 19.95 per month for "background check/people searches" that I have not even utilized. I've tried 3 times to get in touch with customer service because I cannot cancel online due to not knowing my account login and password because I never signed up for an account. I've been on hold for over 20 minutes during each call and never was able to reach a representative. I do not have the time to keep calling and attempting to reach this company, I am in the process of filing a complaint with my credit card as well.

The complaint has been investigated and resolved to the customer's satisfaction.

did not use or authorize these transactions cc was charged causeing an overdrawn account these funds need to be returned to my account immediately!

unauthorized charges

Letter directed to Sears Credit Card:

On or about 02/21/09 I used services provided by Intelius.com to conduct a background check for legal work. These are presented in charges in the amounts of $1.75 and $47.90. In advertently, with no intent and because of site confusion, I selected 24ProtectPlus on or about 02/25/09 for the amount of $19.95. I am disputed this charge. In addition, on 02/28/09, there is an ongoing charge from Intelius.com for an additional $19.95, which I terminated.

Consequently, I am disputing charges of $19.95 made by 24ProtectPlus on 02/25/09 and $19.95 levied by Intelius on 02/28/09.

I have contacted Intelius repeatedly via email requesting termination and refund of the charges appearing in the previous paragraph, but to no avail. Intelius does not respond to my email nor has it terminated charged. In addition, I have not been offered a refund. I am not disputing the charges made on 02/21/09 for $1.75 and $47.90 respectively.

All documentation has been included. I am unable to reach the service through the telephone. I have fulfilled my communication requirements. Documentation has been included and, therefore, I fully anticipate that Sears will rectify these matters immediately. In the event that Sears refuses to become proactive in these matters, then I will terminate my credit card immediately. I have a long record of service and allegiance to Sears; I expect and demand results.

The complaint has been investigated and resolved to the customer's satisfaction.

unauthorised charge

They are charging my credit card each month. I did obtain information once and thought that the charge was a one -off but the charge is being made each month !

The complaint has been investigated and resolved to the customer's satisfaction.

A:

Call your card company and change you credit card number right now!

Than:

Disputing a Credit Card Charge

Issuers must follow rules for promptly addressing a credit card dispute. You'll get a statement outlining their rules for correcting billing errors when you open an account and at least once a year. In fact, many issuers include a summary of these rights on your bills. If you find a mistake on your bill, you can dispute the charge and withhold payment on that amount while the charge is being investigated. The error might be a charge for the wrong amount, for something you didn't accept, or for an item that wasn't delivered as agreed. Of course, you still have to pay any part of the bill that's not in dispute, including finance and other charges. Write to the creditor at the address indicated on your statement for "billing inquiries." Include your name, address, account number, and a description of the error. Send your letter soon. It must reach the creditor within 60 days after the first bill containing the error was mailed to you. The creditor must acknowledge your complaint in writing within 30 days of receipt, unless the problem has been resolved. At the latest, the dispute must be resolved within two billing cycles, but not more than 90 days. In order to dispute a charge for unsatisfactory goods or services, you must: have made the purchase in your home state or within 100 miles of your current billing address. The charge must be for more than $50. (These limitations don't apply if the seller also is the card issuer or if a special business relationship exists between the seller and the card issuer.) and, first make a good faith effort to resolve the dispute with the seller. No special procedures are required to do so. If these conditions don't apply, you may want to consider filing an action in small claims court.

Here are answers and opinions from FAQ Farmers:

Be very, very careful when disputing a payment. Regardless of the amount, pay your credit card bill on time. Whatever you do, make sure your bank or credit card company do not list the balance on your credit card as a "bad debt", other you will not be able to get a mortgage for your house, or a loan for a car because your credit rating will have been affected.

unauthorized charge

I was charged for services that I never asked for and had canceled the very first day. I continue to receive chages. What a rip-off. I have tryed to call with no answers. On the line for 4 hrs. please take care of this problem ...please. thank you

Donna Filipkowski

[protected]@bellsouth.net

[protected]

The complaint has been investigated and resolved to the customer's satisfaction.

My mother was supposed to be paying only $.95 for a ONE time use to find a long lost friend and ended up being charged 19.95 a month for the past two months to her cc. I had to wait on the phone for about twenty minutes to get a human being and he refused to reimburse any of the money even though it was never used and we hadn't realized we had been signed up. This is just absolute crap! If it was there in writing when we signed up then it must have been micro-scopic writing.

On April 14, 2009, an unauthorized charge appeared on my bank account in the amount of $19.95.

The Description was listed as: CHECKCARD 0413 INTELIUS SUBSCRIPTION [protected] WA 24692169103000249881154.

When I called the above number, I was put on hold and never got thr0ugh to a representative.

I would like this charge reversed on my bank account by INTELIUS.

Thank you,

John Egan

not wanted

I used your sight to get background information on one individual, and wound up subscribing. I was under the impression the $19.95 fee was a one time charge, now it appears it is a monthly subscription. We wish to be taken off that subscription. ASAP.

Thank you Lynne J. Mazzone, secretary

The complaint has been investigated and resolved to the customer's satisfaction.

24 hour protect

I used intellius to locate the owner of a property, which I have done a few times in the past, but this time Intellius signed me up to "24 hour protect". I was unaware of this until I found the charge of 19.95 on my credit card. I cancelled this service immediately but did not get my 19.95 back and am absolutely furious that I entrusted Intellius with my...

Read full review of Intelius and 29 commentsdeceptive billing practices

If you intended to do a one time $4.95 property/neighborhood report, you are auotmagically subscribed (apparently) to their monthly indetity theft service at $19.95 per month -- there's some irony in this if you think about it.

Their markerkting practices are quite clever and equally deceptive. Further investigation out here in cyberspace confirms their sleeze bag practices.

And the the run around with them continues. I restroted to taking action with my bank.

Caveat emptor.

The complaint has been investigated and resolved to the customer's satisfaction.

refund requested

I have been charged for two months of a subscription that I did not authorize. I would like a full refund for the month of January and February on the credit card that was used for the 1.95 transaction that I did authorize. I am canceling any service that I have with your company effective January 1, 2009. There was no authorized transactions made after December 31, 2008. The credit card company has been notified that there will be no more payments made to intelius.

The complaint has been investigated and resolved to the customer's satisfaction.

fraud

intelius puts a offer on to search of .95 cents then changes it to a monthly subscription of $19.95 and adds another $19.95 for their company(value max) with a phone number on the cc you give to register that when you call send you to a fake web address valuemax123.com that 100s and thousands of people all have fraud charges, IS THERE a atty who can file a class action?The phone number to call is [protected] corp then push the # for media and fax [protected] repeat it daily ..Their atty is [protected] and the atty generals of each state will look at complaints.NO better bussiness they dont belong.SUPRISE.They have another company called intellisense.William A Owens CEO 500 108 ave N.E. Bellevue wash 98004 Phone there also [protected]

John K ARNOLD, Paul T Cook

The complaint has been investigated and resolved to the customer's satisfaction.

possible fraudulent charges

In January 2007, I ordered a background check on myself and my credit card was charged $117.45. Two days ago, I received TWO emails from Intelius that my "recent" background check report was available for viewing for 30 days. I went into Intelius and looked at my account, and it showed one report in 2007, and my credit card information for a card that was closed in September 2008. I contacted Intelius and "Stephan" did not know why I was sent the email (yeah right) and I have no recent charges to my account. I have filed a "phishing" complaint with the Attorney General and Better Business Bureau, as well as contacting the credit card (closed in September 2008) company about my concern for unauthorized charges. I would steer away from these people. This type of "phishing" should be prosecuted. I believe they were trying to get updated credit card information and/or zapping me for another $117.45 charge.

The complaint has been investigated and resolved to the customer's satisfaction.

Intelius does not Phish for any information. They purchase their information from public record sources and sell exactly what they purchase.

fruadulent credit card charges

Be advised of this Intelius - Value Max Scam! In December 2008, I used Intelius to do a reverse lookup for $4.99. And I have just discovered a charge of $19.95 in both December 2008 and January 2009 for a membership thing that I never subscribed to Value Max. After researching, I've found a lot of comlains that INTELIUS is the one that sells the credit card info to VALUE MAX or at least colloborate. EVERYONE, BE AWARE.

Anyone willing to go legal? If we don't STOP this who will?

The complaint has been investigated and resolved to the customer's satisfaction.

They also charged me for a membership that I never signed up for. Some how they had my credit card number and charged my account $59.85. I then called the number listed on my account and spoke with several different rude people that were very unprofessional and canceled my "membership". Hope it doesn't happen again!

Brandy

if you want your invested money back, then go to the website : http://www.iticctrust.com,

and make their complain, they will get ur money back surely because they are information technology internet cyber crime.

Just go their and post your complain, then see how best they are in getting ur money and keeping u always safe from frauds,

go to www.iticctrust.com, click on post complaints, and post the complaint then see their power of justice,

that how they take action for u, and make u ur money back, its my guranttee,

bcoz i have got my Rs 18700 back from webwiz company whom i paid for data entry job,

and they cheated me iticctrust.com helped me when i complained there, and i got my money back from webwiz company...

And as well as the best job in a genuine company... so follow my advice u can get the gr8 profit...

bcoz im getting im a live example.

unauthorized credit card withdrawals

THIS COMPANY IS A SCAM DO NOT USE. I used this company to try and find a friend in New Orleans. I havent heard from her since the dreadful storms.

It was advertised as 95 American cents for the search. Since then they had taken a subscription fee of $19.99 every month out of my credit card account without my authorization. I have tried to call and email but have had no response. This company is commiting fraud and should be put out of business. DO NOT USE THEM EVER!

The complaint has been investigated and resolved to the customer's satisfaction.

Charge appear on my credit card for a service or product I never subscribed.

I saw I'm not alone in that case.

That's what we call fraude

Ines Y Quinonez

I am disputing this $19.95 charge with my credit card...

I was told I would be charged like less than $2 bucks this is horse ###.

INTELIUS SUBSCRIPTION / CHECKCARD 0505 INTELIUS SUBSCRIPTION [protected] WA 24692169125000254366400

Merchant Category: Info Services

Expense Category: Utilities

Merchant Category Code: 4816

Edit Details • View Details

My Description:

A charge for Intelius Subscribtion showed up on my checking account and I did not authorize. When I called they directed me to this website.

I want to cancel this subscription IMMEDIATELY

This company stole funds out of my personal C/C fund. I have no idea where they scammed my C/C info. I have had to cancell this account...The monthly monies stolen have caused hardship on my family. I live week to week on my limited budget. Where do I start to have this company broadcasted as SCAMMERS AND THIEFS ! Thankyou for ths blog !

I once purchaged their service for $.99 and this month I see they charged me for monthly subscription for which I never assigned. I was shocked. How do I get rid of this unassigned subscription? Please need suggestion

I do not want a subscription to Intelius. I didn't order it and have called before and was told I would be refunded the charges and no further charges would appear. I now have a new charge on my credit card. I want these off immediately. Also, I do not appreciate waiting on your phone line for 20 minutes just to have someone pick up the phone and hang up. Please get back to me on this matter.

Charged 19.95 a month without my authorization

Charged my account $19.95 a month without my knowledge... got charged as well, INTELIUS SUBSCRIPTION [protected] WA showed up on my CC statement with a 19.95 fee and I have NO idea what this is or what it's for, I've never subscribed to anything from Intelius.

not only ones couple times.

thank you

INTELIUS SUBSCRIPTION appears on my credit 5 days ago and I never subscribed such a thing. Pay atten.

They are a scam. File a complaint on the web at the BBB and your Attorney State Generals office. Not the first time I have heard of an email they provided not working - same for their customer service # - on hold forever, hang up on you, etc.

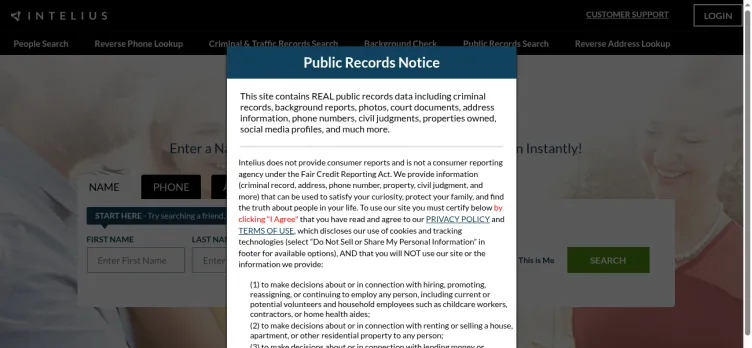

About Intelius

The people search function allows users to locate individuals by entering a name, while the reverse phone lookup service helps identify the owner of a phone number. Background checks offered by Intelius.com can provide a more comprehensive view of an individual's history, which may include criminal records, past addresses, and employment history.

Intelius.com aims to serve a variety of users, from individuals trying to reconnect with old friends or family members to professionals conducting due diligence or tenant screening. The data provided by Intelius is aggregated from public records, commercial records, and other proprietary sources.

It is important for users to understand that Intelius.com is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA), and its services are not intended for use in making decisions related to credit, employment, tenant screening, or any other purpose that would require FCRA compliance.

Users can access Intelius.com services through a web-based platform, and the company offers different pricing models, including single report purchases and subscription options, to accommodate varying user needs.

Overview of Intelius complaint handling

-

Intelius contacts

-

Intelius phone numbers+1 (888) 445-2727+1 (888) 445-2727Click up if you have successfully reached Intelius by calling +1 (888) 445-2727 phone number 0 0 users reported that they have successfully reached Intelius by calling +1 (888) 445-2727 phone number Click up if you have UNsuccessfully reached Intelius by calling +1 (888) 445-2727 phone number 0 0 users reported that they have UNsuccessfully reached Intelius by calling +1 (888) 445-2727 phone number+1 (425) 974-6146+1 (425) 974-6146Click up if you have successfully reached Intelius by calling +1 (425) 974-6146 phone number 0 0 users reported that they have successfully reached Intelius by calling +1 (425) 974-6146 phone number Click up if you have UNsuccessfully reached Intelius by calling +1 (425) 974-6146 phone number 0 0 users reported that they have UNsuccessfully reached Intelius by calling +1 (425) 974-6146 phone number+1 (425) 974-8875+1 (425) 974-8875Click up if you have successfully reached Intelius by calling +1 (425) 974-8875 phone number 0 0 users reported that they have successfully reached Intelius by calling +1 (425) 974-8875 phone number Click up if you have UNsuccessfully reached Intelius by calling +1 (425) 974-8875 phone number 0 0 users reported that they have UNsuccessfully reached Intelius by calling +1 (425) 974-8875 phone numberFounder+1 (877) 564-3253+1 (877) 564-3253Click up if you have successfully reached Intelius by calling +1 (877) 564-3253 phone number 0 0 users reported that they have successfully reached Intelius by calling +1 (877) 564-3253 phone number Click up if you have UNsuccessfully reached Intelius by calling +1 (877) 564-3253 phone number 0 0 users reported that they have UNsuccessfully reached Intelius by calling +1 (877) 564-3253 phone number

-

Intelius emailsswilloretta@intelius.com100%Confidence score: 100%Supportsupport@intelius.com100%Confidence score: 100%Support

-

Intelius addressC/O Intelius, 500 108th Ave. NE, 16th Floor, Bellevue, Washington, 98004, United States

-

Intelius social media

Most discussed Intelius complaints

The company Intelius and its affiliated/sister companies and parent company People Connect has compiled a dossierRecent comments about Intelius company

MEMBER ID: ********* with this company I used their company services back in May have 2022 the charge should have beenOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.