- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- UnReplied

- With attachments

drive time complaint and or

Drive Time in ABQ, NM was my last resort to getting a used vehicle, but now with my experience with them I never should have. iF THERE IS A LAWSUIT AGAINST THIS COMPANY, PLEASE INCLUDE ME IN AND CALL ME FOR MORE INFORMATION. I SURE LIKE TO GET BACK AT THEM.

THEIR CUSTOMER SERVICE IS REALLY VERY BAD, THEY ARE RUDE AND THEY WANT TO HAVE THE LAST WORDS IN EVERYTHING THEY. THEY DON'T GIVE YOU TIME EXPLAIN YOUR SITUATION ESPECIALLY AT THE ALBUQUERQUE OFFICE.

THEY CALLED MY OFFICE AND HARASSED ME. THIS LADY STARTED CALLING ME NASTY NAMES AND I TRIED CALMING HER DOWN BUT SHE WENT ON AND ON HARASSING ME.

broken car

I need it a bigger car for my growing family and I stopped the first dealer I saw, Drive Time. They sold me a Dodge Caravan 2005 nice looking from the outside. A month and a week into the account my car started to give me problems with the gasket. Took the car to the repair shop and to my surprise I had to pay 50.00 just for them to look at the car. They make the call to the warranty department and the claim got denied. I called and argued with them and the agreed to pay. Then I started to have problems with an oil leak again take the car to the repair shop and got denied, this time they say they would no cover the damage. Now I have an oil leak, a light sensor on and my car gets over heated as soon as I'm 5 minutes on the road. I went to see the manager and he said there is nothing he can't do about it, called customer service and they can't do anything about it. The warranty department won't pay for my repairs either. The sad part of this story is that I only had this car for 3 months!. Drive time is a nightmare.

The complaint has been investigated and resolved to the customer’s satisfaction.

Purchased a 2008 Saturn. Needed front end alignment, I was told to do it under warranty. Took the car in 1 week after purchase and found out all 4 wheels were bent. Repairs denied. They are telling me that we hit something. Now we are 2 weeks into the contract and the car is dead. Told to have it towed to a shop 13 miles away and that they would only cover $75 remember only had car 2 weeks. Was told that it would have to be diagnosed to determine if it will be covered under the warranty. Told that since it was under 30 days that they TRY to take care of customer. Was told by lot that we could bring car back and they would cancel the contract but that we would not be able to get another car because the warranty department probably would not ok another sell. Since when does a warranty department have the say as to who can and who can not buy a car? My son is in the military and he has to have a car to get to his next duty station and after today when the warranty department comes back and says that nothing is covered we will have to much money invested in this piece of ### car to give it back. DONT BUY A CAR AT DRIVETIME BECAUSE AFTER YOU LEAVE THE LOT IS NOTHING BUT A RUN AROUND AND THEIR WARRANTY IS NOT WORTH THE PAPER IT IS WRITTEN ON!

bait and switch

I applied for a loan on their website. 5 minutes after applying I received a phone call stating that I was approved for a loan on a car. I had told the person who called the I only had $500 down payment. I was asurred that was enough and that they could put me in a car. 2 Days later I paid $20 to take a taxi to get the the showroom. While there I decided to do the financing before looking for a car. I had all the paperwork with me that was required. While there I was introduced to the credit manager and he said $500 should be plenty. Well he did the numbers crunch and guess what? Now they wanted $900 down payment before I could even look at a car. I came up with $860 for the down payment, taking every penny I had on me at the time. I asked if we could find a car, and give me 20 minutes to go and get the other $40.00. I was told no! Well I left the lot, again having to call a Taxi. I went to another car lot and bought a car. After I got home the credit manager had the nerve to call me and asked if I was still interested in one of their cars. When I told him that I was upset over the $40.00 difference he said that it was the computer that told him he could not accept anything less then $900. I told him that I only needed a car (to get to the bank) and I would have had the other $40.00. He said he could not let a car off the lot for less then $900. Again he blamed the computer. I told him that I wanted nothing to do with him or Drive Time. He actually told me that if there was anything they could do in the future to help me with a car to call. You have got to be kidding. I would never do business with them again and encourage people to stay far away from them. I read the other reviews on the internet but still thought I would give them a chance. Boy was I wrong. If they would not budge on $40.00 for 20 minutes, I don't think they would understand any other circumstances that could cause a person to be 20 minutes late in a payment. Don't do business with them. I personally went to a "mom and pop" dealer who was more then willing to help me out and with only a $500 down payment. Oh by the way, the car I got was only 12% interest and Drive Time wanted approximately 33% interest.

The complaint has been investigated and resolved to the customer’s satisfaction.

i AGREE THEY ARE DEFINITELY UNPROFESSIONAL. i ATTEMPTED TO HAVE PAYMENTS DATE CHANGED FOR OVER FOUR MONTHS.

aNY IDIOT KNOWS THAT THERE Is A DIFFERENCE BETWEEN SEMI-MONTHLY AND BI-WEEKLY. SUBSEQUENTLY MAKING PAYMENTS

THAT SHOULDL HAV CHANGED HOWEVER IN THE INTERIM IT MADE IT appear that I was late on payments

please contact me at xxshyne2002xx@aol.com

After reading all of the complaints I am so glad drivetime did what they did to me. I went to drivetime in conyers georgia, and the sales guy was so rude to me. When I called and did my information over the phone the sales guy said I would need a 400 dollar down payment, so I was so happy about that. I go up there the guy that I had spoken with on the phone I did not get a chance to meet with because this other sales guy was so pushy that he forced me over to his office. Once this guy saw my income he literally got up from his chair and left while I was still sitting there. He wanted me to put down 2000.00 plus have a monthly payment of 423 dollars. He suggested that I get a co borrower. I was thinking this is just like a real dealer ship, there is no difference. I am so glad that I read the complaints. Thank you to everyone who posted you really helped me out, because I thought about going back. Everyone sometimes have a situation that causes you to be late, and you don't need knowone down your back every second of the day. Again thank you so much!

repairs on car

I bought a 2006 Chevy Colbalt from Drive Time Feb. 1, 2010 and had a week and had to take it to one of their repair shops in Haltom City only to have them tell me that they could not fix it. So I had make an appointment with their main shop on Blue Mound Rd to have it fixed there. About a month later the clutch goes out and I take it to the same repair shop in Haltom City only to have them tell me it is gonna cost over $1400 to have the clutch fixed and Drive Time was not gonna cover it. So I took it somewhere else to have it fixed for less then what they were gonna charge me. Only to have something else go wronge with the car.

I have called the Warranty Department and have called the manager of the Dealership that I brought it from. All I want is for them to make it right. Which they have not done. So now I am at the point were they can have the PIECE OF CRAP that sold me back. This place needs to be exposed for what they really are SCAMMERS!

The complaint has been investigated and resolved to the customer’s satisfaction.

I'm having the same problems with my car..I just buy a 2004 Nissan Altimia. The first day I had 2 buy a tire for the car..They don't want to pay my out expense for the tire talkie about normal wear and tear..No sir not if I haven't had that car a day good..Now the light to check the engine is on and the part cost a lot..I should went ta Dealership to get me a car..Then they have the nerve to transfer my call back and forth to warranty to payments but you no what I'll put up with bull.This is my first and last car from them.Deferred my payment but I'm still paying for the repairs. I haven't even gotten tags for the car yet but can you say trade in a year time or lawyer. a

I BOUGHT A CAR JANUARY OF 2009 AND HAVE HAD NOTHING BUT PROBLEMS FROM TWO WEEKS OWNERSHIP. AT TWO WEEKS OWNED BY ME THE CAR NEEDED ROTORS, AND THEN CHECK ENGINE LIGHT CAME ON AFTER MY WARRENTY WAS DONE AT 6 MONTHS AND I REPLACED THE EGR VALVE, MASS AIR FLOW PUMP, MY A/C MOTOR INSIDE THE CAR SOUNDS LIKE AN AIRPLANE TAKING OFF, AND CHECK ENGINE LIGHTS ARE A PART OF MY LIFE WITH THIS CAR (ALWAYS ON NO MATTER WHAT) NOW THEIR TELLING ME I HAVE A VACCUM LEAK AND IT IS EXPENSIVE TO FIND.

WHEN I CALLED DRIVE TIME TO TELL THEM THAT THE CAR I NEEDED TO BE DEPENDABLE ISN'T AND I NEED MY FAMILY TO BE SAFE AT ALL TIMES, THEY TOLD ME TO CALL THE WARRENTY DEPT., SO I DID WELL THEY DON'T WANT TO DEAL WITH ISSUES AT ALL BUT IF YOU GIVE THEM THE PAID REPAIR ORDERS THEY WILL NOT TAKE CARE OF THE BILL BUT DIFFER YOUR PAYMENTS TO THE END OF YOUR LOAN. SO TECHNICALLY THEY THINK THEY ARE HELPING YOU BUT YOU ARE STILL PAYING FOR THE REPAIRS AND YOU CAR PAYMENT TOO JUST AT A LATER DATE. WHEN YOU PAY $16, 000 FOR CHRYSLER PACIFICA 2004 YOU EXPECT IT TO RUN EXCELLENT FOR ALONG TIME. THE ISSUE WITH THE ROTORS, MY CAR WAS DRIVING ROUGH AND WHEN I TOLD THEM ABOUT IT THEIR SOLUTION TO THE PROBLEM WAS RAIN PUDDLES AND THEIR MECHANICS AS WELL, WELL OKAY BUT CONSIDERING I HAD BOUGHT THE CAR WHEN FLORIDA WAS IN A DROUGHT AND IT HADN'T RAINED IN SEVERAL WEEKS AND NOT WHILE I HAD OWNED THE CAR FOR TWO WEEKS, IT SEEMED A BIT IMMPOSSIBLE... SO ANYWAYS THE SO CALLED MECHANICS THAT THEY SENT ME TOO REPLACED THE ROTORS WHICH I DON'T BELIEVE THEY REPLACED THEM I THINK THEY MAY HAVE RESURFACED THEM. I REALLY WANT TO LET THEM KNOW WHAT PROBLEMS I AM HAVING AND REALLY STICK IT TO THEM. I ONLY WENT THERE CALLED CAR DEALERS MAKE IT SO HARD TO BUY CARS NOW DAYS AND MY VAN'S WHOLE GAS SYSTEM WENT AND I NEEDED TRANSPORTATION FOR MY KIDS TO SCHOOL ETC. SO HERE I AM 15 MONTHS OWNERSHIP WITH THIS EXPENSIVE PIECE OF CRAP AND I AM ALWAYS IN THE SHOP WITH IT (CHECK ENGINE LIGHT ON AGAIN), GOING TO SHOP TUESDAY FOR CHECK ENGINE LIGHT (LOOKING FOR A VACCUM LEAK)... i HAVE EVEN ASKED DRIVE TIME FOR THE NEW PURCHASE WARRENTY ON CARS 36 MONTH WARRENTY INSTEAD OF 6 MONTHS AND IT COVERS WHAT WRONG WITH MY HUNK OF EXPENSIVE JUNK. BUT THEY SAID THEY COULDN'T CAUSE IT'S ONLY FOR NEW CUSTOMER PURCHASE. THEN I ASKED THEM TO SWAP IT FOR ANOTHER VEHICLE A NEWER ONE WITH MAYBE LESS PROBLEMS AND THEY SAID I HAVE TO WAIT TILL I OWE ABOUT $3500.00 ON THIS CAR BEFORE I CAN TRADE IT IN WITH THEM. WOW THEY HAVE A ANSWER AND A SOLUTION FOR EVERYTHING. SINCE I HAVE PUCHASED THINS CAR PEOPLE HAVE TOLD ME STORIES ABOUT UGLY DUCKLING CAR SALES AND DRIVETIME CAR SALES...

AND THEY THINK I GOT STUCK WITH A LEMON... AND I DID! I BOUGHT THIS CAR ON 441 OR PINE STREET IN OCALA FLORIDA ACROSS FROM AAMOCO THEIR MECHANICS WHO ARE JUST AS CROOKED AS THEY ARE.

predatory lending

This company drives on predatory lending..that get you in with everyone is approved but they sell cars that are not worth what they are selling them for and they have interest rates that are out of this world. The constant harrassment for one day late payment is crazy. All of their cars have problems from suspension to transmission. When you take the car in you have to pay $50 for them to check it out only for them to tell you nothing is wrong with it. They need to be stopped! I own a 2005 Ford 500 and it's only worth $5, 000 but I owe them $20, 000. Is this not predatory lending!

The complaint has been investigated and resolved to the customer’s satisfaction.

You can only blame yourselves. You didn't research the car you were buying, you agree'd to the price, if you didn't like it why did you buy it. If you are going to drive time chances are your credit is junk. They know this, you know this. They know if you want a car, they are prob one of the few chances you will have to get a car that is not 35 yrs old. Don't like it, don't buy it. I keep laughing at people that pay 3 times the cars value, then complain about it like they had a gun to their head.

Wise up, its your fault and no one elses

Tony Judd!

I read your complaint and others about DriveTime being a scam. I'm so disappointed, I need a car really bad, and I am ready to go look at what they have here in Charlotte, NC. I will confront them, and see what they say.

I met someone else who purchased a car through them, here in Charlotte, she seemed happy.

Disappointed,

Cyd33

I agree with the first comment. I bought a 2004 Chrysler Sebring which is only worth about $4, 000. Drive Time sold it for $13, 000 and let us not forget the $7, 000 interest I was charged at almost 22%, which comes to a total of $20, 000 for a car that I can't even get $1500 for in a trade in! Yes, they helped me get into a car, but I am paying out the bazooka for it! My advice is to try to stay on top of your credit so other companies won't get to do this to you again!

We purchased / 2/cars, and had problems with both. I live in Durham, NC. If you would like to email me back and talk about the high interest rate and what can be done. I am ready. I am a praying person, and don't believe God is pleased with this! Lets talk. Email me back if you would like to talk further. tonyholloway48@yahoo.com

faulty information

Complaint starts with the company stating that they do an inspection of every vehicle that comes through their lot. I purchased a $17, 000.00 GMC Envoy through Drivetime on 1/30/10. It all seamed to be in working order at that time. 1 day later I had to drive the vehicle at night. It was then that I noticed I could not see half of the buttons on the radio...

Read full review of DriveTime Automotive Group and 1 commentdo not get a car there

IF YOU NEED A CAR AND YOU SEE THERE COMMERCIAL APPROVED APPROVED APPROVED! DONT FALL FOR IT UNLESS YOU WANT TO PAY HIGH PRICES ON A CAR THEY PUT YOU IN THAT YOU DONT PICK OUT A CAR THAT YOU THINK WILL WORK THE 4 YRS YOU WILL BE PAYING ON IT! THE DAY YOU SIGN YOUR NAME ON THAT GREEN BOOK AND WALK OUT WITH THE KEYS IN YOUR HAND YOUR SCREWED! YOUR LUCKY IF THE CAR WILL LAST YOU A MONTH.. YOU WILL SEE MISSED PHONE CALLS FROM A [protected] EVERYDAY EVEN IF YOU HAVE MADE ALL YOUR PAYMENTS ON TIME.. AND THEN GUESS WHAT THEY WILL CALL EVERYONE YOU PUT ON THAT REF. YES EVERYONE UNTILL THEY GET A HOLD OF YOU.. THEY WILL TELL THEM ITS VERY IMPORTANT SHE CALLS US BACK IN 24 HRS. THEN YOU CALL THEM BACK THEY SAY OH WE JUST WANT TO SEE IF YOU WANT TO POST DATE A CHECK CUZ YOU HAVE A PAYMENT COMING UP! LMAO BYE THEN YOUR PISSED OFF.. YOU CAN SAY NO THAN THEY WILL ASK YOU WELL HOW ARE YOU GOING TO MAKE THIS PAYMENT? YOU HAVE TO EXPLAIN HOW YOU DONE IT FOR THE PAST MONTHS WALK IN A PAYMENT CENTER! HUM WILL YOU THINK ITS OVER BUT HELL NO THE NEXT DAY THEY WILL REPEAT ON THE SAME THING CALL YOU UNTILL YOU PICK UP THE PHONE! ECT... THIS IS A NONE STOP THING! SOO NOT WORTH IT I WAS SHORT 8 DOLLARS ONCE AND THEY CALLED 20 TIMES A DAY.. SO UNREAL MAKES YOU WANT TO DRIVE THE CAR IN A LAKE! DONT GET A CAR FROM THERE EVERYTHING THAT PEOPLE HAVE POSTED IS TRUE.. THEY ARE A SCREWED UP COMPANY!

The complaint has been investigated and resolved to the customer’s satisfaction.

I am so with you on this! It is a shame that when your credit is not just perfect, you have to go and get a car (due to unforeseen circumstances), and you pay the HUGE deposit AND a trade in and still making bi weekly payments, NOT monthly and it just places you in a desperate situation! You have no car, you have a great job, and you need a dependable car! Those were my circumstances! However, I did not realize how much I was paying until I get the paper work home...(which they do not go over with you before you sign!), and I was just FLOORED! I thought, how in the hell am I going to afford this! I did make my payments, on time and then I became sick and was out of work for about 6 mths drawing short term disability and their customer service did not even care! " Can you borrow it from a family or friend?" NOT! So...after the 2nd past due on the car payment, I received a letter of repo! I called them up and told them to come and get it! It took them TWO months to pick it up! Tacking more payments and interest. Finally when it was done, I received a WONDERFUL BS letter telling me that they sold the car at an auction and received $2800.00 for it! Leaving me on my credit a balance of $6688.00! Please be fair warned! They are not out to help you with nothing! Hell I wish I would have never walked in to that place of business!

harrassment

OMG! DO NOT DO BUSINESS WITH THESE PEOPLE! They prey on people. My daughter's car broke down so she needed a new car. She was in college and had no credit built up so she bought a 2004 Dodge from them. Unfortunately, had no choice but to accept the loan at 24% interest ~ can you say vultures? Anyway, had car for 18 months, still owes 2+ more years ~ car...

Read full review of DriveTime Automotive Group and 11 commentswrongful repossesion/illegal repossession

On August 17th of 2009, in TX, Drivetime/Santander repossessed my Tahoe in a VERY violent and illegal manner. After being phyically injured (thrown across my vehicle while trying to remove a child safety seat), treated horribly, and leaving me with extremely emotionally to the point of PTSD, I've decided to move forward with legal action, in hopes of...

Read full review of DriveTime Automotive Group and 16 commentsscam

I was a first time car buyer and had been turned down at a biger dealer. Me and my mom desided we would try drivetime they advertised that they approved just about anyone and they do just so they can screw as meany people as possible. I purchased what i thought was the cutist car on the lot a 05 Suzuki Forenza, they presented me with a car fax stating there...

Read full review of DriveTime Automotive Group and 4 commentslack of customer care/assistance

I have been dealing with DriveTime since 8/06 and until this past Oct. 09, things were fine. Due to Tucson City Court "auditing" their records June 08 and finding supposedly "outstanding" tickets for 1994/95/98, I had my vehicle impounded by Police and DT Corp retrieved it and took my vehicle to Phx for storage. I told Corporate that I wouldn't be able to get my suspended license back til Jan 2010. They said they want to "help" me but it has been a pain in the #*s for last 4 months. The non-communication between coporate and dealership in Tucson is appalling, not to mention fustrating. Corporate kept insisting on me "Just find a friend to be put on your loan w/valid license", all my family is back east or NW and to ask a friend to be put on your car note is just rude. Out of pocket and in full $458 had to be promptly paid in Nov 09 (they deferred truck note for single month) and resume note in Dec. This month I spent entire S.S. check reinstating license, paying fines and truck note meanwhile doing ALL the footwork for corporate and dealership. I asked dealer if they could bring truck back to Tucson since I got impounded there, they stated..."Thats not our responsibility"-WTF!?! How the heck am I supposed to go get my truck in Phx if you have the vehicle? again, Just find a friend to take you is all they were willing to say or do. Recently DT Corp tells me they will not go on and on with this matter and if I'm not able to pick up truck by Jan. 15th, the 16th they will put up for auction-WTF! As of this very moment I have fullfilled my end as far as jumping thru hoop after hoop and they still have not released the vehicle because of a fax that DT Corp says has not gotten-I have coversheet that says successfully delivered to them 1/14/10. The auction place holding truck is only open 9-11am today and it is 2hr drive from Tucson and can't cal Corp til 8am and dealer opens at 10am so what now? I have hustled up a ride from neighbor, got valid license and another friend on loan so I can register truck (due to hold on registration by Court). There is a whole lot more bulls*&%t I have not mentioned that DriveTime needs to be accountable for and resolve...pls contact me @ [protected]@gmail.com ASAP, yes I'd like to join lawsuit. Thanx Elena

The complaint has been investigated and resolved to the customer’s satisfaction.

"HORRIBLE, DECEPTIVE, LYING, MANIPULATIVE, AND UNPROFESSIONAL" all describe the types of customers that finance vehicles with DriveTime. The words of "Listen2Experience" perfectly represent the customers, not the company.

DriveTime caters to people with [censor] credit. People that rent furniture, pay bills at Wal-Mart, cash checks at the liquor store, religiously play the lottery, etc... These statements aren't race exclusive.

Grow up, pay your bills, and shop at reputable dealerships.

This is so very sad and I'm sorry you have experienced this headache. Drive Time is a HORRIBLE, DECEPTIVE, LYING, MANIPULATIVE, UNPROFESSIONAL COMPANY in my opinion.

PLEASE LISTEN TO THIS COMPLAINT AND STAY AWAY FROM DRIVE TIME! They are only out for themselves and not the consumer. They will call and harass you, your family and friends constantly even if you are ONE day late. They are like finance company MAFIA!

sold me a lemon

first car i bought they wanted $1000 down then changed it to $1200 down. not many problems until after it was paid off. a 1993 pontiac gran prix that i overpaid $13, 000 after interest. then i traded it for a 2003 mercury sable that they charged me just about $19, 000 that has been nothing but problems after the first year a lemon that i am paying more than...

Read full review of DriveTime Automotive Grouptheir sales and fowlowing state and federal laws

I am in the military and my husband and I had purchased a 2006 chevey colbalt from them it was good I was on a military program with them and every thing was going great until my car was totaled in a car accident that I was not at fault for. It was paid off and I also had gap insurance, so we went down to get put into another car of same value. They did not tell us we were going to still have to pay a down payment, that they had to run our credit again, and that it was going to be for a vehicle of lessesr value. We were nput in a 2001 Mazda 626 and when we test drove it there was nothing wrong, but the day wer drove it home there was numeras problems we contacted them requesting them to fix it they sent us to a brke specialest and the problems had nothing to do with it and also wanted us to pay for any repairs that were under the warrenty. We argued for 3 months then i finally took the car to them and said im not paying for a car i cant drive they then procceded to tell me that they would do whatever they could to help and get me to keep the car well needless to say we didnt take the line of bull. So to end it all they are required by texas state law and federal law to notify me when and if they are going to seel the vehicle to give me a chance to buy it back. They did not they did send me a letter notifing me that it was sold at auction for 3900 and now it is being reported on my credit that I owe them over 8800. So please add me to that list I want everyone in the military to know dont go to drive time they are just a bunch of scam artist.

The complaint has been investigated and resolved to the customer’s satisfaction.

F Wells

VERY WELL SAID!

Some attorney you are! you simply don't get it do you...it's easier said than done as far as that crapy contract because you can buy the lot probably. They are still taking advantage of poor people and it has to stop..It is predatory lending in the fullest and you're to stupid of an attorney to see that innoscent people are getting ripped off..What you don't know is that they give you a spill when you are signing the contract and they get people when they are anxious and feeling good about being able to buy a vehicle so does this give them the right to sell TRASH and charge prices of a Luxury vehicle? You do the math..Mr. expert!

Holy crap people. Do you not read anything before you sign it? the contract that YOU signed, stated all of this. I am a lawyer and got very interested in this, until i read DTs contract that every customer reads and signs before buying a vehicle from them. and guess what genius. It states that there is a 6 month POWER TRAIN Warranty, which does not cover brakes. also the "Total Loss " program that DT offers states there is a $500 participation fee. also of course they are going to run your credit again, because you are financing a different car from them. so if you didn't like the Mazda, you should not have bought it from them, by signing the contract with them YOU agreed to the limited warranty they offer, YOU agreed to the price and YOU agreed to pay it off. so by giving it back, YOU DO owe them the balance of the car, and it should be on your credit, so other dealers see that you like to play the victim and don't pay your bills.

freudulent company

Unfortunately I have to say that I am part of the Drive Time's victims. I putted myself in the middle of a nightmare, by buying a car from Drivetime. I am the kind of person that value time as a treasure, working 14 hrs. a day and assisting to university too, I don't have time for this mediocrity. So, I have to let others know the kind of bussiness they are. I bought an SUV from them in July 24th of 2009 and from day one I confronted problems with the vehicle. To begin with, the fuel gauge on the panel won't work, which I couldn't notice before buying it, because the vehicle was even marking empty when I saw it. After that, the next morning when I went and moved the car from my garage, I saw an oil leak on the floor. Another problem with the SUV. This problem itself have brought me twice to the mechanic shop in less than three months. Now, the power windows started to act out, and the driver side got totaly stuck half open, not going down neither going up. the passenger side is probably soon getting stuck too. As if this were enough, the transmission is giving signs of problems now too. I called trying to reach a reasonable deal to change the vehicle for another one in better conditions, but they are totaly stucked on the the warranty is there for that reason. But, I don't buy a used vehicle, which I'm going to pay as new price, for being in the shop every week, month, or so; not to mention all the money involved.

Drivetime you are a REAL SCAM! Very UNPROFESSIONAL! HOW DARE YOU TO BETRAY CUSTOMER'S TRUST! You are the kind of bussiness that never should have been in the market! I'will make sure this doesn't happen longer more, sooner or later!

The complaint has been investigated and resolved to the customer’s satisfaction.

It surprises me these Aholes are still in business. I am up date on my payments- have been for 3.5 years and STILL get grief, threats and haraasment from them. My last payment was $30 low, due to misunderstanding between my husband and I. They called me every day approximately 8-10 times a day until I made up the difference.

[censor]. I regret every dealing with them. As I come up to the end of the contract I CANT WAIT for them to try contacting me to upgrade! AS IF.

Would love to know if anyone else is filling complaints about the collection practices.

harassed and threatened

I am so appalled at this company, for starters as anyone who has purchased a car from drivetime you know that they have you so upside down in a loan and at such a ridiculous rate that you will never be able to finishing paying but since your credit is less than desirable they have you, more like they prey on you.

My husband is active duty and because of this I had to leave my job causing a significant loss of income, I explained this to them every time they call which was twice a day but this time they have gone too far, I answer the phone to explain that I will either be returning the pos or i have a friend who may be able to take over my payments after explaining a resolution to the said debt she then proceeds to ask me why I haven't been paying, again after I explained why. We began discussing SCRA and she tells me to have him add himself to the loan, I explained to her that I wasn't able to because he was away at boot camp and even if we did I wouldn't be able to continue paying, this woman has enough nerve to tell me she will be contacting his commanding officer about my personal debt, because this doesn't look good for my husband.

I was so upset, that I called drivetime to lodge a complaint and the woman on that end ask me what I thought they would do, that they would be following up and reporting this to his commanding officer! I was so furious, I told her that is illegal that she cannot contact a third party about this debt and she told she could and would, that I needed to get my facts straight, I then explained that he wasn't even on my loan and it was drawn prior to marriage, this woman then says that I was correct that they couldn't do that.

The frustrating part is that violates the fair debt collecting act on many levels, she cannot contact a third party regardless if he was on my loan or not, and who is so disrespectful to threaten someone with that.

This company should be sued and shut down for their behavior and loan sharking!

I have filed a complaint with every possible company, I suggest you all do the same, so something can be done about this rip off joint.

The FTC complies complaints to build a pattern of bad business practices against a company then takes action.

Fair Trade FTC.gov

Better Business Bureau www.bbb.com

Attorney Generals Office naag.org

Florida Office of Financial Regulation flofr.com

And I am still not done, I have never been so embarrassed and offended. The worst part is I wasn't arguing with them about the debt or trying to fight, I was trying to resolve the matter and this is the treatment that I received.

The complaint has been investigated and resolved to the customer’s satisfaction.

Your friends and family were listed as references so they can call them all they want. And your husbands commanding officer was listed as his boss they can call him too.

I agree! My husband has been in the hospital for two weeks (he's still there!). We got behind on our payments and they are calling a zillion times a day AND calling my friends and family.

They called today and left a message that they would be able to offer some assistance. I made two payments last week. I called her back (Irene) and she says, nope, I just needed you to call back! When I challenged her about lying, she said, "I'm just not going to get into that with you."

These people are unethical, unprofessional and probably breaking so many laws. They are the WORST car company I've ever used and I will NEVER use them again. PLEASE DON'T BUY FROM THIS COMPANY, you will regret it!

excessive harrassment

If you are late one day with your car payment.. no matter the reason... Drive Time will repetitively call every person on your reference list. They have made my life and the lives of my family and friends a living hell!

If you are on time with your monthly payments .. Drive Time will repetitively call you to remind you that you have a payment due. Drive Time calls this a courtesy, but it is still another form of harrassment!

DO NOT DEAL WITH DRIVETIME! UNLESS YOU WANT TO BE HARRASSED ALONG WITH YOUR FRIENDS AND FAMILY!

The complaint has been investigated and resolved to the customer’s satisfaction.

Popfts

Again I have to say the Drive Time you deal with must not be in the state I live in. My son needed a car because he worked two jobs and the motor blew in his previous car. Due to an extended hospital stay he had some credit issues. He saw a car he liked it drove great during his test drive. A week later the transmission went out, so he went without it for 3 weeks. Then the clutch went out which was not covered under the limited warranty. So it came out of pocket. My son brought the car to me when he left for basic training along with all the paper work. I looked the car up on KBB which had the dealer price on that car listed at $6, 000. The sticker on the window which he kept said $12, 000 so they charged him almost double the value of the car along with a 21% interest. Hell why not rip off a 22 year old just trying to make a living! Under the Soldiers and Sailors act If a person earns less money in the military than they did as a civilian, its mandatory that all loans and credit cards they had prior to joining the service can not have an interest rate any higher than 6%. Drive Time refused to lower the interest rate although the were very insistant that they fully understood what the Soldiers and Sailors Act was. They don't care about people, they over price their cars, give people payments they know they can't afford because they know they can repo the car and resell it. I was glad that my son got stationed outside of the U.S because under the Soldiers and Sailors Act if they get sent out of the country or deployed they can give the car back to the dealer with out any repercussions on their credit report.I have to say that the Drive Time here paid out some good money for not dropping the interest rate. Maybe the one you deal with is a good dealership. But the one here is nothing but legal loan sharking.

For Commonsense254-

Actually they do call you even if you make your payments on time. If you pay biweekly they call once a week to see when your coming in to make your next payment. Which is none of their business as long as its paid by the due date. My son always paid his payments on time. He even set up automatic payments when he joined the Air Force and took Drive Time a copy of the allotment to put in his file. They knew they would receive a payment the 1st and 15th of every month per a government allotment. He left them his information regarding when he was leaving for basic training, where is was going for basic training and how long he would be in school after basic training and where the car would be while he was gone. Drive Time called him every week to see when he would be coming in to make his next payment. After the first 3 weeks when they couldn't reach him they called me on my cell and at work every week and if they got my voicemail they continued to call till they reached me. You think its right for a company who has received every payment on time for over year and has on their computer and in a file the exact days they will be paid to call someone while they are in training to serve this country? I will tell you that the Fair Credit Reporting Act and the Dept of Defense did not and Drive Time paid a hefty fine!

You agreed to them calling your references when you filled out your finance packet with them. what are you whining for.. If you paid on time, like YOU agreed to in your contract you would not have this problem. Drive Time is one of FEW "Bad Credit" car dealers that actually helps people. they warranted your car, the did not sell you a lemon for twice its value at 80% interest. maybe before you bash a company who has done NOTHING THAT YOU DIDNT AGREE TOO, You should read your contract and make your payments on time.

First things first... If you pay your payment on time they will not call you. They only call your references if you do not answer the phone. DriveTime is always willing to help you, if you keep the lines of communication open and let them know whats going on. As for the people that are upset about reposession after the first payment being late... The managers state, at the time of sale, how important it is to pay the first three payments on time for that reason. It automatically puts the vehicle out for reposession if the customer is delinquent on the first payment or if the down payment bounces unless you can prove that it is a bank error. Any company does this! Nothing is free! If you get something you have to pay for it! If you dont make your payments, what company wouldn't call! If you know of one that is selling things and you don't have to pay it back let me know because i will be all over that!

I am in the same situation. Is there any way to stop them from calling my references?

lies to customers and takes advantage of people needing second chance financing

I had purchased a car from Drivetime in April 2008 and made every payment on time, and of $202.02 bi-weekly because of my bad credit! In June 2009 I called and spoke with Drivetime's finance company-DT Credit Corporation to notify them I had been laid off and was looking for work. I should have know from that moment on this would be an awful experience! The Manager said that because my account was in good standing and I had always paid on time, she could not help me.

2 weeks after that I found work and by this time DT Credit Corporation Collection Representatives were calling. Eventhough I was out of work for only 3 weeks I got majorly behind on all of my bills. Also, my husband quit recieving commission so we lost most of our household income for our family of 5. From June to August 2009 I would recieve 2 phone calls a day and so does my husband from there collection reps threating me with repocession and talking to me like I was a dog, like that kind of behavior will make me pull money out of my wallet that I dont have.

Between my husband and myself DT Credit Corp. Collection Reps call us 4 times a day! Once to me and my husband around 9am when they first open and then they call us both again around 5pm before they go home, like in between that time I've managed to come up with an extra $1500? Thats harrassment!

I went to the dealership and decided I could not afford the car and I would return it, despite the reprocussions of having a voulentary repocession on my credit-my 3 boys eating was more important. The Manager at the dealership said there was no one there that could help me and that they just sale cars here. It was funny because this same Manager was the guy who was so nice, helpful and kind when I went into there dealership 1 year ago and bought the car, just like a sucker! He gave me the phone number to collections, which I called and worked out a payment arrangement with a Collections Manager. If I made a $202.02 payment in good faith, she would defer my 2 months past due (in other words give me a payment extension to make me current where the 2 months past due would be added to the end of my loan with them) I had to waid until that Friday when i got paid and I called in to make the payment and a different Manager told me that because of the ways there billing periods worked that I needed to hold off on making my payment that day, but to call back the very next day to make the payment, that way I would qualify for the payment extension and it would give me an extra week to make my next payment and that she would note on my account to wave the $10 or so they charge to do a check by phone. The very next day at 11 am I called in to the same Manager who was off that day, but the guy who answered said that he couldnt wave the check by phone fee, so I was upset, but since I wanted the extension so badly I went ahead and bit the check by phone fee and made an extra $25 to my standard payment making it a total of $140.00 or something like that. He went over all the payment extension information and got my fax number and email to send the papers to sign and fax back.

4 days went by when the guy called me back and told me he was sorry but the Manger who promised the payment extension made a mistake and that because I had not made 6 payments within a 90day period I was not elidgable for the payment extension. Which remember, in June when I was first laid off I knew I would have problems with the car payment and I asked them to help me which they refused to do and keep in mind I paid the last 1 1/2 yrs on time without any problems! I was furious, because by this time I was $800 past due and with all the utility bills, other car payments, healthcare expenses for 5 un-insured people, and food for 5 there was no way I could catch that up and pay my regular monthly payments of $404.04!

The other day the collections people called my cell phone, which I had left with my 10 yr old son while I went to the hospital with my other child and the collections rep thought she was talking to me and cussed out my son and also said he was lying. This rep used the F--- word!

I had fraud on my checking account which made my checking account overdrawn and I bounced a check because Wachovia was investigating the transactions so they called my work and threatened me over $87.00. Over the last 4 months I talk to atleast 2 reps everyday who either agree with me after reviewing the notes on the account and they apologize, or they continue to lie to me over and over. They cuss, they yell, they are just awful! Sad thing is I also have a car with Americredit and all I did was call 1 time and ask and they helped! With Drivetime it is like pulling teeth! I dont avoid there calls either! If I miss there call and they get voicemail, I dial them right back and tell them I am sorry but Im at work. I keep in constant communication with them and even have made all my payments the last month in a half, so its not like I am dodging them! And all these promises of extensions and help have been thouraly noted on my account information so its not like my word vs. theres, they just flat out lie and then say they are sorry there is nothing they can do, "When can you make your next payment", and every day I have to tell both reps that call me that I get paid on the 1st and the 15th, my paydays do not change so quit asking! I take about 45 minutes of my work time to talk to them and also even went to the Emergency Room because after the rep talked to me harshly and cussed and threatned me for 20 minutes, I had an terrible anxiety attack and passed out from the stress of it all! I know its not worth it, and you would laugh when I tell you I really dont need the car, I have 2 that are paid for that just sit in my drive way, but because they did sell me a wonderful, dependable car I do want to try and work with them to keep it so I have something reliable to drive my 3 children to and from school in! I am sure DT Credit Corp. is suffering along with all of America during these hard economic times, but come on...when your willing to pay and you just need a little help getting back on your feet a company needs to be able to work with you, otherwise they will end up just loosing money if they repo it and it just gets sold in an actution.

I am now $1500.00 past due and have been making my payments of $202.02 on Aug 1, Aug. 30 and Sept. 15 and they still have me as 59 days past due and have now referred me to a repo man. I have called and talked to manager after manager and went up to the dealership and emailed the corporate office 3 times to get some help. I am not asking to skimp out on my financial obligations, just to move my past due amout to the end of my loan. I had all the nessisary paper work to prove I was laid off and that now I make 1`/2 of what I use to make, my husbands pay was cut with him now not getting commision, and my X husband quit paying child support. I have robbed peter to pay paul and now paul is broke! I have downsized and pawned valuables in my house just to be able to put food on the table. At this point since Drivetime refuses to work with there customers they can come get the car!

The complaint has been investigated and resolved to the customer’s satisfaction.

Hey sgfsfsdf, don't be an [censor]. Bad things do happen to good people. The problem is, that greedy [censor] companies like DT have no common sense or compassion. People work hard for what they have, and when hard times fall companies like DT need to understand that harassing phone calls and threats do not help matters in any way. I understand that in todays business everything is run by computer, and that companies have lost the ability to think for themselves. That they must abide by what some machine is telling them other than using common sense. If it were the case that people instead of computers were making decessions, and that a person actually looked at a customers history with the company and that customer had been in good standing until tragedy struck the compassionate thing to do is work with the customer and set up an arrangement they can afford, otherwise your pissing in the wind. That is only common sense. It is a shame that I had to explain what compassion and common sense means, and how it works, get off your computer and go make some friends.

TO ALL OF YOU (tYRA, TDA1909, AND The little people won),

The contract that you signed states "make payment $____ on _____, or we will repo the car. What isn't clear about this? It seems to make perfect sense to me. Am I missing out on something?

@Tyra

Listen, you seem like a good person, but bad things happen to good people. You are not the only person to lose their job, miss a payment, and deal with collections.

@Little people won

Hey, the Attorney General won't do [censor] w/out proof. Some guy recently settled with a debt company for harassment. He had tons of voice mails, phone records, and tapes. I doubt customers of DriveTime care enough to work this hard. Come on, they ended up purchasing from DT because they didn't care enough to pay their bills in the past.

Discussing this is almost pointless. I'm open for rebuttals.

Wow! all these stories sound just like mine, i was actually told that me being a 42 year old man and cant afford his truck payment must be an embarrassment to my family. I hung up on them, , , the next day they called my father and said i have disappeared and they couldn't get in touch with me, , wow if you answer the phone they talk to you like you have stolen the car, if you avoid the calls they will contact everyone on your contact information. Oh did i mention i am only 23 days past due, i was laid off and doubled my payment last month to help get caught up, they don't care.

I understand how u feel as I was a a FORMER DT customer. This is what u need to do. Contact your states Attorney General. File a complaint and tell them everything they did. The attorney general will send them the notice and they have to respond to it. This will stop the harrassing phone calls to friends and family as this is against the law and bad business. Not to mention all the rudeness and foul mouths they all have down at DT. Tell the AG everything. The file another complaint with the FTC. They have specific rules and regulations regarding debt collections and telemarketing, the whole bit. If any one of those rules are violated they company is in violation. This wlll also stop the phone calls. Good luck and remember we do have people out there to help us...we just need to know where and how to find them.

drive time/ ugly duckling

I am interested in the Drive Time class action suite. I purchased a Suzki esteem in 2001, paid bi weekly. Vountarly returned the vehicle in 2005, in good conditon and I am slaped with wage garnishments from a collection agency Persolve LLC, that lied and said I was served Papers. I believe my Information was given out third party. I am seeking Legal advice. Drive Time waited six years, before the collection agency started to garnish my wages. The vehicle has been sold in a public auction. I am unable to not only pay for a car that I do not own, but being ripped off, for another 16, 000. Is constitutionally wrong. Drive Time has to be stopped.

The complaint has been investigated and resolved to the customer’s satisfaction.

I agree...Drive Time is such a rip-off! I was in a bad space and was crazy enough to sign a contract with Drive Time...Now I am stuck in a situation in which I can't get out of paying over 3 times what this car is worth. I was certainly fast talked into this mess...pressured into this mess. I recently tried to go to a reputable car dealership and trade in this car, but I owe much more than the car is worth and can't get out. Drive Time customer service folks are rude and talk much s--t becdause they know that they have you over a barrell because you signed that contract to pay 22% interest and 3 times what the car is worthed. I am so upset...I would like to simply drop it off...but I know that will cost more problems. I need help...any suggestions? I am interested in the class action law suit also.

everything you hear about drivetime is true. I got a car from them 3 years ago and the trans started to go bad about 3 months down the road, and when i called them about it they told me it was out of warranty and i had to pay for it out of my pocket. So oneday i took the car back to them and gave them the keys and 2 years and some months later i get a court order on my door about they want 13, 000 for the car, 5, 000 for the interest and 1, 500 for lawyer fees and court fees and i have 30 days to answer to the charges so now i dont know what to do. DO NOT GO TO DRIVETIME PLEASE

high payments and constant harrassments

We bought a car based on nothing but lies and now we are stuck with a super high car note and upside down in it. We were told in Ft.Worth at a Suzuki dealer we only qualified for a New Car- 07 then, which was completely lies- Drive Financial which is now Santander for us, refuse to refinance and all they do is constantly harrass even if you loose your job- i really want to give them this car back and by someone else- with much cheaper rate and payments. They make you feel stuck- I really hope this Class Action Suit works- consumers get screwed too much!

The complaint has been investigated and resolved to the customer’s satisfaction.

this company suck every rep i talk tp lies about setting u up on payment arrangement. Then u get a call 3 days later and there is nothing in the note about the arrgments made. I have a trick for these mfers. I know i cant record the call but i can get a noter republican to listen and document the call and can be held up on court. Please for give any misspellings i am doing this from my cell

STRONGLY AGREE!

My payments were made to Sovereign Bank and cashed by said bank. I always paid more than what was owed on the car loan I was running a month ahead on the payments anyway. Apparently, the car loan was sold to Santander but instead of being told this they just presented themselves to me a collection agency working on the loan for and through Sovereign Bank. Due to the economy slowing my carpet business was suffering and I sent a letter to Sovereign asking them to be patient as the busy season for carpet installation was fast approaching. Meanwhile, I secured a job in an industry I had been in for ten years previously so I could get caught up. In addition, I had given up my rental home in lieu of becoming a room mate in order to further free up my finances. Finally, I lacked $250.00 to get it out of repossession, running two payments behind. I made arrangements with them to pay this amount on Friday May 14, 2010 with an additional payment shortly thereafter. On the wee hours of Thursday morning May 13th a repo man came and got my van and ironically this was the day I started a new job for a major grocery store chain. It was the grand opening and I had to go to work basically hitching a ride and in shock with all of my personal possessions and tools God knows where. I had many items from the move in there including taxes and personal papers and finances...

I would have voluntarily given the vehicle up had there not been any other options but for them to be dirty and make arrangements and then pick it up with no regard for someone who had paid on time for three years. When I could finally arrange for a day off so that I could go pick up my belongings as the recovery company told me I could only come between 8-11 am m-f, a whole new problem arrived on the scene. THE AUCTION COMPANY WAS THERE TO PICK IT UP AND AS THEY DROVE IT PAST ME I NOTICED IT HAD BEEN DAMAGED SEVERELY IN THE RECOVERY PROCESS. THIS VAN WAS IN PERFECT NEAR SHOWROOM CONDITION AND THE WHOLE BACK QUARTER PANEL INCLUDING RIPPING OFF THE RUNNING BOARDS I HAD PUT ON WERE GONE. The recovery company would not let me notate this on the paper I had to sign to get my things nor would they admit to anything. In fact, they had a incident report stating it was like that which is a complete and total lie. I had full coverage on this vehicle there is no way there would be any damage on it, it was my baby and my livelihood. Now where does this leave me? They want me to pay $2000.00 to get it back for a vehicle that was trashed after having made arrangements with me. How can a company operate this way? In addition I had not officially moved in yet so they were trespassing on my room mate’s property. How can these people operate as OUTLAWS and get away with it? Who holds them accountable? Please let me know as I do not want anyone else to have to suffer such losses and emotional and financial distresses. Class action lawsuit? I'm IN!

I purchased a vehicle and it was financed "pre-approved" through Santander. I kept calling them for three weeks to find out how much to pay, to whom, and when. They kept telling me I was not in their system. Then, I get a call from the dealer almost a month later that the finance company is just now getting around to verifying my information and since I changed jobs since I bought the car, they no longer wanted to finance me. I called Santander and spoke with Felicia, who said if I don't have a job where taxes are taken out (because I'm a contractor) they won't finance me. I asked how long I have to stay at the same job in order for them to verify and get me in the system? She said there's no set time, it just depends on how busy they are, and they are busy right now. So, it appears I am required to plan my life and job situation around the schedule of how busy Santander is or isn't.

She hung up on me and sent my paperwork back to the dealer, refusing to honor the loan they had already approved. This made the dealer then want the car back.

Their website says they process their loans in 2-3 days. This was a month later.

A complaint was made to the OCCC who licenses them.

Damage Resulting = A tow truck was sent to my home to try to take the car, the dealer attempted to file theft charges on me, the car is owned by no one at this point and they are threatening me to bring it back or lose my downpayment.

I also had my Soverign bank load sold to Santader. I became pregnant, and due to an illness was unable to stay at work. Month after month i told them i couldn't afford it, and yet they stated they wanted to work with me and gave me an extension. Finally i have returned to work, and can now afford the payment. I recieved a call the other evening from a manager who stated that even though i made payment arrangements, the car was out for repo anyway. i'm letting them take the car because i will no longer deal with this company, and my credit is too low to refinance with another company. There should definately be a class action lawsuit against this company. There practices are probably illegal, and 100% SHADY! I read on anothe website how they have been known to report late payments to the credit bureau for customers who make timely payments, and refuse to correct the problem. I also saw where they've been known to repo cars from people who are up to date on payments, just so they can collect additional fees. OUTRAGEOUS! All i can say is that Karma is a B@#%, and people who work there will get their just desserts!

Unfortunately they are marketed to those of us who have poor credit and no options. If we want to finance a car, we get a company like this, the "Slum Lord" of the credit complex. They can be bullies because we don't have options. If we did, we would never be paying the outrageous rates they charge. Their rates are so high because a good portion of those who get financed, wind up getting repo'd, or just default. And it's not that they don't care if you lose your job, or have a family medical issue (my issue my wife was in the hospital for 2 months and they called all day every day), it's they don't believe us because so many people lie about it. While I understand the reasoning behind their bullying, there are now laws in place that prevent them from doing some of the illegal practices they do. I had a car dealer tell me how to get out of the car loan with them with minimal damage to my credit, it was brilliant and I now drive an 07 Charger, and my wife an 08 Grand Caravan...email and I'll tell you what I did. tommy-gunnz@live.com.

I've been a customer with sovereign bank, which was bought out buy Santander. I recently was unemployed and called Santander to warn them of my upcoming financial struggle. Although I have NEVER missed a payment with them for 3 years, they would not consider helping me. My car is $15k upside down and they had no other programs to help me, even in the economy we are in. A fair and just bank SHOULD have programs to HELP customers in need. A refinance is not anything they do either, one would think that rewarding and retaining good clientele is what they would do, but they are no help. I was told that my only option is repo, seeing that a bank loses more money on a repo, u would think they'd negotiate- but no dice! so I told them to send the repo man over.

The same with me. I financed a 2003 Hyuandai Sante Fe that was originally $13, 000.00. Gave a $3, 000.00 down payment, have been paying for over 2 years, and have a payoff of $10, 000.00. I am trying to trade it in for something that gets more miles to the gallon but I am upside down. I was informed that I would be able to get refinanced, that was a huge lie. I ended up getting the highest interest rate you could possibly get. My question is, is there something that is legally binding in which they have to put a certain percentage of your payment towards the principle and a certain percentage towards finance fees? What's interesting is that the car is supposed to be paid off by 2012, and with a monthly payment of $391.00, basically my payments are now being put towards the principle. If anyone knows of a Class Action Lawsuit against them, please post it so that everyone can get a bite of these people.

I have a loan with Drive Financial which is now Santander, We purchased our new car back in Feb 2008 . We never missed a paymento on our Charger until July this year2009. Before we missed a payment, we told (Drive) them that I financial situation had changed. My husband and most of his co-workers were all laid off. The company laid off over 80% of it's workforce. We called Drive Financial, we needed to make arrangements, to re-finance. Drive told us their company is not that kind of company. They don't re-finance. Our payments are too high, we are upside down. I cannot understand, why this company cannot work with us.

I don't recommend Drive Financial or Santander company's to anyone.

Where can Americans find help when you need it .We have lost out to foreign companies. What is happen in America.

disappointed

I bought a car from Drivetime and not 24 hours later Iam driving home from work and my clutch goes out and of course they cant do anything to help me get home or anothter vehicle while mine is being repaired.There is also wrong information on the web site about auto pay.They also ripe you off by charging an outrageous amount for the cheap vehicle that is not any where near the price it should be... I know I have bad credit but they should not be able to rape me more.I am so dissappointed in this company.I wish I had never used them.

The complaint has been investigated and resolved to the customer’s satisfaction.

I HAVE BEEN WITH THEM FOR AT LEAST 8 YRS I HAVE PAYED OFF THREE CARS THAT WERE OVER PRICED FROM THE START NOW ON THE FOURTH HOW COME THEY CALL ME FOR $20 EVERY OTHER DAY TWO OR THREE TIMES A DAY.THEY WILL CALL OTHER PEOPLE SOMETIMES BEFORE THEY CALL U.HOW CAN THE PEOPLE WE PAY TAXES KEEP LETTING CO LIKE THIS DO WHAT THEY DO SOME BLAME NEEDS TO GO TO LAW MAKERS . HOW MANY OF THEM HAVE CARS FROM DRIVETIME OR CASH ADVANCES. DONT MARK ME BAD CREDIT CAN HAPPEN TO U.I DONT MIND PAYING A LITTLE OVER WHAT THE CAR IS WORTH. VAN 14.000 DRIVETIME PRICE BLUE BOOK 8000 DRIVETIME 20% $20000 U DO THE MATH. WILL NOT OFFER GAP INSURANCE

believe me i wish i wouldnt have got the ford taurus that they pushed me to get! my drivers side panal was super glued on and when i first got the car it would stop working will to find out they put a small battery in the car not even supposed to be used in that car and i ended up buying a new one.. my AC is also going out.. oh i am having the worst phone calls and now emails from them for being a day late.. i hope no one ever gets a car from them.. i tried doing that auto pay and they charged me 10 extra dollars.. i dont even like going in there to pay my bill cuz i am afraid i will see some one purchasing a car i swear i will go up there and tell them how awful they are..

About DriveTime Automotive Group

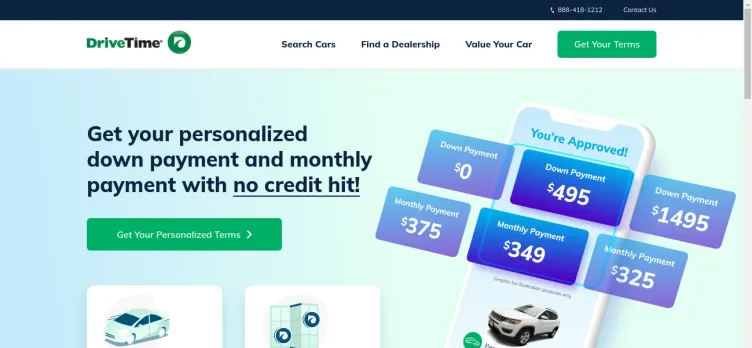

One of the things that sets DriveTime apart from other dealerships is its focus on helping customers with less than perfect credit. DriveTime understands that not everyone has a perfect credit score, and they work hard to provide financing options to those who may have been turned down by other dealerships.

DriveTime also offers a wide selection of vehicles to choose from, including cars, trucks, and SUVs. Each vehicle undergoes a rigorous inspection process to ensure that it meets DriveTime's high standards for quality and safety.

In addition to its impressive selection of vehicles, DriveTime also offers a range of services to make the car buying process as easy and stress-free as possible. These services include online pre-approval for financing, a 5-day return policy, and a 30-day limited warranty.

Overall, DriveTime is a reliable and trustworthy dealership that provides an excellent car buying experience to its customers. With its commitment to quality, affordability, and customer satisfaction, it's no wonder that DriveTime has become a popular choice for used car buyers across the country.

DriveTime Automotive Group Customer Reviews Overview

One of the most significant advantages of DriveTime is their flexible financing options, which allow customers to purchase a car regardless of their credit score. Many customers have praised the company for helping them get behind the wheel of a reliable vehicle when other dealerships turned them away.

Another positive aspect of DriveTime is their extensive inventory of high-quality vehicles. Customers can choose from a wide range of makes and models, including sedans, SUVs, and trucks, all of which undergo a rigorous inspection process to ensure they meet the company's high standards.

DriveTime's customer service has also received high marks from reviewers. Many customers have praised the company's friendly and knowledgeable staff, who go above and beyond to help customers find the right vehicle for their needs and budget.

Overall, DriveTime is an excellent choice for anyone looking for a reliable and affordable vehicle, regardless of their credit score. With flexible financing options, a wide selection of high-quality vehicles, and excellent customer service, it's no wonder that DriveTime has received so many positive reviews from satisfied customers.

Overview of DriveTime Automotive Group complaint handling

-

DriveTime Automotive Group contacts

-

DriveTime Automotive Group phone numbers+1 (888) 418-1212+1 (888) 418-1212Click up if you have successfully reached DriveTime Automotive Group by calling +1 (888) 418-1212 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (888) 418-1212 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (888) 418-1212 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (888) 418-1212 phone numberCustomer Service+1 (800) 813-5883+1 (800) 813-5883Click up if you have successfully reached DriveTime Automotive Group by calling +1 (800) 813-5883 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (800) 813-5883 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 813-5883 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 813-5883 phone numberLease Inquiries+1 (800) 460-0104+1 (800) 460-0104Click up if you have successfully reached DriveTime Automotive Group by calling +1 (800) 460-0104 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (800) 460-0104 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 460-0104 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 460-0104 phone numberGet Approved or Schedule a Visit+1 (888) 781-5649+1 (888) 781-5649Click up if you have successfully reached DriveTime Automotive Group by calling +1 (888) 781-5649 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (888) 781-5649 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (888) 781-5649 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (888) 781-5649 phone numberAeverex Warranty+1 (866) 387-3724+1 (866) 387-3724Click up if you have successfully reached DriveTime Automotive Group by calling +1 (866) 387-3724 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (866) 387-3724 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (866) 387-3724 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (866) 387-3724 phone numberDriveTime Warranty+1 (800) 967-8526+1 (800) 967-8526Click up if you have successfully reached DriveTime Automotive Group by calling +1 (800) 967-8526 phone number 0 0 users reported that they have successfully reached DriveTime Automotive Group by calling +1 (800) 967-8526 phone number Click up if you have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 967-8526 phone number 0 0 users reported that they have UNsuccessfully reached DriveTime Automotive Group by calling +1 (800) 967-8526 phone numberMake A Payment

-

DriveTime Automotive Group emailscustomerservice@drivetime.com100%Confidence score: 100%Supportchristopher.lindstrom@drivetime.com94%Confidence score: 94%salesjeffrey.kormanik@drivetime.com93%Confidence score: 93%salesdaryl.peterson@drivetime.com92%Confidence score: 92%saleswiley.short@drivetime.com88%Confidence score: 88%kenneth.carter@drivetime.com87%Confidence score: 87%newvendorrequest@drivetime.com83%Confidence score: 83%supportreviews@drivetime.com79%Confidence score: 79%copyright@drivetime.com76%Confidence score: 76%Legal

-

DriveTime Automotive Group address4020 E. Indian School Road, Phoenix, Texas, 85018, United States

-

DriveTime Automotive Group social media

Most discussed DriveTime Automotive Group complaints

class action against drivetimeRecent comments about DriveTime Automotive Group company

Straight up lied toOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

They can go to hell and kiss my ###!

Yes DriveTime is horrible! The personal references you give them, they call and harrass them as if they own them money. They call your personal references 3-4 a time a day every day if they can not get a hold of you. They will start harrassing you if your car payment is 1 day late. I can't wait to trade this vehicle in and I wil NEVER do business with DriveTime again and I told everyone I know not to do business with them.