- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- UnReplied

- With attachments

checking

The picture says it all. This bank charged me NSF fees when I have money in my account. When I complained, oh well to bad, 1 free fee reversal per year!

They have my mortgage as well. and it is never NEVER what the payment is suppose to be.

They always are charging random amounts, increasing the house payment sometimes by 500.00 a month, just out of the blue.

I thought Chase bank was bad, oooh no. This bank has to be one of the absolute worst banks in the world.

I blame myself, this is not the first account they have done this to me on. They closed my last account out and had 2 NSF fees on it. AFTER I CLOSED IT!

Then when I was stupid enough to open this account, thinking maybe the new branch would change things, NOPE. Without any warning or notice they withdrew the 75.00 in NSF charges, that were charged off on the old account from 2 years ago, to this new one.

What they are doing is criminal, I hope they are brought to justice soon.

The complaint has been investigated and resolved to the customer's satisfaction.

stolen money from account not refunded

My 88 year old mother had over $7, 000 taken from her account by unauthorized user. The bank actually called her to let her know this. But she never received compensation for the theft! Why would they give someone the money in the first place? She almost had a heart attack! This was 7 months ago in North Carolina. NEVER DEAL WITH BB&T! Your money is NOT secure!

The complaint has been investigated and resolved to the customer's satisfaction.

fee based, horrible customer service

Beside the excessive fee's and horrible customer service, this bank is hard to do business with. On 5/19 I deposited two checks one for $3200 & another from BB&T for $1900. I had $265 in my checking. I asked the teller for $200 back. She argued with me that I didn't have enough to cover? What One check was drawn from a BB&T account and I had $265 already in the account. Okay ready, she said that I can withdraw from my checking but that it is a different transaction and I would have to leave the drive through and come back around. HAHAHA you can't make this up. I wrote to BB&T asking for someone to contact me. It's been 11 days... nothing. Calabash branch

The complaint has been investigated and resolved to the customer's satisfaction.

overdraft fees, late posting accounts

I have paid them thousands in overdraft fee, s, this bank needs to be looked into, I, am disabled vet and even told them I have bad memory, it did, nit bother them a bit, they take their time posting accounts and always some excuse, one month I deposited 1050.00 and they kept almost 800.00 dollars.Aped them thousands in the last four or five years.i can, t think to good somebody needs to check this bank out, i, am, serious.they have a lot of complaints against them, how much longer are they going to get by with these practices,

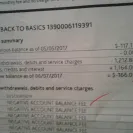

I was told bbt free checking as long as thru out a months time I have 500 just deposit not a minimum, so I guess $1479.00 per month doesn't apply, once bills fun life per month happens we may find it to be negative, so if i've already met my free checking account quota why for 7ndays was I charged $8 on negative account fees, per pay period I seem to get average-108, please see pics

Look I know they don't use a update processor so when paypal says yes, bbt [censor] sucking,

I love the south, but if bbt were to be a force on which the south will raise again

My 108 yr dead grandfather cocktails would raise [censor] em and raise again,

I'm all in adam speaker

I am sick of them posting my transactions at their convenience, and constantly holding my money when they can charge me a bogus overdraft fee or returned item fee. I have been told by a supervisor that they have made the mistake, but couldn't refund my fee because they can only do it once every 24 months. The most recent one they said twice every 24 months, and refused to refund my money. They admittedly charged me or made an error multiple times yet noone has the authority or ability to fix it? They are stealing from the working class and need to be stopped. How is this even possible or legal?

Dude, sleeping with your sheep isn't helping, frreally checking well if i'm being charged 8 bucks not free even I can follow that, stop

You will only upset people yes [censor] happens but in the last 2 months

-2854.0 just man up and have fee, I am not apologies I have a 13, 15yr how awesome could 1 weekend be with the money, so [censor] off

banking fraud

My father owned a property he was developing named hallam preserve. Located in lakeland, florinda off of state rd 540a. We had the property and had done all the underground utilities, the sewer work the roads and the fenciing, retention ponds a nature trail and was startng to sale off the lots. Well my dad passed away right when the housing market went in the toilet. Well we owed 12 million to the bank on the development. Then out of the blue as were dealing with dads death the bank says they sent in a team of there appraisers and that the property now is worth 3 million. This was vacant property that had just started to be sold to be built on. I wanted to fight but my mom just didnt have the strength to fight, so she let it go to the bank. I think what they did was illegal and immoral.in fact i know it was but dont know how to pursue it. Pls contact me. This is involving a 600 acre development and millions of dollars. To much info to provide here

Mark a hoffman

[protected]

BB&T bank in lakeland, fl

BB&T bank in lakeland, fl Contacts & Information

Posted: May 1, 2017 by mhoff1

banking fraud

Complaint Rating: 0 % with 0 votes

Contact information:

Lakeland, Floridalakeland, United States

my father owned a property he was developing named Hallam Preserve. located in lakeland, florinda off of state rd 540A. we had the property and had done all the underground utilities, the sewer work the roads and the fenciing, retention ponds a nature trail and was startng to sale off the lots. well my dad passed away right when the housing market went in the toilet. well we owed 12 million to the bank on the development. then out of the blue as were dealing with dads death the bank says they sent in a team of there appraisers and that the property now is worth 3 million. this was vacant property that had just started to be sold to be built on. i wanted to fight but my mom just didnt have the strength to fight, so she let it go to the bank. i think what they did was illegal and immoral. in fact i know it was but dont know how to pursue it. pls contact me. this is involving a 600 acre development and millions of dollars. to much info to provide here. the name of our company was REGAL DEVLOPMENT OF POLK COUNTY AND JREH INC.

mark a hoffman

[protected]

unauthorized fees assessed

I accessed my savings account online trying to determine if i wanted to deposit a lump sum check with BB&T, when i clicked the account I seen i was in my daughters account and not mine. I immediately noticed the account had been assessed a $5.00 fee for return statements. I called the bank and asked why did i get this fee. The rep replied she is not sure and that the address i verified is the same address. She credited back 1 fee and i said how many other fees did i get because the system is not letting me see any other transactions. She said she would have to forward the info to escalations. 3 days later i received a call and the lady i spoke with said Quote " you received the fee because when you changed the address the kids needed to call since they are the primary account holds and the rep changing the address forgot to make a change in the system" I was outraged because Number 1 this is a custodian account and i am the one that opened and maintain the accounts. My kids were 2 months old and now 14 & 17 and have no clue on calling them. WHAT the what. That was crazy. She said she could only credit me $10.00 per account and she really was doing me a favor. Thats when the call got real! The address they claim was returned was from17 years ago when i first opened the account & i havent been there since 2007. She had to forward the request and 13 days later i still had no call, when i called back the rep stated no ones has colled me because the last lady forgot to click a button for me to get a call back, after 15mins of requesting a manager she finnally transferred the call to a sup who was very lost & couldnt help or issue me a refund, I asked for his manger and he hung up. I then went in the branch and the sup there couldnt help but she was eager to close my 4 accounts that iv had since 2000 before the was even bank atlantic and before most of the staff was old enough to work. I finally had to file a complaint. There are 2 accounts and this was an error on t heir behalf not mine. Even if they credit the 2 accounts $45 each its mine. No have the authority to issue me a credit but they dont mine charging 39.00 for an over draft fee. And not 1 supervisor apologized to me.

The complaint has been investigated and resolved to the customer's satisfaction.

account fees, etc. rip off charges

I don't have enough negative energy to channel how much I hate this bank. My bank I had dealing with for years was bought out by BB&T bank, so it was not by choice that my banking changed. IT was pretty good at first. smooth transition, no issues. I am about 1 year in, and I cannot wait until my checks clear so I can switch banks. My card was fraudulently charged, and I called the "customer service" to report it. They always say check on it, we will issue a new card and call us back. As such, resulting in a call back. Little do the customers know that more than one call per month to the "customer service" that you will be charged. That's right. a charge for phone calls. its especially damning when I had my cable bill be charged 2x. Naturally, the bank blamed the cable company, and vice versa; which resulted in about 5 or 6 calls, and you guessed it...charges! when I called a branch manager, she emailed me asking to call me but never did. When i asked another branch manager...here was her reply: "well, a lot of our older customers (I'm guessing she is referring to the seniors) they like to call customer service and ask them to read off their accounts transactions, and it just clogs up the "customer service" lines. We like to keep those lines open for more serious calls such as someones fraudulent charge, or stolen cards" EXCUSE me, what? This is just the tip of the iceberg with the plethora of charges they try and get away with. Or the fact that not one of them has any idea about the bank (fees.etc). um, ok, so if my job changes companies, I'm not going to get trained? get real. So I submit a complaint to FDIC and BBT sends me some bull&^#@ letter about how I "over drafted" so on and so forth. Newsflash BBT, I wasn't complaining about my gd overdraft fee, I was complaining about your ridiculous practices and (lack of) customer service. I cannot wait to hang it up over at BBT. Stay away from these $ hungry ###. Save yourself the agony and frustration, and bank somewhere else. Banking with a baboon in Somalia would be safer.

excessive overdraft fees

I am an individual who manages my money down to the scent. I have received over $1, 000 in excessive overdraft fees when my account has not been over drawn. Most recently yesterday, to which one I called today and complained of the excessive fees and the fact that my account was not over they been credited it back immediately. Someone needs to look at how they are fining their account holders and hold them accountable for the fact that they are in not properly handling their customers and are unwilling to accept responsibility when they are in the wrong. I'd like a refund of all the incorrect fees that they've charges me, especially since they finally confirmed today that they incur fees in error.

checking

If you're looking for a bank do not, I repeat do not use this bank. They will rip you off and take all your money. They will charge you fees and then take your money and tell you that your account is now even and then after they take your money they will tell you they were mistaken and add more fees to your account. They are the absolute worst bank I've ever been to and I would never ever ever ever use them again.

fees

The fees are ridiculous. The deposit times have changed in Athens, Georgia from eight pm to six pm. So when you get off work at five fight traffic your already out of luck. So then you get an overdraft fee. You call to handle it but it take about three calls to handle it there goes another fee $2.00 for the third call and any there after that month. Then it gets real let your account stay negative for seven days another fee. To top it off you only get one overdraft fee returned every two years. Hope your not having a bad year cause they will eat you alive.

I chose not to be able to over draw on my account. I am more cognizant of the amount I have and less likely to make impulsive purchases. It was an option they gave me when I opened my account.

unethical behavior

We have been working overseas and our pay has been deposited into a foreign account, therefore our business account went into a dormant status without notifying us. Since we assumed we still had access to our money, this December we transferred 13K from our other BBT account to this supposed dormant account and wrote a check from it for the IRS as not to get penalties for underpayment. We found out that the check to the IRS was denied. We have looked at the BBT Commercial bank agreement and it does not cover this. My Question is if the definition of a dormant account is one without a transaction, the transfer was indeed an allowed transaction. I was told that it was a withdrawal that was needed by the branch, but deposits were accepted. Furthermore in talking with the bank employees "complaint department" and branch both said that we would have to go in to branch to change this and get our account restored and the check to the IRS resent. We are overseas and unable to do so and now we are without the funds in our other account to pay the IRS. I think this is illegal any thoughts or lawyers out there that would provide us information?

overdraft fees

On Dec 23, tmobile took my payment out 2 times out my account, I had used my card a few times before the 2nd charge came out for tmobile, so I have like 7 to 8 pending charges in my bb&t checking account, tmobile refunded one of the payments back on 12-24, I was emailing at rep at BB&T about my account I'm wanting to know when these pending charges would be posted dating back 12/22- 12/24, she stated she don't know, I have seen this before they pull higher to lower amount, and then hit you with overdraft fees for t h e remaining pending transactions. If you have deducted the money when the purchase was made why am I going into the negative when you clear the pending transactions? That's like double payment, it's not right, I'm sick of this bank and them robbing people out their money

excessive fees

> Date: Saturday, December 10, 2016, 12:37 PM

> I am trying to reach someone at the

> executive level of BB&T bank, Please see the string of

> emails below that no one wants to take responsibility for.

> I made a deposit into my BB&T account, I transferred $200.00 from another bank. The $200. Did not post on time! BB&T has charged

> $180.00 in fines against my account, putting me in the

> negative for $128.09! Please waive these fees, they are

> extreme. If you are unable to do it please pass this

> along to someone that is empowered to waive fees.

I can pay this, it might as well be $1, oooo.oo to me because I can not afford it. And I think it is unfair and extreme. Lola Jones

This is a all because my transfer from another bank did not post at your bank in time.

12/12/2016

Debit OVERDRAFT FEE $36.00 -$128.09

12/07/2016

Debit OVERDRAFT FEE

$36.00 -$292.09

12/06/2016

Debit OVERDRAFT FEE

$72.00 -$71.14

12/05/2016

Debit OVERDRAFT FEE

checking account/deposit policy

The folks at BB&T have always been pleasant and respectful toward me. I feel lucky in that regard, because there are a lot of complaints here about their customer service. But I still have a gripe, and it's a big one!

To put it simply, I don't understand this bank's ridiculous policy on crediting deposits. Every other bank I've done business with has credited me for deposits immediately (or at least within an hour or so). After making two ATM deposits that took almost 24 hours to clear, I decided the best remedy was to deposit my checks inside the bank. I figured that if a teller entered the checks manually, there shouldn't be a problem. Well, it makes absolutely no difference at BB&T! Checks take 24 hours regardless of where they're from. I work for a large restaurant chain, and the company that owns them is well established both here and across the country. But for reasons known only to BB&T, every one of my paychecks has to "clear" before I get credit for it.

There is no way it takes them that long to confirm my paychecks. Every other bank in town accepts payroll checks and confirms them quickly. It makes me wonder if BB&T is running on pre-Cyber Age technology, because the last time I had to wait THIS long for a paycheck to clear was back in the 80s!

Do not deal with this place if you are accustomed to having money on hand every pay day. I guarantee you'll get it long after your co-workers have cashed their checks and spent them.

We have been working overseas and our pay has been deposited into a foreign account, therefore our business account went into a dormant status without notifying us. Since we assumed we still had access to our money, this December we transferred 13K from our other BBT account to this supposed dormant account and wrote a check from it for the IRS as not to get penalties for underpayment. We found out that the check to the IRS was denied. We have looked at the BBT Commercial bank agreement and it does not cover this. My Question is if the definition of a dormant account is one without a transaction, the transfer was indeed an allowed transaction. I was told that it was a withdrawal that was needed by the branch, but deposits were accepted. Furthermore in talking with the bank employees "complaint department" and branch both said that we would have to go in to branch to change this and get our account restored and the check to the IRS resent. We are overseas and unable to do so and now we are without the funds in our other account to pay the IRS. I think this is illegal any thoughts or lawyers out there that would provide us information?

constantly asking for my id/not cashing my checks

I started banking with bbt 25 yrs ago in denton nc.house mortgage, car etc.I had no problem with them now I cannot go to this bank without getting mad.there is always something that makes my blood pressure go up. doctors orders-stop going to this bank and I will live a lot longer.so I will start transferring my things to another bank. Sorry bbt but my health is more important

mortgage

This is the worst Bank I have ever encountered. They force you into foreclosure as they tried to do with me charged astronomical as the bank who issued my original loan question what do you mean they're charging you a reinstatement fee? They charged astronomical fees refuse to accept payments that I had until I paid the astronomical fee. Yes these people will ruin your life lied and said they contacted me not one phone call not one letter telling me that there was an issue and they tried to put a foreclosure on me. Thousands of dollars worth of mortgage payments that they wouldn't accept because I wouldn't be there mod like mentality to get more money out of me. Every bank I know sometimes does home loans and sells them off to another I promptly advised by local bank that if they value their customers whatsoever please do not ever sell another customer's loan off to these people I have owned two homes several cars multiple loans and never had an issue. Went to my loan officer who was giving me every loan I've ever had since I was in my twenties and told her the problem that I was having she was shocked. After 9 years of mailing payments either through their coupon mailing address or at the post office not having it in hand calling them and keeping the address that they gave me in my vehicle at all times told me that I had made payments when I verify that they had to receive the payment in the trunk of an envelope that I send anytime I mailed them a payment the gentleman on the phone said that's not our post office box I don't know where you been sending them. I Google the post office box no name just a post office box location. It automatically popped up as BB&T mortgages payment post office box when I told him that I knew they had received it I knew that that was our post office box there only response was we didn't cash the checks not our problem I wouldn't give these people anything and if the banking regulators Would Rain these people and maybe they wouldn't be ruining people's lives and taking their homes and as I've discovered reading review after review after review I have not seen one good review via personal checking accounts credit cards mortgages nothing these people are monsters.! The link below shows the post office box in which my payments for mail to and the gentleman customer service told me he had no idea what that post office box was too and that I had been making my payments to for the last 2 years to the wrong post office box and didn't know how magically all the other payments got there but suddenly these didn't they're nothing but money-grubbing sadistic monsters

http://www.onlinemortgagehub.com/bbt-mortgage-customer-service/

fee charges

For 4/1/2015 to 6/30/2015 period

BBT Activities: There was service charge for any account.

My Argument: when I signed contract with Citi bank, my accounts were set up with no service charges. During this period, BBT abided the contract I had signed with Citi bank.

At 6/30/15

My request: I made request to transfer all money from my “Business Money Rate Savings” account to “Business Value 200 Checking” account and close “Business Money Rate Savings” account.

BBT Activities: the clerk didn’t do it and left the account open with $9.76 although he told me the account was closed.

My Argument: why the clerk didn’t tell me the truth, whether that was intentionally or just mistake?

From 7/1/2015 to 2/29/2015 period

BBT Activities: There was a “Cash Management Online” service charge $35 from my “Business Value 200 Checking” account.

My Argument: I never set up “Cash Management Online” service with BBT and even don’t know that I have this service with BBT. BBT never tells me either by phone or letter anything about this service.

On 12/23/2015

My request: I noticed that my “Business Money Rate Savings” account had not been closed as I requested at 6/30/2015, I asked clerk to close my account.

BBT Activities: Again, the clerk said my account was closed, but actually left open with $9.76.

My Argument: I really don’t know this is BBT system issue or clerk issue?

From 3/1/2016 to 5/31/2016 period

BBT Activities:

1. There were “Cash Management Online” service charges $35 from my “Business Value 200 Checking” account each month.

2. There were “Cash Management Online Business Banking” service charges $35 from my “Business Money Rate Savings” account which had $9.76 each month.

3. There were “Cash Management Online CD Account Maintain” service charges $40 from my “Business Money Rate Savings” account which had $9.76 each month.

My Argument: in these three months period, BBT added two other charges to my “Business Money Rate Savings” account: “Cash Management Online Business Banking” and “Cash Management Online CD Account Maintain” which I never get noticed. And BBT charged me “Cash Management Online CD Account Maintain” even I don’t have any CD account!

From 6/1/2016 to 8/31/2016 period

BBT Activities:

1. There were “Cash Management On” service charges $35 from my “Business Value 200 Checking” account each month.

2. There were “Cash Management Online CD Account Maintain” service charges $40 from my “Business Value 200 Checking” account each month.

3. There were “Cash Management Online Business Banking” service charges $35 from my “Business Money Rate Savings” account which had $9.76 each month.

4. There were “Cash Management Online CD Account Maintain” service charges $40 from my “Business Money Rate Savings” account which had $9.76 each month.

My Argument: in these three months period, BBT added one more charge to my “Business Value 200 Checking” account: “Cash Management Online CD Account Maintain” which I never get noticed and even I don’t have any CD account!

The Keys:

1. “Cash Management Online” service with BBT:

a. I never get notice that I have BBT “Cash Management Online” service associated with my accounts.

b. I never get notice that BBT “Cash Management Online” service has fee associated with it.

c. BBT charged me total $1158.75 for nothing!

2. BBT “Cash Management Online” service charge changes without notice and agreement:

a. At first eight months, the service charge was $35 monthly; then the following three month, the service charge became $120 monthly; and then following three month the service charge became $160 monthly.

b. There was no notice or explanation why these service charges keep on increasing.

c. I don’t have any CD account, why there were service charges for “Cash Management Online CD Account Maintain”. BBT put charge on the account I even don’t have!

d. BBT charged me total $75 per month from my “Business Money Rate Savings” but the money was deducted from my “Business Value 200 Checking”

3. BBT Customer Services:

a. After found these unauthorized charges, I went to BBT branch at Houston downtown and talked with Eric Contreras. But I was told BBT can only refund me $470. I want to know why BBT decided to refund me $470 and why BBT decided why not to refund me rest of $648.75? What’s the underlying reason for BBT’s decision?

b. When I asked for any document about the service charges on my account, Mr. Contreras emailed me fee disclosure on September 27th, 2016, which should sent to me on before the first day of BBT took Citi customer accounts.

c. The fee disclosure Mr. Contreras sent me doesn’t indicate the charges applied to my account (please refer to following screenshot).

d. After I found these issues and want to discuss with Mr. Contreras, he refused to talk with me about the detail and told me that he can only refund me $470, TAKE IT OR NOT.

e. After numerous arguments with Mr. Contreras, and his manager Andrew Delauro, they agreed to refund me $840 but still held my $318.75 for no reason.

ongoing money missing from my account, fees, bad service

I was a former member of Susquehanna Bank for at least 20 years until bb&t took them over. The same month this transition took place I started missing money from my account and having over draft fees charged left and right, which I never had a problem with before this take over. I tried to resolve this with costumer service and branch management with no resolution. They were rude and very unhelpful. After at least 6 months of this happening, I withdrew all my money and tried to close my account which they refused to do. Now I am getting letters in the mail saying my account is negative $400.00 after the hundreds of dollars that went "missing" to begin with. This is just a minor description of the issues myself and my family has dealt with from this horribly dishonest bank!

mortgage department

BB&T is considered a large bank compared to other banks and credit unions I have worked with. Every time you want to pay just principle on your Mortgage on line you cannot do it without making a payment which would be a month or so ahead. I had 195, 000 left on my mortgage and paid an addition 50, 000 towards the principle, approximately 1, 663 of the 50, 000 was put towards the next payment. You cannot just pay principle without calling and doing it. This is the first mortgage I have had that you cannot just pay principle towards the loan.

This is not the worse thing about it though. It would be alright if they charged the interest on the payment after the 48, 337 went towards the principle. No! No! They charge the interest towards the payment (due on 1 Oct) before the principle is paid towards the loan. Even though that payment is not due until the 1-10 Oct. Keep in mind I did this transaction on 16 Sept. This pays an additional $125-$150 in interest towards the loan that BB&T pockets. Every other mortgage company I have dealt with, most smaller than BB&T has allowed me to pay principle only on the loan. I would have rather just put it all towards principle. They do this because there are people that don't realize how much you can save in interest. Instead you have to call to do this transaction no matter the amount of the transaction. I don't know about the CEO but my time is valuable and I don't have the time to call and go through teleprompters to get things like this taken care of. I wonder how much money they make a year on people that don't know this.

BB&T is considered a large bank compared to other banks and credit unions I have worked with. Every time you want to pay just principle on your Mortgage on line you cannot do it without making a payment which would be a month or so ahead. I had 195, 000 left on my mortgage and paid an addition 50, 000 towards the principle, approximately 1, 663 of the 50, 000 was put towards the next payment. You cannot just pay principle without calling and doing it. This is the first mortgage I have had that you cannot just pay principle towards the loan.

This is not the worse thing about it though. It would be alright if they charged the interest on the payment after the 48, 337 went towards the principle. No! No! They charge the interest towards the payment (due on 1 Oct) before the principle is paid towards the loan. Even though that payment is not due until the 1-10 Oct. Keep in mind I did this transaction on 16 Sept. This pays an additional $125-$150 in interest towards the loan that BB&T pockets. Every other mortgage company I have dealt with, most smaller than BB&T has allowed me to pay principle only on the loan. I would have rather just put it all towards principle. They do this because there are people that don't realize how much you can save in interest. Instead you have to call to do this transaction no matter the amount of the transaction. I don't know about the CEO but my time is valuable and I don't have the time to call and go through teleprompters to get things like this taken care of. I wonder how much money they make a year on people that don't know this.

teller putting hold on my paycheck deposit and not telling me he did it

I hurried to my local BB&T on Columbia Avenue in Lexington, SC today to ensure my pay was deposited before the holiday weekend. The check was somewhat larger than normal, but I didn't think it would be an issue. When you drive up to the teller, there is no one at the window anymore. They speak to you through video screens. This teller, a middle aged male, was cordial and made my deposit and returned my receipt to me along with some cash back and said have a nice day. Only tonight after finding out that some bills I am attempting to pay online are refused due to not enough funds, did I go online and then call the customer service line, to find out this teller put a hold on my deposit check, and did not have the professionalism or courtesy to tell me. They have to tell customers when they are placing a hold, and this man did not tell me or send me back a receipt with hold information on it - nothing. So, here I am stuck until Tuesday morning and then I will have to take time out of work to go to the branch and discuss this error with the branch manager. I am so mad right now I could spit fire!

1. Log in or create an account: Ensure you are logged into your ComplaintsBoard.com account. If you do not have an account, please register by providing the required information in the sign-up form.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, briefly summarize the main issue you have encountered with Truist Bank. Make it concise yet descriptive enough to convey the essence of your complaint.

4. Detailing the experience: In the complaint description, provide a detailed account of your experience with Truist Bank. Mention specific key areas such as customer service interactions, problems with account access, unexpected fees or charges, issues with loan or mortgage applications, delays in transactions, or any other relevant incidents. Include details of any transactions, clearly stating dates, amounts, and the nature of the transaction. Describe the issue in detail, including what you expected to happen versus what actually occurred. If you attempted to resolve the issue with the bank, outline the steps you took and the responses you received. Explain how this issue has personally affected you, whether it's financial loss, stress, or inconvenience.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence with the bank, statements, or receipts. Be cautious not to include sensitive personal information like social security numbers or full account numbers that could compromise your security.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred as a result of the issue with Truist Bank. In the 'Desired Outcome' field, clearly state the resolution you are seeking, whether it's a refund, apology, or any other specific action from the bank.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is correct and that your narrative is easy to understand.

8. Submission process: After reviewing your complaint, click the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Stay active on ComplaintsBoard.com to monitor any updates or responses to your complaint. Check your account regularly to see if the company has responded or if other users have commented on your complaint.

Yes, Truist Bank is a legitimate financial institution, formed by the merger of BB&T and SunTrust Banks.

Truist Bank, like all reputable banks, is expected to follow stringent data security measures and federal regulations to safeguard your information and deposits.

As a major financial institution, Truist Bank provides a broad range of reliable banking services.

While scams can target customers of any bank, it's crucial to use official channels when interacting with Truist Bank to avoid potential scams.

Customer reviews and the bank's commitment to service can provide insight into the responsiveness of their customer service.

Charges and fees should be outlined clearly by the bank. Make sure to review these details when opening an account or using their services.

Truist Bank should employ secure technology for its online and mobile banking platforms, ensuring the safe transaction and personal data protection.

You can assess the bank's reputation by looking at reviews, ratings, and commentary in the banking industry.

As a reputable bank, Truist Bank should provide efficient and reliable transaction and transfer services.

Yes, Truist Bank is a member of the FDIC, which means deposits are insured up to the maximum amount allowed by law.

Interest rates vary and should be compared with other banks to ensure competitiveness.

All charges should be transparently disclosed by the bank. Make sure to read all terms and conditions or consult with a bank representative.

Truist Bank offers a variety of financial products which, as part of their service, should be reliable. Always read the terms before signing up for any financial product.

Opening an account should be a straightforward process, with guidance available from bank representatives if needed.

It's advisable to research recent news articles or reports for the latest information about the bank's involvement in any controversies or lawsuits.

Overview of Truist Bank (formerly BB&T Bank) complaint handling

-

Truist Bank (formerly BB&T Bank) contacts

-

Truist Bank (formerly BB&T Bank) phone numbers+1 (800) 226-5228+1 (800) 226-5228Click up if you have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (800) 226-5228 phone number 0 0 users reported that they have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (800) 226-5228 phone number Click up if you have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (800) 226-5228 phone number 0 0 users reported that they have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (800) 226-5228 phone numberDomestic+1 (910) 914-8250+1 (910) 914-8250Click up if you have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (910) 914-8250 phone number 0 0 users reported that they have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (910) 914-8250 phone number Click up if you have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (910) 914-8250 phone number 0 0 users reported that they have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (910) 914-8250 phone numberInternational+1 (888) 833-4228+1 (888) 833-4228Click up if you have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (888) 833-4228 phone number 0 0 users reported that they have successfully reached Truist Bank (formerly BB&T Bank) by calling +1 (888) 833-4228 phone number Click up if you have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (888) 833-4228 phone number 0 0 users reported that they have UNsuccessfully reached Truist Bank (formerly BB&T Bank) by calling +1 (888) 833-4228 phone numberHearing Impaired Clients

-

Truist Bank (formerly BB&T Bank) emailsceoline@bbandt.com100%Confidence score: 100%Support

-

Truist Bank (formerly BB&T Bank) address214 N Tryon St., Charlotte, North Carolina, 28202, United States

-

Truist Bank (formerly BB&T Bank) social media

Most discussed complaints

They will flat ruin you! 5 (opinions to this review) Trust wallet fund is gone without my consent 2 (opinions to this review) Credit card 2 (opinions to this review) Truist - 8 months trying to get my title and lien release. 8 months can't use my own car. Thanks to Truist! 2 (opinions to this review) NO Communication 1 (opinions to this review)Recent comments about Truist Bank (formerly BB&T Bank) company

NO CommunicationOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.