TaxAct reviews and complaints 62

Keywords

tax preparation website tax filing taxes customer service return information irs refund software tax software experience program customer credit card e-file file customer support e-filing schedule cNewest TaxAct reviews and complaints

The Whole Company

I never dealt with this company; I get a text for my one tome login verification. That concerned me. Was someone trying to steal my I, D. or trying to file a false tax return in my name. I called on Saturday Feb 12, I was on hold for 45 minutes, I finally hit one to hold my place in line and get call back. Well this Monday Feb 14, and never got one back. I called again and the recording said it could not accept my call. It says use the website. The website says call. I am not creating a account just in case if is someone trying to steal my info. Alll i wanted to know if someone is trying and have the company delete any info they have on me. Worse service, can not contact them by phone. If they were trying to get my business, they just lost that

Desired outcome: contact ma A.S.A.P,

Scam

Through the irs.gov free file, I used taxact this year as I did last year. My wife and I filed jointly with a gross income of just over $70,000. After over 3 hours of trying to get everything right, Taxact hit us with a fee of almost $100 claiming we were above the free file threshold. If this even was the case, which it should not be since we easily made less than $65,000 per person, they waited until the end, again over 3 hours later to charge us. This is at the very least unethical, and possibly illegal.

Desired outcome: I would like a refund and penalties enforced upon Taxact

2021 tax software program

Have used Taxact for the past 10+ years. This year again I filed with Taxact. On completion, TA setup a voucher that I owed $4165 which I sent in to the IRS with payment. The other day I received a letter from IRS stating I underpaid some $486.27. Upon reviewing the return I saved, it appears that Taxact program did not take into consideration that I was over the $75, 000 limit and should have had my recovery rebate credit remove. That would have upped my payment voucher to the correct amount.

Have tried to find a person to talk to at Taxact but without any luck. Want everyone to be aware of the issue they have in their program.

Desired outcome: Payment from Taxact of $47 tax penalty & Interest charges

No customer service / scammed / want to delete account

I've been trying to reach TaxAct for weeks but I cannot get to them by phone nor will they return my emails. I used the email from the Contact Us page. I started to use chat but they want to look at my computer and I'm not willing to give anyone that access.

The problem is that twice I received a one time authorization code that I did NOT generate both in a text and an email which means someone has accessed my sign in information and tried to get into my account. The first one was on June 21st and the second was on June 23rd. I'm franticly trying to get this resolved but to no avail.

I've decided to delete my taxes and my account but cannot find any way to do that. The online help does not work as they indicate in their online help pages.

Desired outcome: I want CURRENT steps (not something from the past that no longer works on this site) to delete my account in total. Ideally if someone could contact me to walk me through the steps but not chat as I do not want to do a screen share.

Lost a paid for tax return.

03/09/21:

I have been filing my taxes with Tax Act since 2017.

We are currently purchasing a home and needed the last 3 years of returns. One of my returns; for 2018 was lost. I stood on the phone for hours; sent from one center to the other. One tech support said it simply slipped through the cracks. The system did not save my return and there is nothing they can do about it. Not a letter/ email, nothing they could do to help me... to try going through the IRS (5-10 days) to find my returns. I feel like if I purchased through TaxAct it should be a secure place not only to file taxes but to save and view previous returns. If my tax return simple slipped through the cracks of the system, will it not happen again?

-Lauren Garcia

Username: taxes2017L

Desired outcome: Refund, or help finding my return in a timely manner.

Cannot Delete Account

I have fallen victim (like many other reviews I've read here) to thinking that I could file my taxes for FREE. Only to get to the end to tell me that I have to pay a fee. While the inconvenience of this was highly annoying, it's not what really ticked me off.

For some reason I CANNOT delete my user account from their website, I can only "manage/update" my personal info. Now all of my sensitive information is actively floating around in their database. It is for this reason I will never use this site again.

The least Taxact (2021) can do is allow me to break free from them after having deceived me.

Desired outcome: Allow a customer to DELETE their account.

Free Tax Act online

I usually use TurboTax, but last year, I thought I'd try this. DON'T! It's a complete rip-off! Halfway through a simple tax return I've been doing myself with TurboTax since 2004, I got hit up for a large fee 'because the return was more complicated'... Baloney! How can a return with 1099's and dividend income be 'more complicated'? I'm a retired, disabled widow. With the higher personal deduction, I didn't even itemize!

I got out of there as fast as I could. This was for 2018.

I'm appalled that IRS recommends this service. It's a total scam. Find Turbo Tax with State return (if applicable) for $50 online. It's well worth it.

TurboTax has 18 pages of complaints and it is worse this year than last year.

poor customer service & support

I've used TaxAct for years. I'm a professional preparer and left TaxAct, for another software provider, because of price increases every year. In addition, when requesting support, often because the software wasn't calculating correctly, it could take two days, for a response.

When I tried to negotiate with the sales rep, Marianne, she was sarcastic and condescending. When I complained to Greg D., yes that's how he signs his email, and Sean Taylor, I received a call from Marianne. I hung up on her, as she began with the condescension explaining to me that I didn't understand what I had purchased.

Because in 2018 I was unable to negotiate a package which worked, for my practice, I was forced me to purchase e-files which I could not use. TaxAct now refuses to refund any portion of the price paid, for those unused e-files. Marianne said not to worry, as I could use them when I returned to TaxAct. She said all their customers return once they've tried other software. One thing is certain. That will not happen. It's not even about the refund, for the e-files. It's about the lack of respect, for the customer. I should have left TaxAct years ago.

unethical behavior

My most recent TaxAct experience (04-15-2019) has been terrible and I hope thousands of people find this helpful and choose to do their online taxes elsewhere. TaxAct has put me into a continuous loop for payment. I had already gone through the Basic version and only needed to e-file and print the payment voucher, however, TaxAct would not allow me to proceed unless I paid for the Deluxe version upgrade. That, by the way, is extortion. Out of sheer desperation, I paid for the Deluxe version, which was $32 just to be able to e-file and print the payment voucher. However, TaxAct will still not allow me to e-file nor will it allow me to print the payment voucher. TaxAct wants me to pay for the Deluxe version again. At this point, I am going to have to print the View Only summary and get a blank 1040, fill in the information, send in all applicable forms with it and the payment. In conclusion, TaxAct is horrible and I will never use it again! -ronaldmccraw

Gift card scam

I opted for part of my refund to be given on an Amazon gift card. I checked with Republic Bank who told me they forwarded that money to TaxAct on Feb 15 and to this date, March 8, I have not received it. No answer from giftcard@taxact.com for several weeks. No answer from Assistance@taxact.com for several weeks. If you call the customer service number 319-373-3600 the message says to email giftcard@taxact.com, but they do not respond at all - even to say they received the message and are working on it. Just silence. I can't get a live person on the phone. Republic Bank can't help any more. I'm afraid this has all been a Tax Act scam and my family just lost over $500.

In their defense, they did file my taxes and the rest of my refund went down as promised - the gift card situation is my only complaint. I've used TaxAct several times before this and had no issues. There is nothing "free" here - this was part of my refund.

software downloads

Your offices are closed but, you website says you should be open

January (mid-month) — April (through IRS deadline)

Monday - Friday 8am - 8pm

Saturday 9am - 5pm

Sunday 10am - 5pm

My complaint is that I cannot down load the State of Kansas tax forms. I called a week or so and they said they should be ready, but still says coming soon. I have been using your software for many years then now this. Help with this or I need to get refund I have several people that I cannot do because of this.

James Erwin

Harrisonville MO

online tax preparation

I was attempting to file my daughters taxes with taxact Wendy L Oliver [protected] and was charged 34.95 instead of 9.95. The I tried repeatedly to e file and never successfully transmitted her taxes. I finally filed with another provider but was still charged $34.95. I have spent all day trying to contact taxact to rectify this situation but to no avail.

basic vs. plus online edition

4/15/2018

My return is a 1040A but I am being charged for 1040 at the plus rate, and will have to pay too much for the state return. Why can't I change back to the Basic rate with reasonable rates for federal and state?

Also, there was no easy way to email TaxAct if not using gmail or yahoo. The email account for the company was not displayed, it was only a link type.

online filing

The IRS never received my 2016 return. According to TaxAct, I didn't finish clicking various buttons to e-file. I know I went all the way through the process. I have a copy of the return. I paid what I owed through a 3rd party online. TaxAct took my money as well. Now they say it's my fault! I'm out $27 and may be facing penalties for late filing! All they can say is I have to mail it in!

federal income tax software

Here is my experience with Tax act bait and switch. You can get a refund of upgrade cost also!

Original Message

From: "greengroth"

Date Received:4/17/2016 8:32:04 PM

To: ""

Subject:Trash Act

I buy the basic edition and find after completing my return I must buy the premium edition. That is UNETHICAL. BAIT and SWITCH!. Then all the NAGS for upgrades and state programs. Very annoying when concentrating on my taxes.

I will let everyone know Tax Act is now a rip off and stay with better options.

------------------------------------------------------------------------------------------------------------------------

On 4/18/2016 1:12 PM, [protected]@taxact.com wrote:

This year, TaxAct introduced a new product line designed to provide customers with a more personalized experience based on each person's unique tax situation. Our new products include different tax forms, schedules and worksheets specific to those tax situations. Although you started a TaxAct Basic return, your tax situation requires at least one IRS tax form, schedule or worksheet that is not included in Basic but is included in Premium. The form(s) that your tax situation requires was listed on the screen where you were given the option to upgrade to TaxAct Premium or proceed with the product you had.

We encourage you to compare TaxAct to other major brands. We are confident you will find that TaxAct is the best deal in tax at a fraction of the cost of other major brands.

If you have specific questions about your fees or our products, please feel free to reply to this email.

Sincerely,

Jessi D.

TaxAct Customer Service

-----------------------------------------------------------------------------------------------------------------------------

[protected]@toast.net is my tax act username

On 4/18/2016 2:58 PM, [protected]@taxact.com wrote:

We do not want customers to have the impression that we utilize "bait and switch" tactics. I am happy to research your situation to see why you were required to upgrade. Please reply to this email with your TaxAct Account username, as your email address of xxx is not in our system.

Sincerely,

Jessi D.

TaxAct Customer Service

-------------------------------------------------------------------------------------------------------------------------------------------------------------

________________________________________

From: "greengroth" Date Received:4/18/2016 4:48:28 PM

To: ""

Subject:Re: Trash Act[6253353:6322551]

I may have been given the option after i purchased basic. Too late, for I didn't have an opportunity to shop for other tax programs after I spent money on basic.

I in fact was a victim of your 'bait and switch'. I had to upgrade at the last minute to be able to file. I've always used Tax Act Basic and it did the job.

I expect the charge of $20.00 to be removed from my credit card ASAP.

Thomas W.Schroeder

Your TaxAct order number [protected] has been refunded in the amount of $20.00. Please allow up to 15 business days for the credit to post to your account.

If you have questions concerning the billing of your account, or believe you have received this email in error, please contact Customer Service via e-mail at [protected]@TaxActService.com.

Customer Service

TaxAct

[protected]@TaxActService.com

Below is my purchase receipt for basic.

Order Summary

Product Format Qty. Unit Price Total

TaxAct 2015 Basic Edition Download 1 $19.99 $19.99

No State Income Tax Download 1 $0.00 $0.00

Sub-total $19.99

Tax $0.00

Grand Total $19.99

This is for the required upgrade to file my taxes

Billing address:

THOMAS SCHROEDER

Order Summary

Product Format Qty. Unit Price Total

TaxAct 2015 Basic to Premium Upgrade Download 1 $20.00 $20.00

Sub-total $20.00

Tax $0.00

Grand Total $20.00

Billing address:

THOMAS SCHROEDER

tax filing software

I started using Tax Act free but couldn't continue because it didn't support Schedule C. There is no option to delete an incomplete return or account. Online help suggests that this used to be an option but no longer. Company representative in response to a customer complaint advises to go in and enter invalid information to avoid identity theft risk. This is a poor solution. Given the risks for any online service to be hacked, not allowing a customer to delete their incomplete return or their account is a very bad design. I will not use Tax Act again.

they took fee for the late payment. scam.

I used the website www.taxact.com in order to prepare all the documents. The company asked me to fill too many papers and documents; afterwards they said that I could pay in the end of our deal. So, when everything was ready, the rep said that I still didn’t pay for the services and therefore they would ask me to pay for late payment. The fee wasn’t large, but it was so unpleasant that they told not to pay but now decided to charge me for the late payment.

rude and unprofessional company

I decided to return my tax, so I went to the website www.taxactonline.com. I filled the form and made the claim, and in result I got the big sum. I was a little bit confused, but the agent told me that everything was ok. After 4 days I got the phone call and the agent started to ask, why I haven’t paid them money back. I was shocked and it turned out that the sum was wrong and they wanted to get it back. I tried to explain it to the agent, but he was rude and didn’t want to listen to me. Better don’t return taxes through this company.

my money

I recieved my taxact card used it at Walmart went to get somemoney the next day and I called the bank and they say its blocked where's my money what's goin on...

Greetings,

My name is Leigh A. and I work for TaxACT. The best number to call is [protected]. This will take you directly to the division in Bancorp that will investigate your card issue.

Thank you,

Leigh

screweing me over

I e-filed for my first time this year, and I decided to use TaxACT online because a family member of mine had recommended it. The whole process was unusually simple and I received my confirmation emails that the IRS had received my return that day. Great!

Last week, a whole 4 MONTHS after the deadline, the IRS sent me a letter stating that I had never sent in my forms. I calmly called the TaxACT tech support line, where they told me if I wanted to know what went wrong with my filing I would have to pay to upgrade my membership. PAY AGAIN TO SEE WHAT THEY DID WRONG?!?!?!?! It is ridiculous and a scam, and I would hope that nobody would use their program ever again. I hope nobody else is put into my poor position now, thanks TaxACT for SCREWING ME OVER!

Just got screwed myself! Got all the paperwork done, hit send, everything seemed okay. They showed me a copy of my taxes and said to print it out & put it in a safe place. Now here I am in June being told that it was never transmitted and I am liable for all penalties. No recourse.

TaxAct In-depth Review

In summary, TaxAct offers a comprehensive tax preparation service that balances features and affordability. It provides a user-friendly experience with a variety of options for different types of filers, backed by reliable customer support and a focus on security.

Ease of Use

- User Interface & Navigation: TaxAct's interface is clean and intuitive, making it simple for users to navigate through the tax filing process.

- Mobile App Usability: The mobile app is convenient for users who prefer to manage their taxes on-the-go, although it may have limited features compared to the desktop version.

- Accessibility Features: TaxAct includes several accessibility features to assist users with disabilities, ensuring a wider range of customers can use their services.

Features and Services

- Tax Preparation Options: TaxAct provides various options catering to different filing needs, from simple returns to more complex business taxes.

- Additional Financial Tools: Users can access additional tools such as a tax bracket calculator and a deduction finder to maximize their savings.

- State and Federal Filing Capabilities: TaxAct supports both state and federal filings, offering a comprehensive service for users in all states.

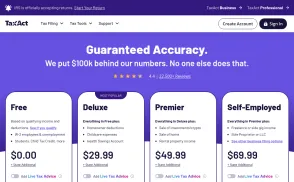

Pricing and Value

- Cost Comparison with Competitors: TaxAct is generally more affordable than some of the leading competitors, offering good value for its services.

- Transparency of Pricing Structure: Pricing is upfront, with clear distinctions between free and paid versions.

- Free Version vs. Paid Versions: The free version is suitable for simple tax situations, while paid versions provide more features for complex filings.

Customer Support

- Availability of Support (Hours/Channels): Customer support is available through various channels, although hours may be limited outside of the tax season.

- Quality of Support (Response Time, Expertise): Support staff are knowledgeable, with reasonable response times.

- Self-Help Resources (FAQs, Tutorials): TaxAct offers a comprehensive knowledge base with FAQs and tutorials for users who prefer self-service.

Accuracy and Reliability

- Error Check System: The software includes a robust error-checking system to minimize mistakes.

- Guarantees and Warranties: TaxAct offers accuracy guarantees and maximum refund warranties, providing peace of mind to users.

- Historical Performance: The platform has a strong track record of reliability and accuracy over the years.

Security and Privacy

- Data Encryption and Protection Measures: TaxAct uses advanced encryption and security measures to protect user data.

- Privacy Policy: The privacy policy is comprehensive, detailing how user information is used and protected.

- User Reviews on Data Security: Most user reviews indicate a high level of trust in TaxAct's data security measures.

User Experience

- First-Time User Guidance: New users are guided through the process with helpful tips and clear instructions.

- Clarity of Instructions: The instructions provided are clear and easy to understand, even for those with little tax knowledge.

- Overall Satisfaction Ratings: User satisfaction ratings are generally high, reflecting a positive user experience.

TaxAct Community and Resources

- Forums and User Communities: TaxAct has an active community where users can share advice and experiences.

- Educational Content and Tax Guides: The platform offers educational content and tax guides to help users understand tax laws and maximize their refunds.

- Webinars and Live Events: TaxAct occasionally hosts webinars and live events to provide additional support and information to users.

Software Integration

- Importing Previous Tax Data: Users can easily import previous tax data, which simplifies the process for returning customers.

- Compatibility with Financial Software: TaxAct is compatible with various financial software, allowing for seamless data integration.

- Third-Party App Integrations: The platform supports integrations with third-party apps, enhancing its functionality.

Filing Process

- Step-by-Step Filing Experience: The filing process is broken down into manageable steps, making it less daunting for users.

- Time to Complete Filing: The time to complete filing varies based on the complexity of the tax situation, but the process is generally efficient.

- E-filing and Direct Deposit Options: TaxAct supports e-filing and offers direct deposit options for refunds, providing convenience and speed.

Refund Options and Tracking

- Refund Processing Times: Refunds are processed in a timely manner, with the exact time depending on the IRS and state agencies.

- Refund Advance Options: TaxAct offers refund advance options for users who need their refund quickly.

- Tracking and Status Updates: Users can track their refund status and receive updates directly through the platform.

Audit Assistance

- Audit Support Services: TaxAct provides audit support services to help users navigate the audit process.

- Audit Risk Identification: The software helps identify potential audit risks during the filing process.

- Cost of Audit Defense: Additional fees may apply for audit defense services, but these can be valuable in the event of an audit.

Updates and Improvements

- Yearly Updates and New Features: TaxAct regularly updates its software to include new features and respond to tax law changes.

- Response to Tax Law Changes: The platform is quick to update its systems in response to changes in tax laws, ensuring compliance.

- User Feedback Implementation: TaxAct considers user feedback for improvements, demonstrating a commitment to user satisfaction.

Pros and Cons

- Summary of Strengths and Weaknesses: TaxAct is strong in affordability, user experience, and support, but may lack some advanced features offered by competitors.

- Comparative Advantage: The platform's competitive pricing and user-friendly design give it an edge over more expensive options.

- Potential Drawbacks for Certain Users: Advanced users with complex tax situations may find the features somewhat limited.

Final Verdict

TaxAct is a solid choice for individuals seeking an affordable and user-friendly tax filing service. It is particularly well-suited for first-time filers and those with straightforward tax situations. While it may not have all the advanced features of higher-priced competitors, its value and ease of use make it a strong contender in the market. The platform's commitment to security and customer support further enhances its appeal. Overall, TaxAct is recommended for users looking for a reliable and cost-effective tax preparation solution.

Here is a comprehensive guide on how to file a complaint against TaxAct on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with TaxAct in the 'Complaint Title'.

4. Detailing the experience:

- Provide detailed information about your experience with TaxAct.

- Mention key areas of concern.

- Include any relevant information about transactions with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any additional supporting documents that can strengthen your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Utilize the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure each step is clearly defined to guide you effectively through the process of filing a complaint against TaxAct on ComplaintsBoard.com. Remember to focus on issues related to TaxAct's business category.

Most discussed TaxAct complaints

cannot delete account/bad experienceRecent comments about TaxAct company

Free Tax Act onlineOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

Is ComplaintsBoard.com associated with TaxAct?

ComplaintsBoard.com is not affiliated, associated, authorized, endorsed by, or in any way officially connected with TaxAct Customer Service. Initial TaxAct complaints should be directed to their team directly. You can find contact details for TaxAct above.

ComplaintsBoard.com is an independent complaint resolution platform that has been successfully voicing consumer concerns since 2004. We are doing work that matters - connecting customers with businesses around the world and help them resolve issues and be heard.

Use this comments board to leave complaints and reviews about TaxAct. Discuss the issues you have had with TaxAct and work with their customer service team to find a resolution.